- United Kingdom

- /

- Medical Equipment

- /

- AIM:IHC

Inspiration Healthcare Group plc's (LON:IHC) Shares May Have Run Too Fast Too Soon

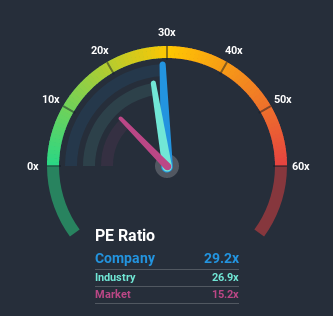

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 15x, you may consider Inspiration Healthcare Group plc (LON:IHC) as a stock to avoid entirely with its 29.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Inspiration Healthcare Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Inspiration Healthcare Group

Where Does Inspiration Healthcare Group's P/E Sit Within Its Industry?

We'd like to see if P/E's within Inspiration Healthcare Group's industry might provide some colour around the company's particularly high P/E ratio. The image below shows that the Medical Equipment industry as a whole also has a P/E ratio significantly higher than the market. So we'd say there is merit in the premise that the company's ratio being shaped by its industry at this time. Ordinarily, the majority of companies' P/E's would be lifted firmly by the general conditions within the Medical Equipment industry. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

Is There Enough Growth For Inspiration Healthcare Group?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Inspiration Healthcare Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 116% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company are not good at all, suggesting earnings should decline by 82% over the next year. The market is also set to see earnings decline 15% but the stock is shaping up to perform materially worse.

With this information, it's strange that Inspiration Healthcare Group is trading at a higher P/E in comparison. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Maintaining these prices will be extremely difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Inspiration Healthcare Group currently trades on a much higher than expected P/E since its earnings forecast is even worse than the struggling market. When we see a weak earnings outlook, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to resist even greater pain to its business from the broader market turmoil. Unless the company's prospects improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Inspiration Healthcare Group (1 doesn't sit too well with us!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

When trading Inspiration Healthcare Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:IHC

Inspiration Healthcare Group

Designs, manufactures, and sells medical technology products worldwide.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)