European Market Gems: Stocks Trading Below Estimated Value In June 2025

Reviewed by Simply Wall St

Amidst a backdrop of easing inflation and potential interest rate cuts by the European Central Bank, the European markets have shown resilience with indices like Germany's DAX and Italy's FTSE MIB posting gains. In such an environment, identifying stocks that are trading below their estimated value can present unique opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.30 | SEK95.13 | 49.2% |

| CTT Systems (OM:CTT) | SEK208.00 | SEK406.70 | 48.9% |

| Absolent Air Care Group (OM:ABSO) | SEK211.00 | SEK416.98 | 49.4% |

| Sparebank 68° Nord (OB:SB68) | NOK179.40 | NOK358.38 | 49.9% |

| USU Software (HMSE:OSP2) | €25.485 | €50.83 | 49.9% |

| Vestas Wind Systems (CPSE:VWS) | DKK106.20 | DKK209.54 | 49.3% |

| Montana Aerospace (SWX:AERO) | CHF19.72 | CHF38.66 | 49% |

| doValue (BIT:DOV) | €2.31 | €4.50 | 48.7% |

| 3U Holding (XTRA:UUU) | €1.495 | €2.99 | 49.9% |

| VIGO Photonics (WSE:VGO) | PLN526.00 | PLN1024.74 | 48.7% |

Let's explore several standout options from the results in the screener.

Atea (OB:ATEA)

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK16.73 billion.

Operations: The company's revenue segments are comprised of NOK9 billion from Norway, NOK13.06 billion from Sweden, NOK8.25 billion from Denmark, NOK3.57 billion from Finland, and NOK1.80 billion from the Baltics, with Group Shared Services contributing an additional NOK10.81 billion.

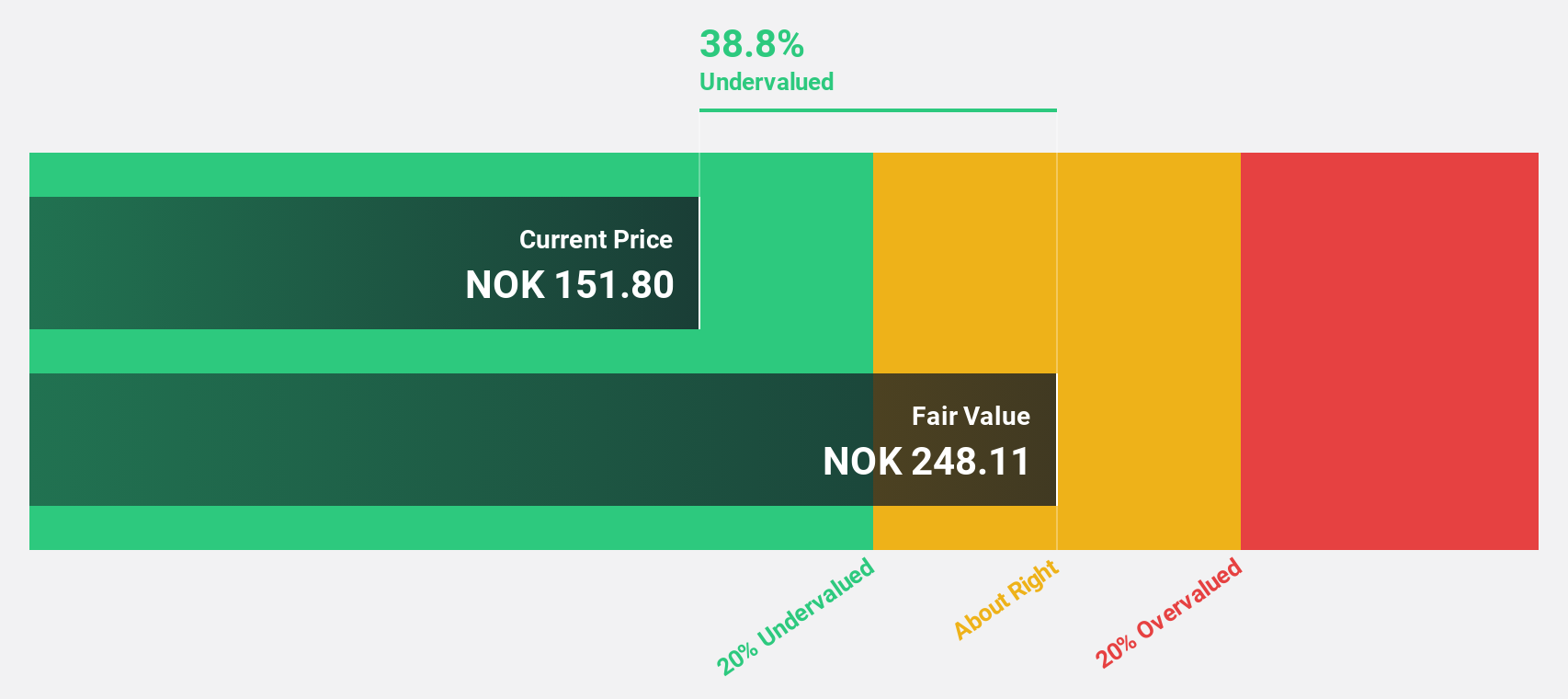

Estimated Discount To Fair Value: 39.7%

Atea is trading at NOK 150.2, significantly below its estimated fair value of NOK 249, suggesting it may be undervalued based on cash flows. The company's revenue and earnings are forecast to grow faster than the Norwegian market, with earnings expected to rise by 19.7% annually. Despite a dividend yield of 4.66%, it's not well covered by earnings, raising sustainability concerns. Recent Q1 results showed increased sales but a decline in net income year-over-year.

- Our expertly prepared growth report on Atea implies its future financial outlook may be stronger than recent results.

- Take a closer look at Atea's balance sheet health here in our report.

Hoist Finance (OM:HOFI)

Overview: Hoist Finance AB (publ) is a credit market company involved in loan acquisition and management across Europe, with a market cap of SEK8.36 billion.

Operations: The company's revenue segments consist of SEK1.16 billion from secured loans and SEK2.99 billion from unsecured loans.

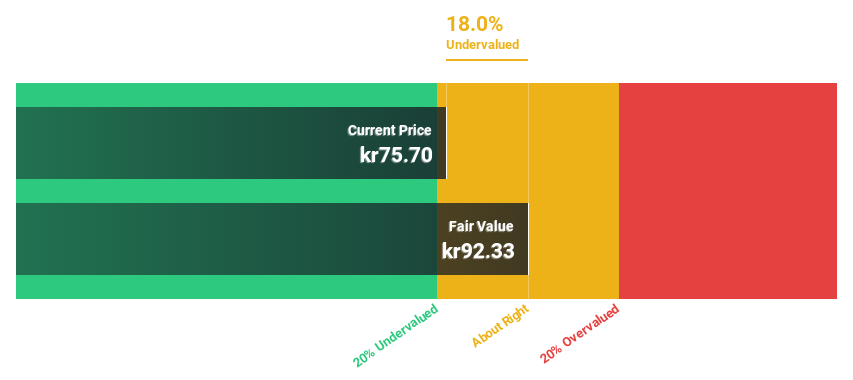

Estimated Discount To Fair Value: 19.6%

Hoist Finance is trading at SEK 95.65, below its fair value estimate of SEK 119.04, reflecting potential undervaluation based on cash flows. While earnings grew by 34.6% last year and are forecast to grow significantly over the next three years, revenue growth is slower than ideal but still outpaces the Swedish market average. The company has a high debt level and a recent dividend approval of SEK 2 per share, though its dividend track record remains unstable.

- Our earnings growth report unveils the potential for significant increases in Hoist Finance's future results.

- Unlock comprehensive insights into our analysis of Hoist Finance stock in this financial health report.

LEM Holding (SWX:LEHN)

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America; the company has a market cap of CHF894.82 million.

Operations: The company's revenue is primarily derived from two segments: Asia, contributing CHF168.27 million, and Europe/Americas, contributing CHF138.66 million.

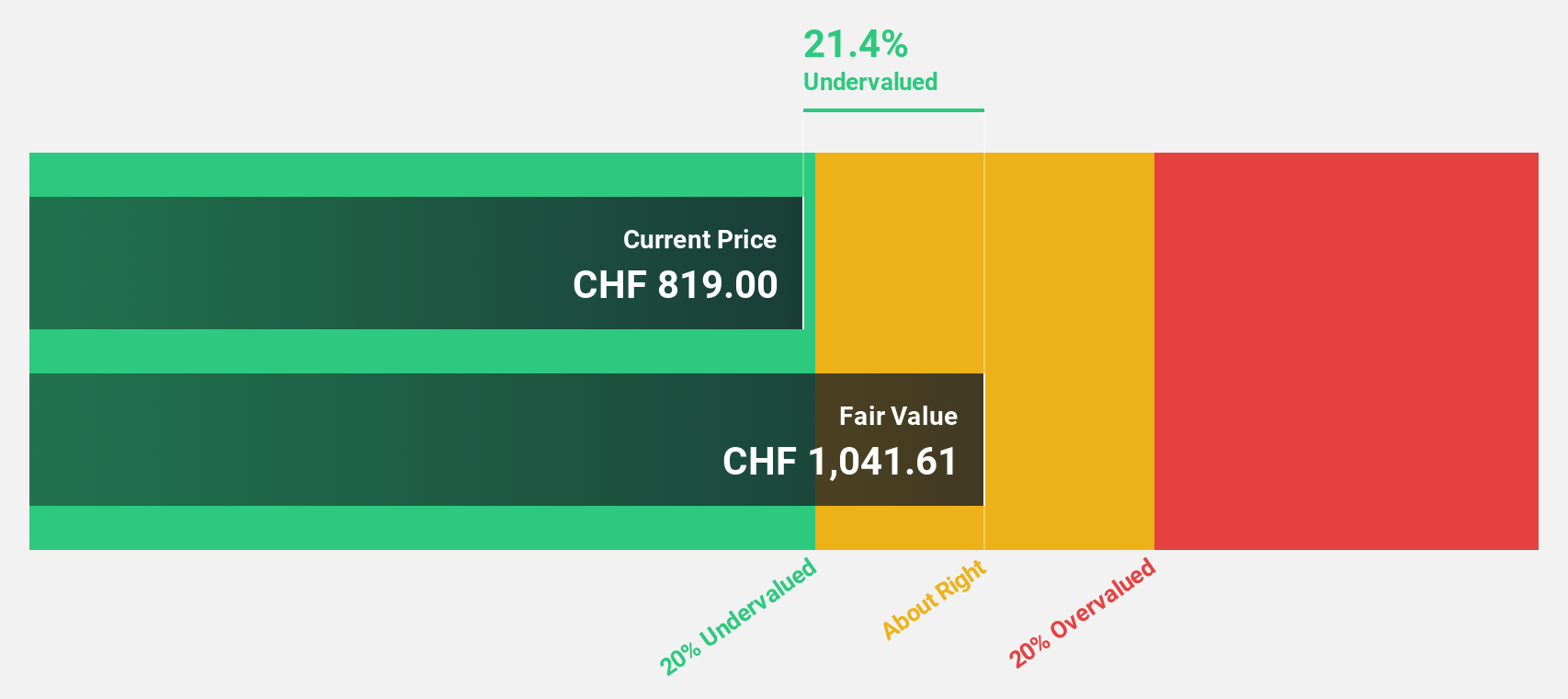

Estimated Discount To Fair Value: 24.5%

LEM Holding is trading at CHF 786, below its estimated fair value of CHF 1040.42, suggesting undervaluation based on cash flows. Despite a challenging year with net income dropping to CHF 8.39 million from CHF 65.33 million, earnings are forecast to grow significantly at 48% annually over the next three years, outpacing the Swiss market average. However, profit margins have decreased and the company carries a high level of debt.

- Upon reviewing our latest growth report, LEM Holding's projected financial performance appears quite optimistic.

- Click here to discover the nuances of LEM Holding with our detailed financial health report.

Summing It All Up

- Access the full spectrum of 182 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives