- Canada

- /

- Personal Products

- /

- TSX:MAV

Introducing MAV Beauty Brands (TSE:MAV), The Stock That Dropped 50% In The Last Year

MAV Beauty Brands Inc. (TSE:MAV) shareholders will doubtless be very grateful to see the share price up 63% in the last quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 50% in the last year, significantly under-performing the market.

View our latest analysis for MAV Beauty Brands

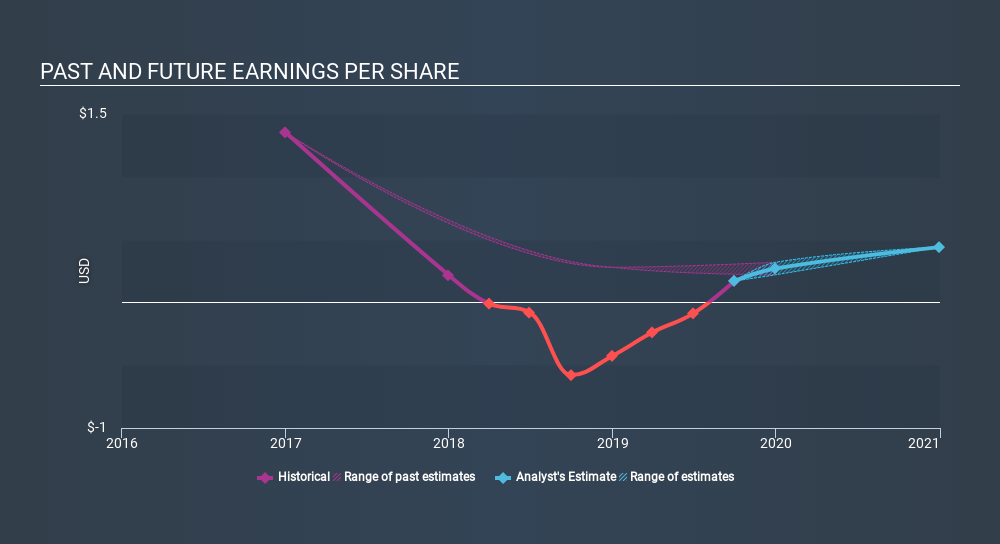

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year MAV Beauty Brands grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on MAV Beauty Brands's earnings, revenue and cash flow.

A Different Perspective

While MAV Beauty Brands shareholders are down 50% for the year, the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 63% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that MAV Beauty Brands is showing 4 warning signs in our investment analysis , and 2 of those are significant...

MAV Beauty Brands is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:MAV

Old MAV Wind-Down

Old MAV Wind-Down Ltd. operates as a personal care company worldwide.

Good value with imperfect balance sheet.

Market Insights

Community Narratives