European Market Insights: AFYREN SAS And Two Other Prominent Penny Stocks

Reviewed by Simply Wall St

As the European markets navigate a period of profit-taking and political uncertainty, investors are increasingly looking at alternative investment opportunities. Penny stocks, though an older term, continue to capture interest due to their potential for growth at lower price points. By focusing on companies with strong financials and clear growth prospects, investors can uncover hidden gems in the European market that may offer both stability and upside potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.93 | €1.36B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.12 | €16.64M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.35 | €44.5M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.99 | €27.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €225.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.40 | DKK111.25M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.70 | €38.11M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0812 | €8.58M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 275 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AFYREN SAS offers alternatives to petroleum-based ingredients using non-food biomass in France, with a market cap of €64.75 million.

Operations: The company generates revenue from its Chemicals segment, amounting to €2.70 million.

Market Cap: €64.75M

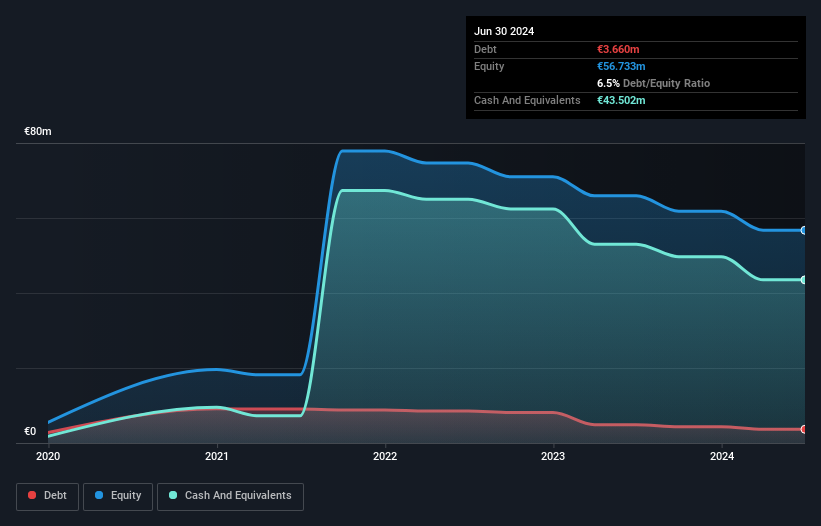

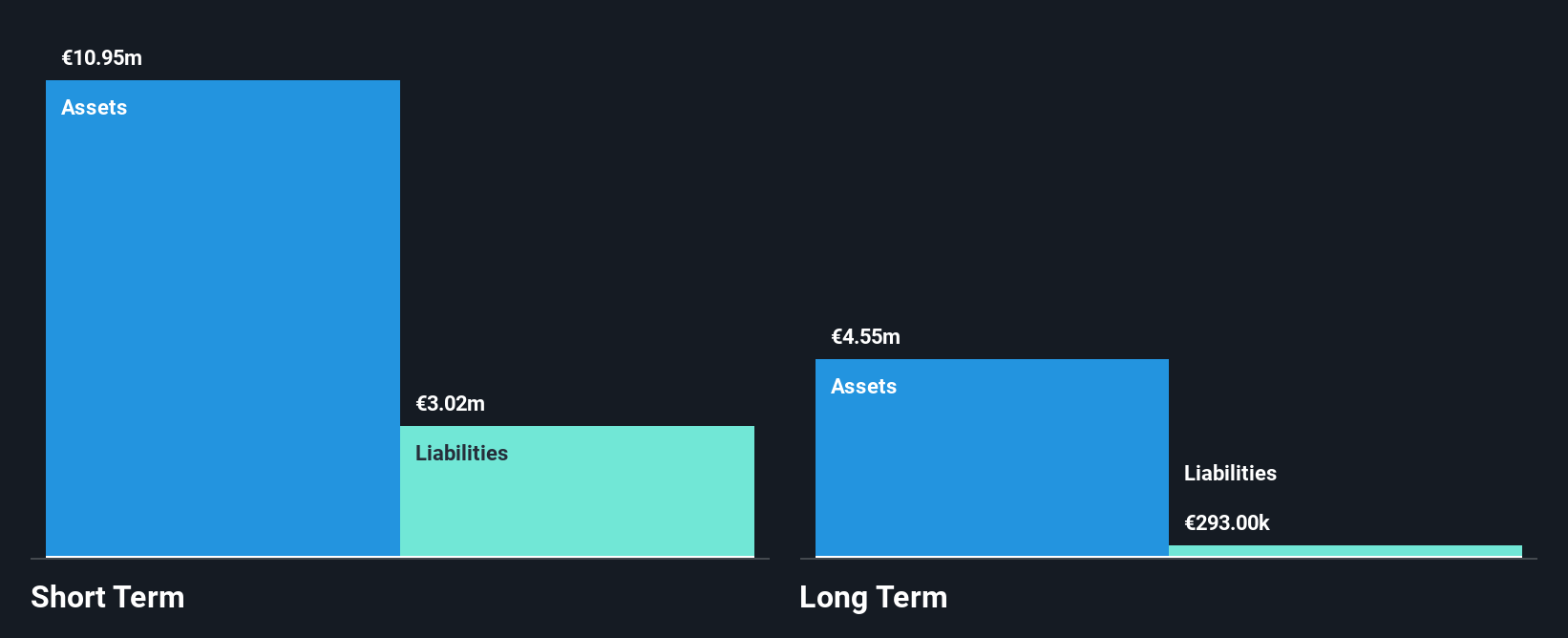

AFYREN SAS, with a market cap of €64.75 million, is navigating the challenges typical of penny stocks. The company is pre-revenue, posting sales of €1.2 million for the first half of 2025 and a net loss of €6.92 million. Despite being unprofitable and not expected to achieve profitability in the next three years, AFYREN has more cash than debt and sufficient resources to cover liabilities short term and long term. Revenue growth is forecast at 72.51% per year, but earnings are expected to decline by an average of 3.5% annually over the next three years.

- Get an in-depth perspective on AFYREN SAS' performance by reading our balance sheet health report here.

- Learn about AFYREN SAS' future growth trajectory here.

Biohit Oyj (HLSE:BIOBV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Biohit Oyj is a biotechnology company that produces and sells acetaldehyde-binding products, diagnostic tools, and systems for research institutions, healthcare, and industry globally, with a market cap of €45.70 million.

Operations: The company's revenue primarily comes from its diagnostic kits and equipment segment, generating €14.28 million.

Market Cap: €45.7M

Biohit Oyj, with a market cap of €45.70 million, has shown stable earnings growth and financial health typical of penny stocks. The company reported half-year sales of €7.4 million, consistent with last year, but net income decreased to €0.9 million from €1.2 million. Despite this dip in profitability, Biohit's short-term assets comfortably cover its liabilities, and it remains debt-free with no shareholder dilution over the past year. Future revenue is projected to grow 15-20% annually through 2028, supported by an expected operating profit margin of at least 10%.

- Click here and access our complete financial health analysis report to understand the dynamics of Biohit Oyj.

- Gain insights into Biohit Oyj's future direction by reviewing our growth report.

Scana (OB:SCANA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Scana ASA is a company that delivers technology and services to the offshore and energy sectors across Norway, Europe, the United States, Asia, and Africa with a market capitalization of NOK720.54 million.

Operations: Scana's revenue primarily comes from its Energy segment, generating NOK631.8 million, and the Offshore Segment, contributing NOK1.06 billion.

Market Cap: NOK720.54M

Scana ASA, with a market cap of NOK720.54 million, is trading significantly below its estimated fair value and shows potential in the penny stock segment. The company has reduced its debt to equity ratio from 380.8% to 22.2% over five years, indicating improved financial stability despite being unprofitable. Scana's short-term assets do not cover all liabilities, but it maintains a sufficient cash runway for over three years due to positive free cash flow growth of 23.2% annually. Recent management changes include appointing Baste Tveito as CEO and Morten Riiser as CFO on a permanent basis, signaling strategic shifts within the company.

- Click to explore a detailed breakdown of our findings in Scana's financial health report.

- Gain insights into Scana's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Jump into our full catalog of 275 European Penny Stocks here.

- Searching for a Fresh Perspective? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SCANA

Scana

Provides technology and services for the offshore and energy industries in Norway, other European countries, the United States, Asia, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)