- France

- /

- Tech Hardware

- /

- ENXTPA:GUI

European Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the European markets reach record highs, driven by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are keenly watching for opportunities in various segments. Penny stocks, often seen as smaller or newer companies with affordable entry points, continue to offer intriguing possibilities for growth when backed by strong financials. Despite being an outdated term, these stocks can still present valuable opportunities for investors looking to uncover hidden gems within the market's broader narrative of economic optimism and technological advancement.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.12 | €16.64M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.28 | €43.57M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.03 | €27.66M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €219.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.43 | DKK112.01M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.79 | €38.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.09 | €288.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0738 | €7.8M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 273 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aelis Farma (ENXTPA:AELIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aelis Farma SA is a clinical-stage biopharmaceutical company in France that develops drug candidates for central nervous system disorders, with a market cap of €16.58 million.

Operations: The company generates its revenue of €2.33 million from the research and development of pharmaceutical products.

Market Cap: €16.58M

Aelis Farma, a clinical-stage biopharmaceutical company, recently reported a significant drop in sales to €0.895 million for the half year ending June 2025, alongside an increased net loss of €4.32 million. Despite being pre-revenue and unprofitable with volatile share prices, Aelis has been added to the CAC Small and All-Tradable indices, reflecting some market recognition. The company maintains more cash than debt and has reduced its debt-to-equity ratio substantially over five years. Its short-term assets exceed both short- and long-term liabilities, providing a sufficient cash runway for over a year despite ongoing financial challenges.

- Get an in-depth perspective on Aelis Farma's performance by reading our balance sheet health report here.

- Gain insights into Aelis Farma's future direction by reviewing our growth report.

Guillemot (ENXTPA:GUI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guillemot Corporation S.A. designs, manufactures, and sells interactive entertainment equipment and accessories across several countries including France, Germany, and the United States with a market cap of €73.01 million.

Operations: The company's revenue is primarily generated from its Thrustmaster segment at €108.57 million, followed by the Hercules segment at €12.25 million.

Market Cap: €73.01M

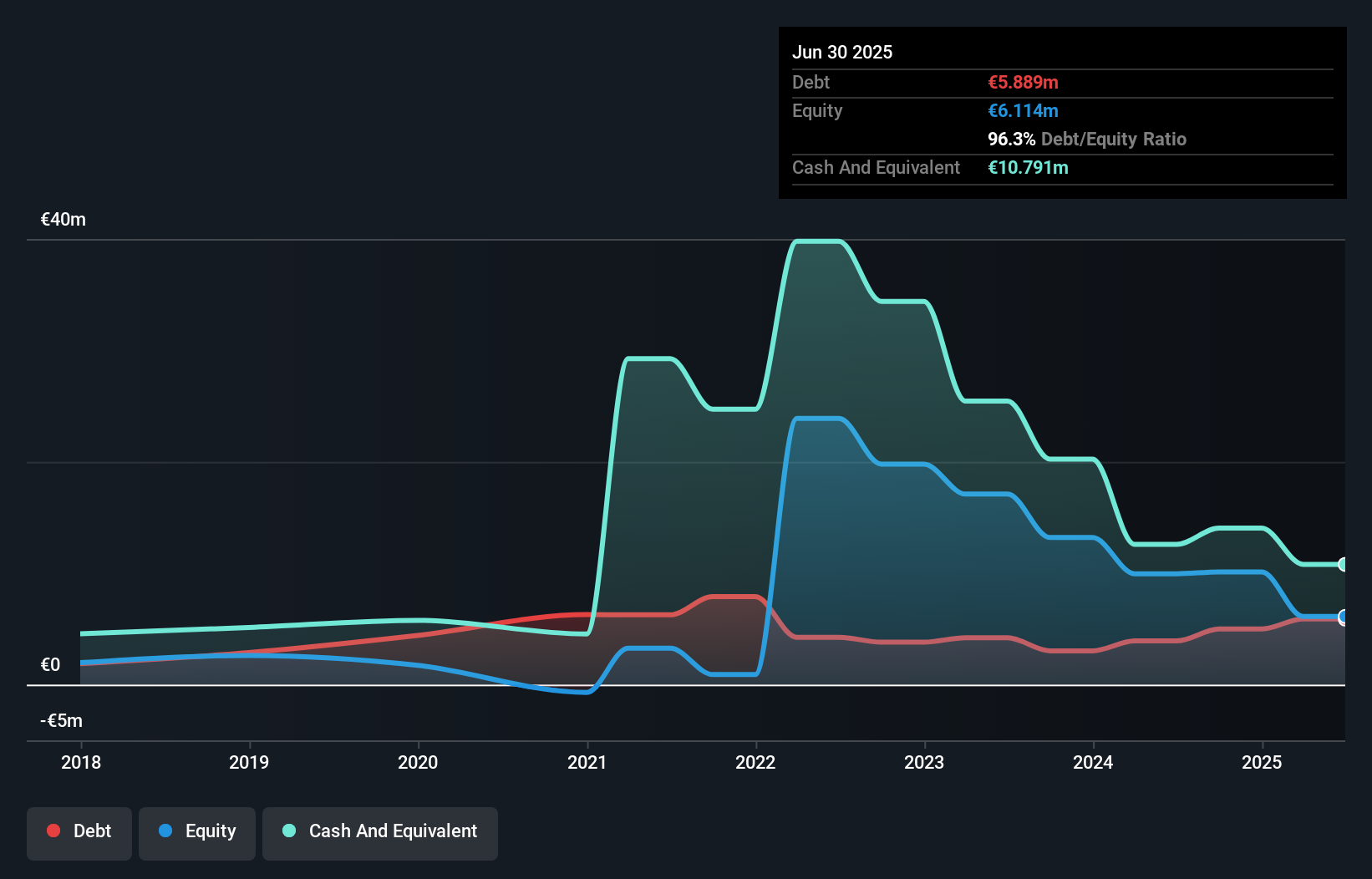

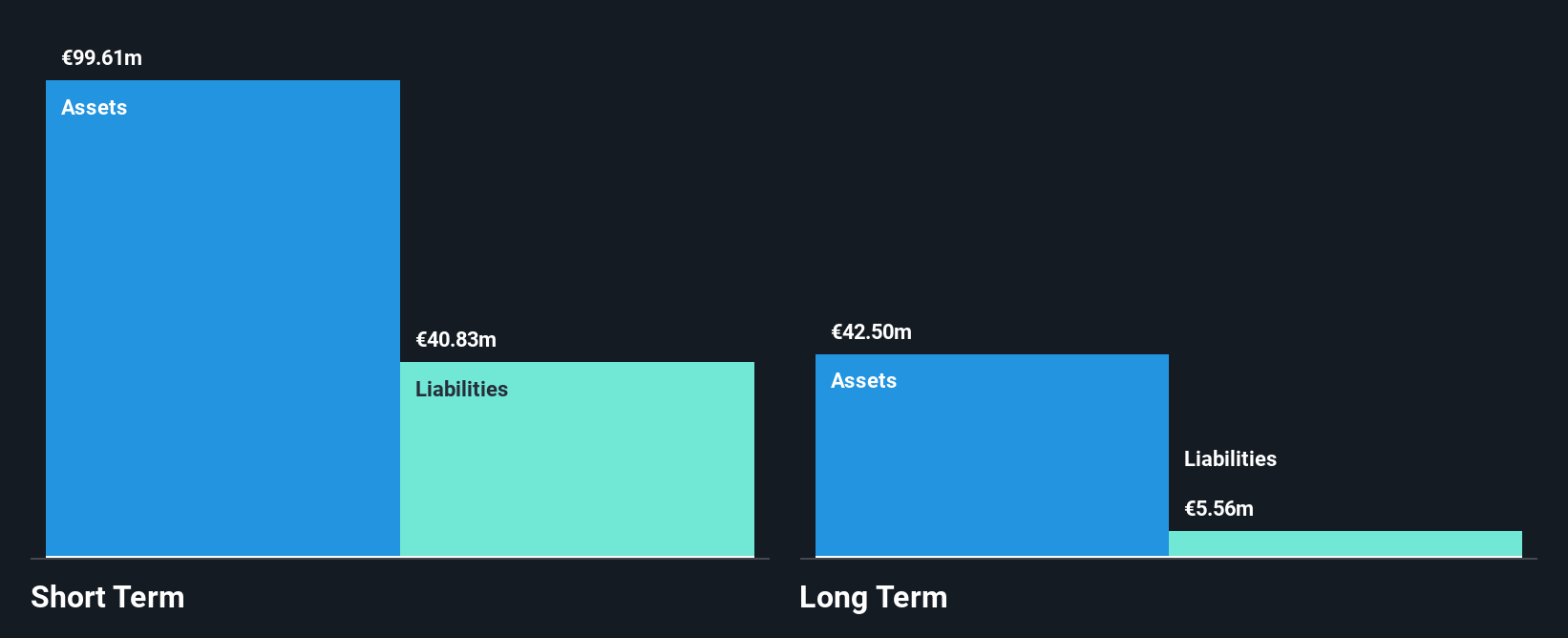

Guillemot Corporation S.A. reported a net loss of €3.59 million for the first half of 2025, with sales declining to €51.71 million from €56.01 million the previous year, reflecting current unprofitability despite a strong revenue base from its Thrustmaster segment. The company projects over €120 million in turnover and a net operating profit for fiscal 2025, suggesting potential recovery prospects. Guillemot's financial stability is bolstered by short-term assets exceeding liabilities and a significant reduction in debt-to-equity ratio to 5.4%. The company's management and board are seasoned, enhancing strategic oversight amidst financial volatility.

- Dive into the specifics of Guillemot here with our thorough balance sheet health report.

- Learn about Guillemot's future growth trajectory here.

Orthex Oyj (HLSE:ORTHEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orthex Oyj is a houseware company that designs, produces, markets, and sells household products in the Nordics, the rest of Europe, and internationally, with a market cap of €81.69 million.

Operations: The company's revenue is segmented into €67.65 million from the Nordics, €19.75 million from the rest of Europe, and €0.94 million from the rest of the world.

Market Cap: €81.69M

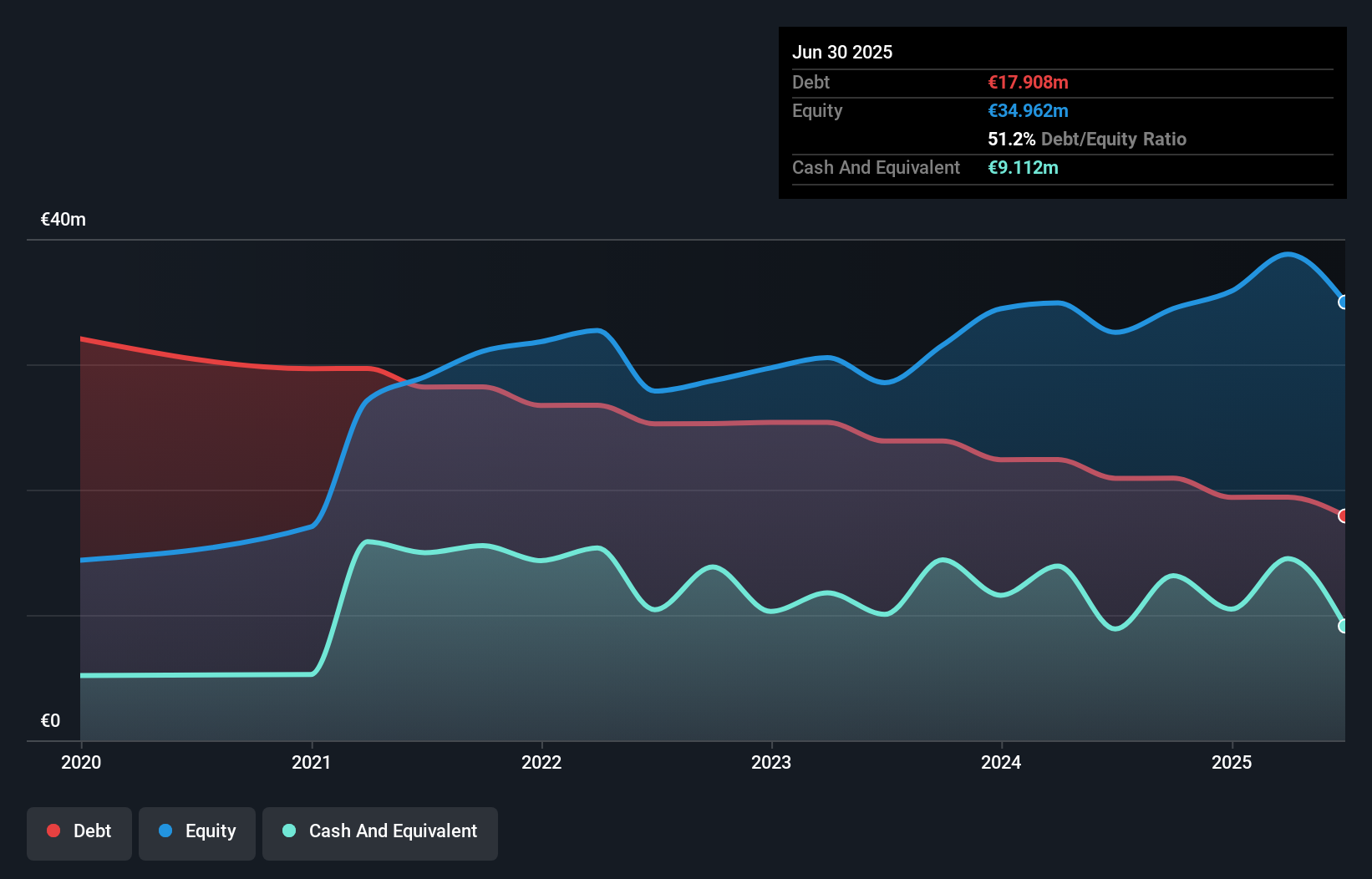

Orthex Oyj, with a market cap of €81.69 million, has shown resilience despite recent challenges in revenue and earnings. The company's debt management is commendable, with a reduction in the debt-to-equity ratio from 196.7% to 51.2% over five years and interest payments well covered by EBIT at 6.5 times coverage. Its short-term assets exceed both short- and long-term liabilities, indicating solid financial stability. While recent earnings growth has been negative, forecasts suggest potential improvement at an annual rate of 14.91%. The appointment of Aurélien Chabannier as Sales Director may strengthen its international market presence.

- Click to explore a detailed breakdown of our findings in Orthex Oyj's financial health report.

- Understand Orthex Oyj's earnings outlook by examining our growth report.

Key Takeaways

- Embark on your investment journey to our 273 European Penny Stocks selection here.

- Looking For Alternative Opportunities? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GUI

Guillemot

Engages in designing, manufacturing, and selling of interactive entertainment equipment and accessories in European Union, the United Kingdom, North America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026