Global Penny Stocks: Dongguan Rural Commercial Bank And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

Global markets have been experiencing mixed signals, with U.S. equity indexes showing modest gains despite concerns over a weakening labor market and the potential for interest rate cuts by the Federal Reserve. In this context, investors are increasingly looking at penny stocks as a viable option for growth opportunities. Although often associated with smaller or newer companies, penny stocks can offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.705 | MYR374.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.56 | HK$958.71M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £2.85 | £230.24M | ✅ 5 ⚠️ 2 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.63 | MYR320.34M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.48 | MYR594.3M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.10 | SGD12.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.93 | €31.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,731 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market cap of HK$25.83 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$25.83B

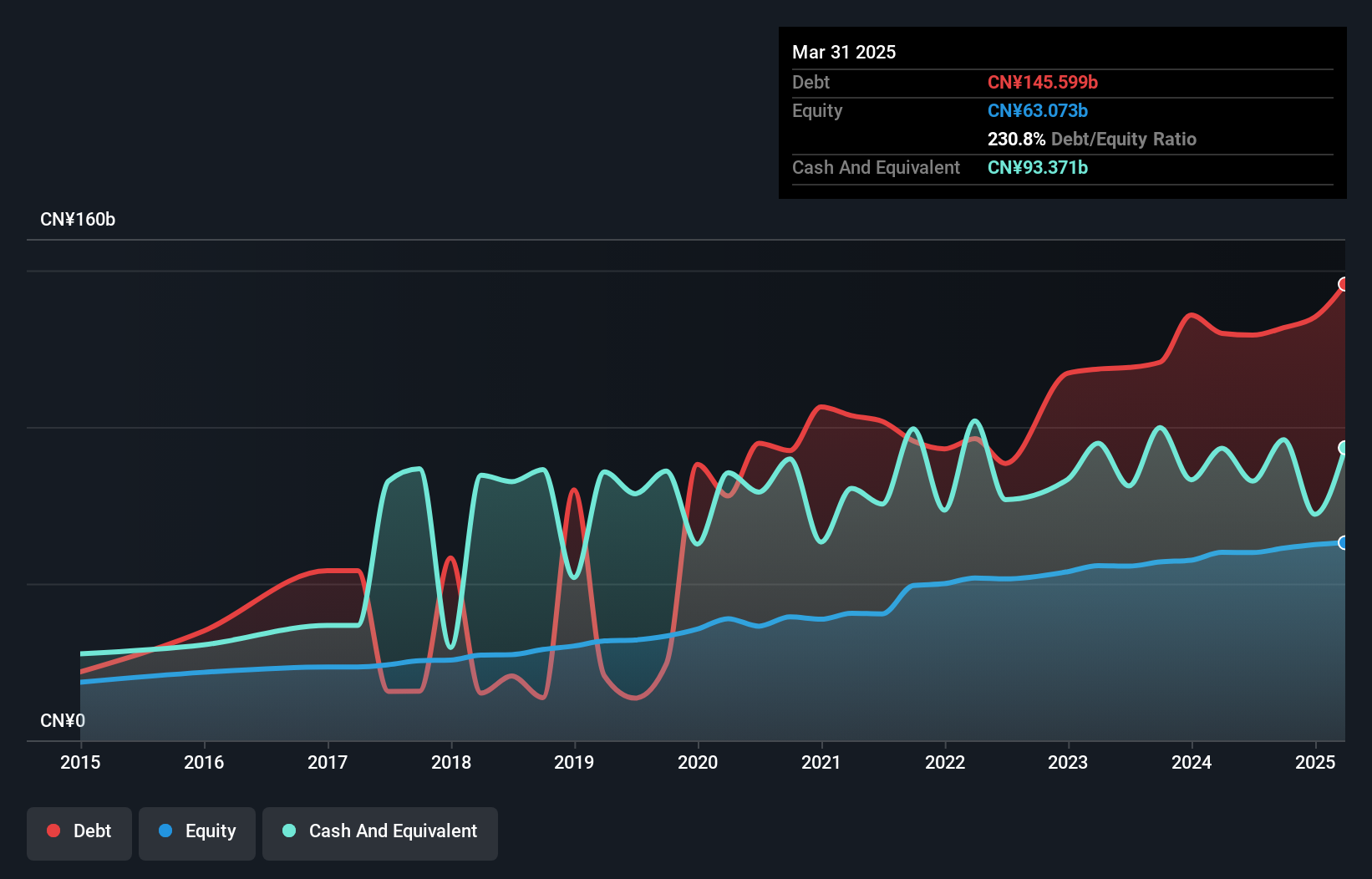

Dongguan Rural Commercial Bank's recent earnings report indicates a decline in net interest income and net income compared to the previous year, with basic earnings per share dropping from CNY 0.46 to CNY 0.38. Despite this, the bank maintains a strong asset base with an appropriate Assets to Equity ratio of 12.1x and a Loans to Deposits ratio of 71%. The board and management team are experienced, contributing to stable operations despite negative earnings growth over the past year. The bank trades at a significant discount below its estimated fair value, offering potential for investors seeking undervalued opportunities in penny stocks.

- Take a closer look at Dongguan Rural Commercial Bank's potential here in our financial health report.

- Explore historical data to track Dongguan Rural Commercial Bank's performance over time in our past results report.

Shanghai Huili Building Materials (SHSE:900939)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Huili Building Materials Co., Ltd. operates in the building materials industry and has a market capitalization of approximately $119.79 million.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥15.27 billion.

Market Cap: $119.79M

Shanghai Huili Building Materials Co., Ltd. demonstrates strong financial health, with short-term assets of CN¥193.4 million significantly exceeding both its short and long-term liabilities. The company is debt-free, which eliminates concerns over interest payments and debt coverage. Recent earnings show a substantial increase in net income to CN¥42.1 million for the first half of 2025, compared to CN¥3.18 million the previous year, highlighting impressive profit growth despite minimal revenue changes at CN¥7.63 million annually. However, high share price volatility remains a concern for investors considering stability in penny stocks investments.

- Jump into the full analysis health report here for a deeper understanding of Shanghai Huili Building Materials.

- Assess Shanghai Huili Building Materials' previous results with our detailed historical performance reports.

Hubei Fuxing Science and TechnologyLtd (SZSE:000926)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hubei Fuxing Science and Technology Co., Ltd operates in the real estate development sector both within China and internationally, with a market cap of CN¥4.54 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥4.54B

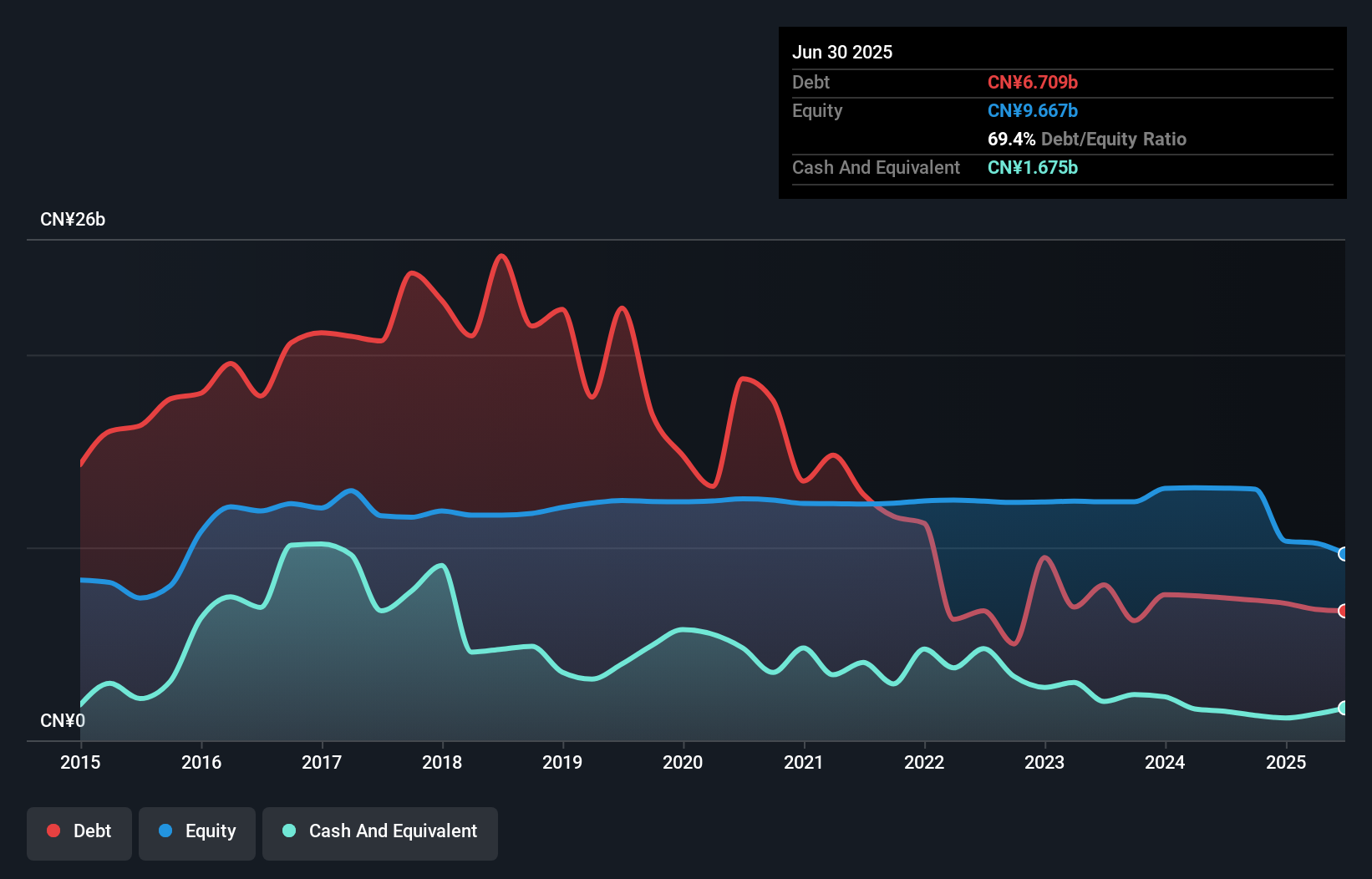

Hubei Fuxing Science and Technology Co., Ltd. operates with a market cap of CN¥4.54 billion, yet faces challenges as it remains unprofitable, with losses widening over the past five years. Despite this, its management and board are seasoned, averaging tenures of 8.4 and 5.3 years respectively, which could provide stability in navigating financial hurdles. The company's short-term assets (CN¥22.3B) comfortably cover both short-term (CN¥13.9B) and long-term liabilities (CN¥5B), indicating solid asset management despite declining revenues from CN¥1,673.57 million to CN¥732.7 million year-over-year for the first half of 2025.

- Dive into the specifics of Hubei Fuxing Science and TechnologyLtd here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Hubei Fuxing Science and TechnologyLtd's track record.

Seize The Opportunity

- Embark on your investment journey to our 3,731 Global Penny Stocks selection here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives