- Italy

- /

- Electrical

- /

- BIT:CMB

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As European markets navigate a landscape marked by trade negotiations and economic fluctuations, the pan-European STOXX Europe 600 Index recently experienced gains amid optimism for new trade deals, although concerns about potential U.S. tariffs have tempered enthusiasm. In this context, dividend stocks can offer stability and income potential, making them an attractive consideration for investors seeking to balance growth with steady returns in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.49% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.24% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.76% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.59% | ★★★★★★ |

| ERG (BIT:ERG) | 5.43% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.95% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and tools across Italy, Europe, and internationally with a market cap of €1 billion.

Operations: Cembre S.p.A.'s revenue from electric connectors and related tools amounts to €231.29 million.

Dividend Yield: 3.2%

Cembre offers a stable dividend history with consistent growth over the past decade, though its current yield of 3.16% is below the top tier in Italy. Despite a reasonable payout ratio of 70.6%, dividends are not well covered by free cash flows, as evidenced by a high cash payout ratio of 121.4%. Recent earnings results show improved profitability, with net income rising to €11.9 million for Q1 2025 from €9.72 million the previous year, supporting future dividend sustainability concerns despite coverage issues.

- Click to explore a detailed breakdown of our findings in Cembre's dividend report.

- Upon reviewing our latest valuation report, Cembre's share price might be too optimistic.

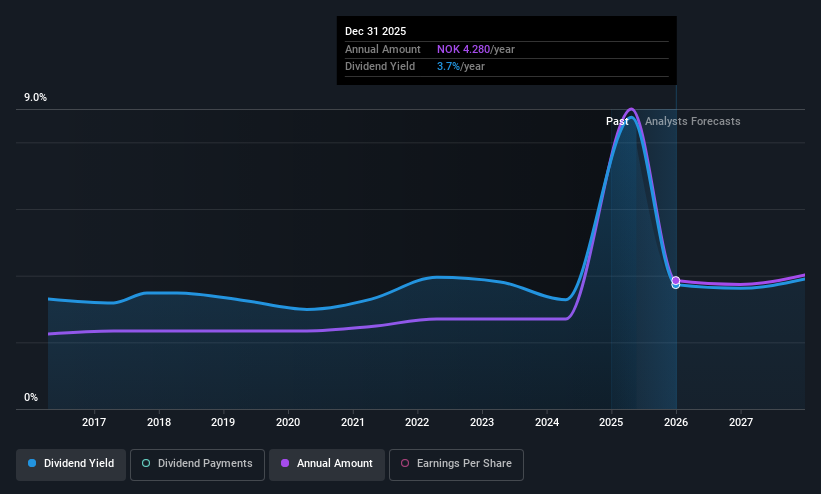

Orkla (OB:ORK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orkla ASA is an industrial investment company focusing on brands and consumer-oriented businesses across the Nordics, Baltics, Europe, and internationally, with a market cap of NOK110.42 billion.

Operations: Orkla ASA generates revenue through its operations in brands and consumer-focused sectors across Norway, Sweden, Denmark, Finland, Iceland, the Baltics, and other international markets.

Dividend Yield: 9%

Orkla has demonstrated a stable dividend history with consistent growth over the past decade, recently increasing its dividend to NOK 4.00 per share for 2024, plus an additional special dividend of NOK 6.00 per share. Despite a low payout ratio of 47.8%, dividends are not well covered by cash flows, indicated by a high cash payout ratio of 140.5%. Recent earnings showed significant improvement with Q2 net income rising to NOK 6,221 million from NOK 2,042 million year-on-year.

- Get an in-depth perspective on Orkla's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Orkla is trading behind its estimated value.

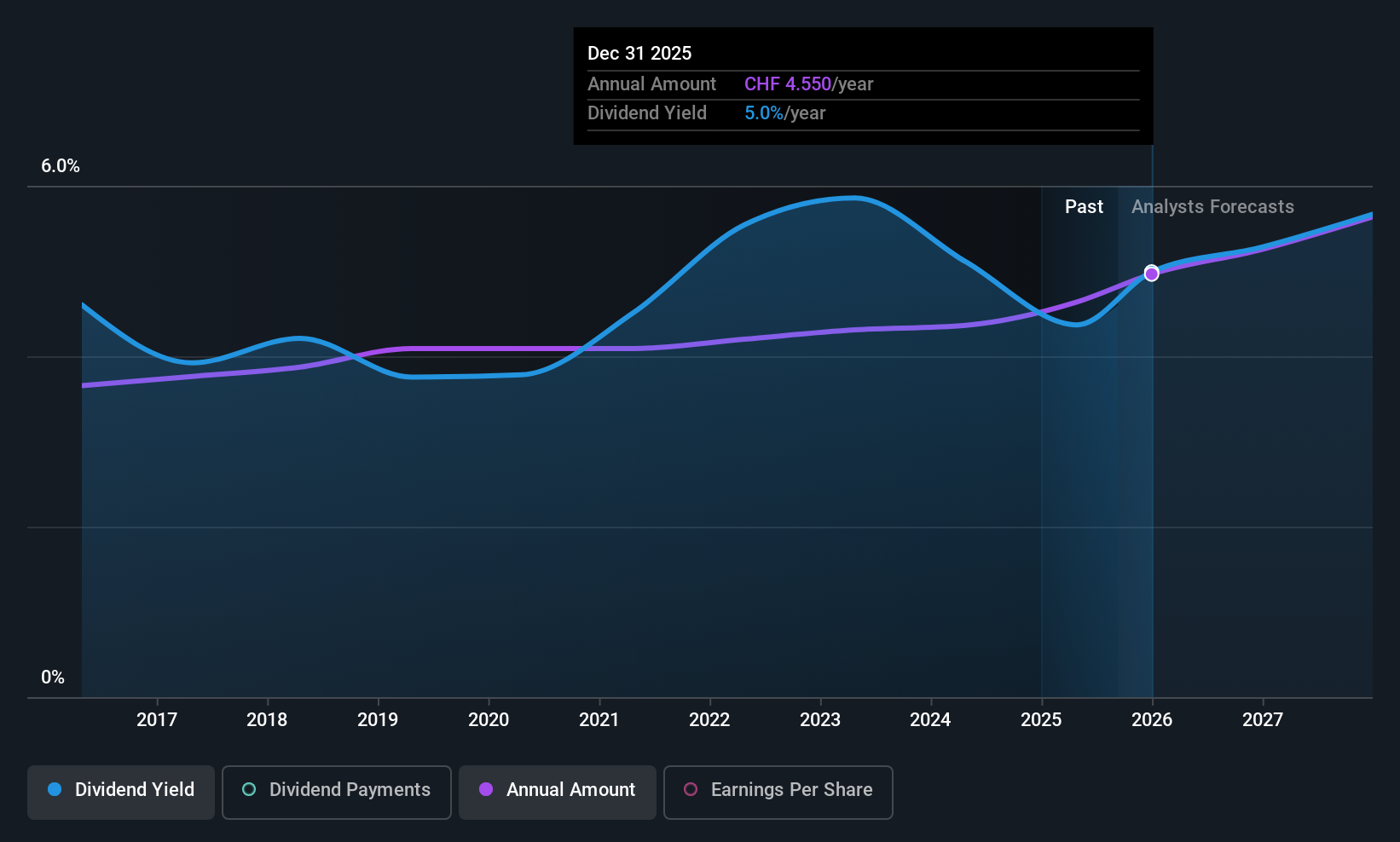

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG offers consumer finance products and services in Switzerland with a market cap of CHF3.05 billion.

Operations: Cembra Money Bank AG generates revenue from its lending segment, which contributes CHF264.46 million, and its payments segment, which adds CHF211.84 million.

Dividend Yield: 4.1%

Cembra Money Bank offers a compelling dividend profile with a recent increase to CHF 4.25 per share, reflecting steady growth and reliability over the past decade. Its payout ratio of 73.1% ensures dividends are well-covered by earnings, aligning with forecasts for continued coverage at 71.9%. Trading slightly below fair value, its dividend yield is among the top in Switzerland's market, supported by consistent earnings growth and stable financial management despite recent board changes.

- Navigate through the intricacies of Cembra Money Bank with our comprehensive dividend report here.

- Our valuation report unveils the possibility Cembra Money Bank's shares may be trading at a premium.

Summing It All Up

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 222 more companies for you to explore.Click here to unveil our expertly curated list of 225 Top European Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and tools in Italy, the rest of Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)