- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

Health Canada Approves Variant-Adapted Vaccine By BioNTech (BNTX)

Reviewed by Simply Wall St

BioNTech (BNTX) recently experienced a 10% price increase in the last quarter, coinciding with the Health Canada's authorization of its variant-adapted COMIRNATY COVID-19 vaccine, a potential positive catalyst. During this period, BioNTech also benefited from positive updates such as the European Medicines Agency's recommendation for its COVID-19 vaccine and the narrowing of net losses reported in Q2, reinforcing investor confidence. Meanwhile, broader market trends showed a general rise, with the Dow reaching record highs, contrasting with softer tech stock performances. BioNTech’s gains align with broader market activities, suggesting its developments added favorable weight to its share performance.

Buy, Hold or Sell BioNTech? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments, including the Health Canada authorization of BioNTech's variant-adapted COVID-19 vaccine, alongside European Medicines Agency recommendations, represent significant potential catalysts that could influence the company's direction. Such news may bolster the mRNA and oncology narrative, signaling promise for diversified growth avenues and fueling increased investor optimism. The company's longer-term total shareholder return of 60.40% over five years further underscores its resilience and ability to capitalize on market opportunities.

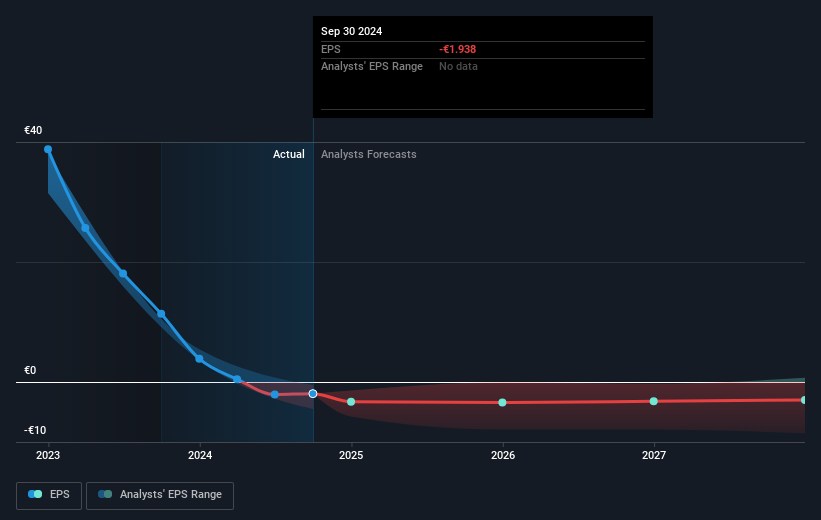

Over the past year, BioNTech's share performance outpaced that of the US Biotechs industry, which saw a decline of 8.1%. Despite analysts projecting unprofitability for the next three years, the price increase could reflect strengthening investor confidence in these growth avenues. The recent developments might not only impact revenue positively but also shape earnings forecasts, potentially reducing reliance on COVID-19 vaccine sales.

With a current share price of US$112.55 and a price target of US$137.76, the stock remains at a discount of 22.4% to consensus targets, reflecting optimism in future earnings growth. The share's upward momentum may suggest that market participants believe in the company's potential to align with analyst expectations for elevated revenue and earnings performance.

Understand BioNTech's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives