- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

HP (NYSE:HPQ) Reports Q2 Revenue Growth But Net Income Declines

Reviewed by Simply Wall St

HP (NYSE:HPQ) reported mixed second-quarter results with a revenue increase to $13.22 billion but a decrease in net income to $406 million. Investors reacted to this news alongside broader market trends. The company's share price rose by 7% over the past month, aligning with the tech sector's advance, particularly driven by Nvidia's strong earnings and AI demand. Despite economic uncertainties and regulatory challenges noted by HP's leadership, such as trade-related costs, the tech-driven market momentum seemed to weigh more heavily, supporting HP's share price increase amid a positive broader market environment.

We've spotted 3 warning signs for HP you should be aware of, and 1 of them is a bit concerning.

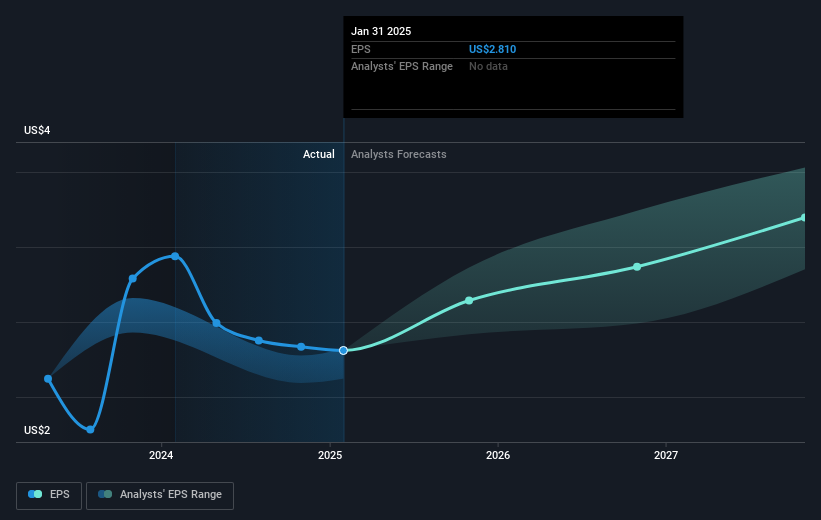

The mixed second-quarter results announced by HP could shape the narrative favorably if strategic efforts in AI and software integration successfully drive future growth. Although HP experienced a revenue increase to US$13.22 billion, the decline in net income to US$406 million might raise concerns about margin pressure due to trade-related costs and broader economic uncertainties. However, substantial investments in AI and a focus on building an intelligent device ecosystem could counter these challenges by enhancing product offerings and potentially leading to higher margins over the long term. Revenue and earnings forecasts, factoring in these strategic shifts, foreseen at a modest annual growth rate amid market softness, could be a crucial determinant of future performance.

Over the past five years, HP’s total shareholder return was 90.05%, highlighting significant growth beyond short-term fluctuations. Nonetheless, in the past year, HP underperformed the US Tech industry and the broader US market, with a modest return compared to the 4% tech industry and 11.5% market returns. This disparity suggests competitive pressures and external factors may have weighed on recent performance despite broader strategic ambitions.

Regarding price movements, the 7% rise in HP’s share price amid tech sector momentum reflects optimism about its direction, yet the current price of US$25.63 shows a discount of about 20.8% from the analyst consensus price target of US$32.35. This indicates potential upside if HP achieves projected earnings milestones and strategic initiatives bolster revenue and margin growth, aligning it more closely with industry expectations and past total returns. Nonetheless, reaching these targets will depend on effectively navigating existing challenges and realizing the foresaw integration benefits of AI and software enhancements.

Our expertly prepared valuation report HP implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives