- Sweden

- /

- Medical Equipment

- /

- OM:CEVI

European Stocks Estimated To Be Trading Below Intrinsic Value In August 2025

Reviewed by Simply Wall St

In August 2025, European markets are experiencing a wave of optimism driven by easing trade tensions and potential U.S. interest rate cuts, with the STOXX Europe 600 Index rising by 1.18%. As investors navigate these favorable conditions, identifying stocks that are trading below their intrinsic value can be a strategic approach to capitalize on market opportunities while maintaining a focus on long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Robit Oyj (HLSE:ROBIT) | €1.15 | €2.26 | 49.2% |

| MilDef Group (OM:MILDEF) | SEK149.40 | SEK291.71 | 48.8% |

| Midsummer (OM:MIDS) | SEK2.67 | SEK5.34 | 50% |

| Kuros Biosciences (SWX:KURN) | CHF27.80 | CHF54.72 | 49.2% |

| Hanza (OM:HANZA) | SEK114.00 | SEK222.02 | 48.7% |

| Eleving Group (DB:OT8) | €1.58 | €3.06 | 48.4% |

| Camurus (OM:CAMX) | SEK691.50 | SEK1378.39 | 49.8% |

| ATON Green Storage (BIT:ATON) | €2.08 | €4.09 | 49.2% |

| Atea (OB:ATEA) | NOK145.00 | NOK286.34 | 49.4% |

| Aquila Part Prod Com (BVB:AQ) | RON1.454 | RON2.86 | 49.2% |

We'll examine a selection from our screener results.

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of SEK4.14 billion.

Operations: CellaVision's revenue is primarily derived from Automated Microscopy Systems and Reagents in the field of Hematology, amounting to SEK751.47 million.

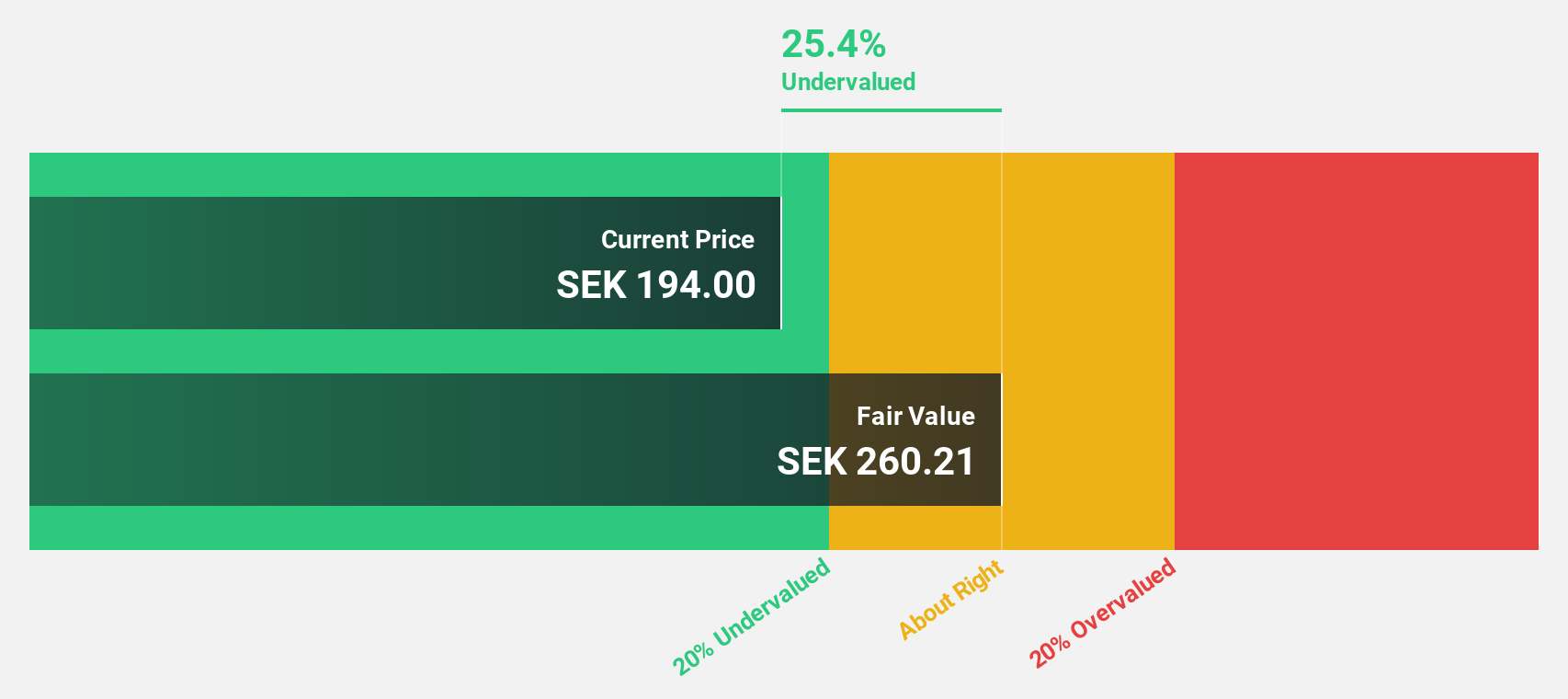

Estimated Discount To Fair Value: 39.2%

CellaVision is trading at SEK173.6, significantly below its estimated fair value of SEK285.7, suggesting potential undervaluation based on discounted cash flow analysis. Despite a modest past earnings growth of 4.2%, future earnings are projected to grow at 17.47% annually, outpacing the Swedish market's average growth rate of 16.6%. Recent financials show steady sales increase and improved net income over six months, reinforcing its strong cash flow position and attractive valuation proposition in Europe.

- Our growth report here indicates CellaVision may be poised for an improving outlook.

- Dive into the specifics of CellaVision here with our thorough financial health report.

Ependion (OM:EPEN)

Overview: Ependion AB, with a market cap of SEK4.22 billion, offers digital solutions for secure control, management, visualization, and data communication in industrial applications.

Operations: Ependion's revenue is primarily derived from its Westermo segment, which generated SEK1.29 billion, and the Beijer Electronics segment (including Korenix), which contributed SEK890.26 million.

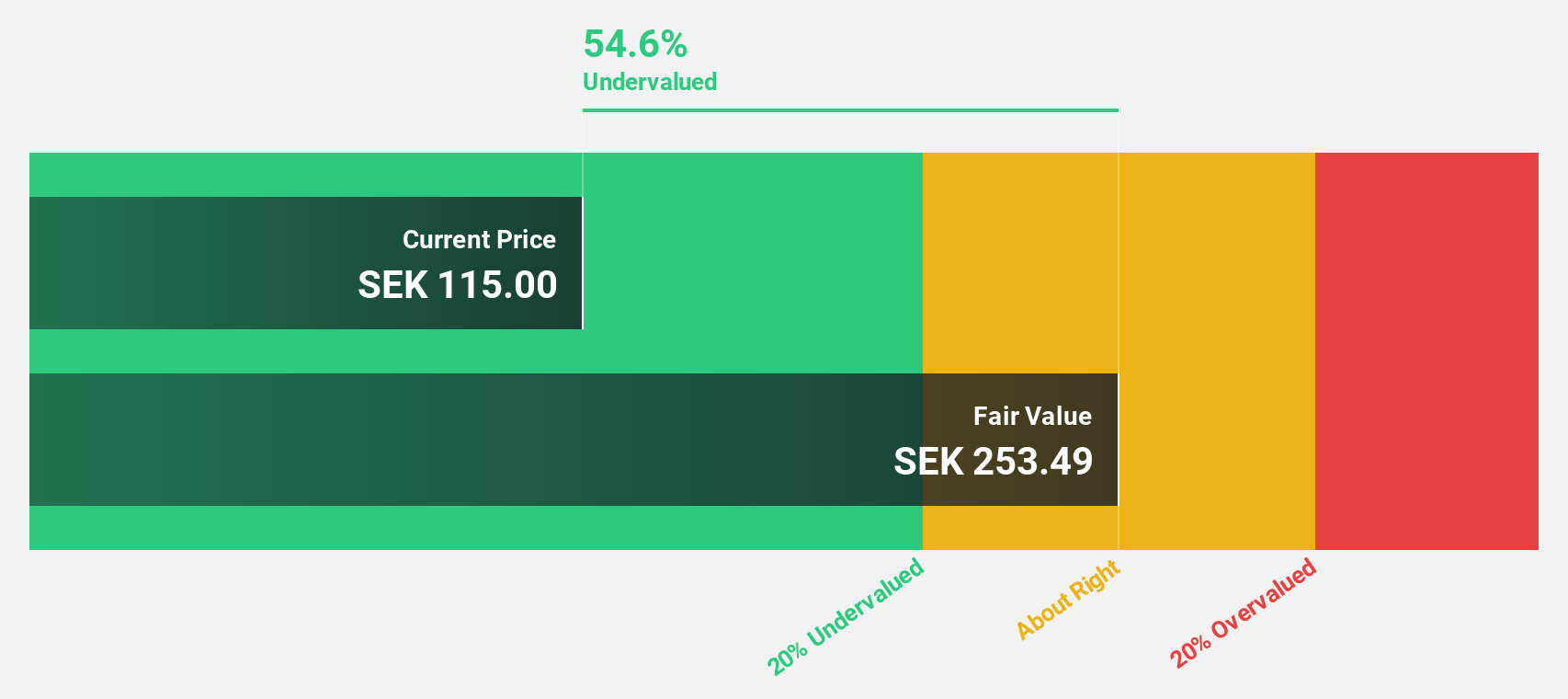

Estimated Discount To Fair Value: 35.1%

Ependion, trading at SEK131.4, is priced significantly below its estimated fair value of SEK202.49, indicating potential undervaluation based on cash flows. Despite recent declines in sales and net income for the second quarter and first half of 2025, Ependion's earnings are forecast to grow substantially at 35.2% annually over the next three years, outperforming the Swedish market average of 16.6%, which supports its investment appeal in Europe amidst current challenges.

- The growth report we've compiled suggests that Ependion's future prospects could be on the up.

- Take a closer look at Ependion's balance sheet health here in our report.

New Wave Group (OM:NEWA B)

Overview: New Wave Group AB (publ) is involved in designing, acquiring, and developing brands and products across the corporate, sports, gifts, and home furnishings sectors globally, with a market cap of SEK14.30 billion.

Operations: The company's revenue segments are comprised of SEK4.73 billion from Corporate, SEK4.03 billion from Sports & Leisure, and SEK853.50 million from Gifts & Home Furnishings.

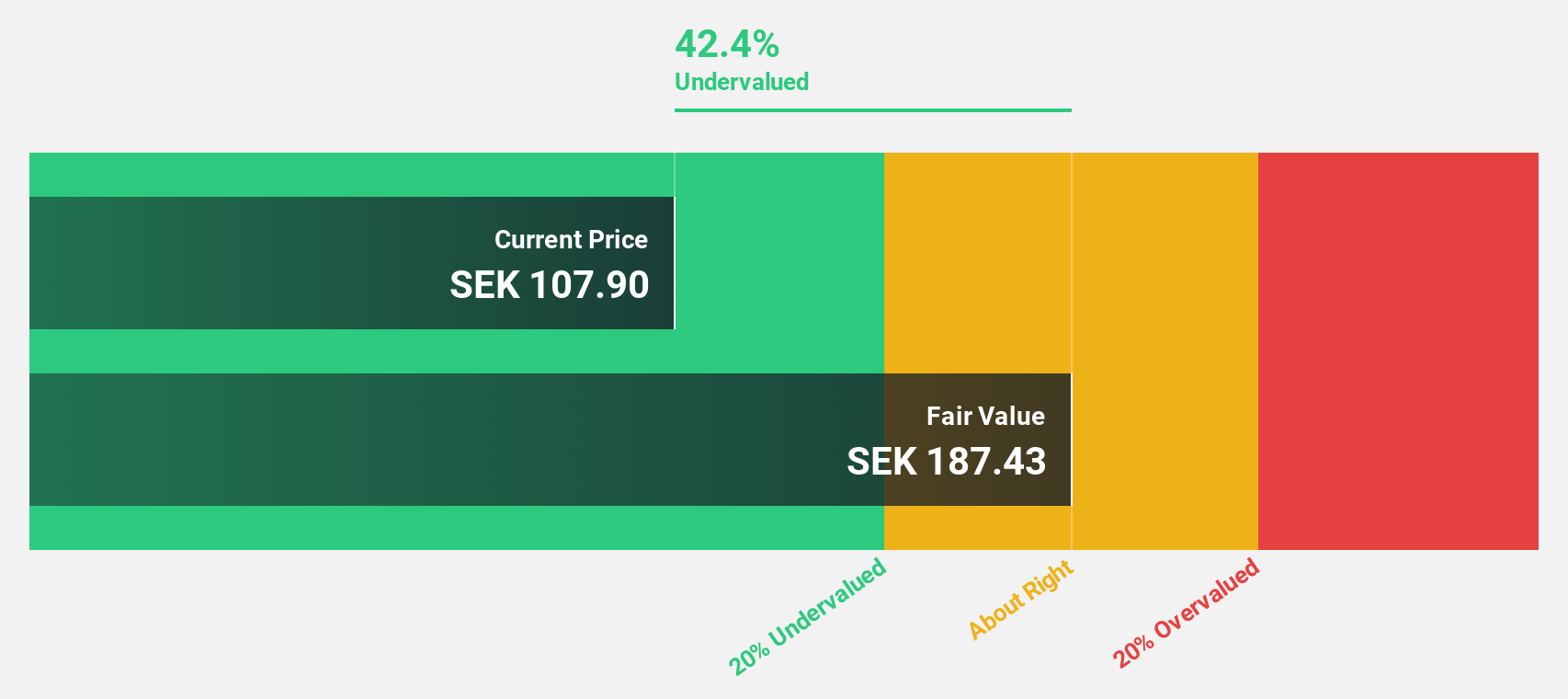

Estimated Discount To Fair Value: 42.5%

New Wave Group, trading at SEK107.8, is priced well below its estimated fair value of SEK187.59, highlighting potential undervaluation based on cash flows. Despite a recent dip in quarterly sales and net income compared to last year, the company's earnings are projected to grow significantly at 20.65% annually over the next three years, surpassing the Swedish market average of 16.6%, which enhances its investment attractiveness amid current challenges in Europe.

- The analysis detailed in our New Wave Group growth report hints at robust future financial performance.

- Get an in-depth perspective on New Wave Group's balance sheet by reading our health report here.

Seize The Opportunity

- Investigate our full lineup of 213 Undervalued European Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CEVI

CellaVision

Develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives