- Belgium

- /

- Electronic Equipment and Components

- /

- ENXTBR:BAR

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and inflationary pressures, investors are increasingly looking at dividend stocks as a potential source of stability and income. In this environment, a good dividend stock is often characterized by its ability to maintain consistent payouts, even amidst economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.38% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.95% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.05% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.96% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.68% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.59% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.23% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.20% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.35% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, with a market cap of €1.19 billion, develops visualization solutions and collaboration and networking technologies for the entertainment, enterprise, and healthcare markets across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Operations: Barco NV's revenue is derived from three main segments: Enterprise (€254.08 million), Healthcare (€273.19 million), and Entertainment (€419.32 million).

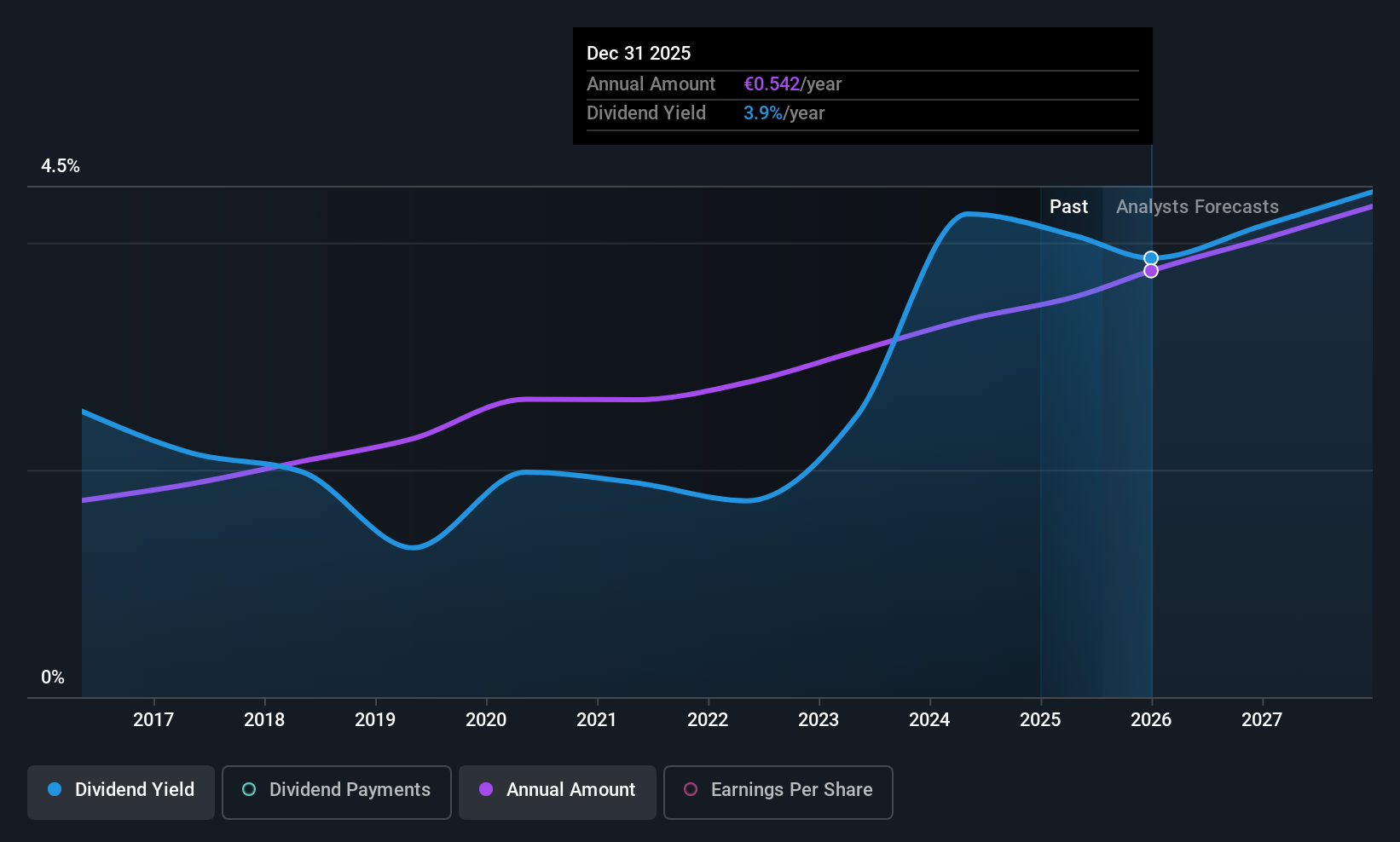

Dividend Yield: 3.8%

Barco's dividend yield of 3.78% is modest compared to the top 25% of Belgian dividend payers, yet it has shown consistent growth over the past decade with stable payouts. The dividends are well-covered by earnings and cash flows, indicating sustainability. Recent product innovations like ClickShare Hub and strategic partnerships such as with Prasad Film Labs highlight Barco's commitment to technological advancement, which could support its financial stability and future dividend potential.

- Delve into the full analysis dividend report here for a deeper understanding of Barco.

- Our valuation report here indicates Barco may be overvalued.

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE, with a market cap of €9.45 billion, operates through its subsidiaries in construction projects focusing on transportation infrastructures, building construction, and civil engineering.

Operations: Strabag SE's revenue segments are comprised of North + West at €7.35 billion, South + East at €7.28 billion, and International + Special Divisions at €3.06 billion.

Dividend Yield: 3.1%

Strabag's dividend yield of 3.13% is relatively low compared to Austria's top dividend payers, and its dividends have been volatile over the past decade. However, they are well-covered by earnings and cash flows with a payout ratio of 34% and a cash payout ratio of 39.8%. Recent earnings growth and an increased EBIT margin target for 2025 suggest potential stability, despite historically unstable dividends. The company announced a EUR 2.50 per share dividend payable in June 2025.

- Click here to discover the nuances of Strabag with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Strabag shares in the market.

Orlen (WSE:PKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orlen S.A. is a multi-faceted company engaged in refining, petrochemical, energy, retail, gas, and upstream operations with a market cap of PLN86.84 billion.

Operations: Orlen S.A.'s revenue is primarily derived from its energy segment, which generated PLN37.11 billion.

Dividend Yield: 8%

Orlen's dividend yield is among the top in Poland at 8.02%, but it faces sustainability challenges with a high payout ratio of 234.5%, indicating dividends are not well covered by earnings. Despite a history of volatility and unreliability in dividend payments, recent Q1 2025 results showed improved net income of PLN 4.28 billion, up from PLN 2.78 billion last year, suggesting potential for future stability if earnings growth continues to support cash flows adequately.

- Take a closer look at Orlen's potential here in our dividend report.

- The valuation report we've compiled suggests that Orlen's current price could be inflated.

Next Steps

- Get an in-depth perspective on all 229 Top European Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:BAR

Barco

Develops visualization solutions, and collaboration and networking technologies for the entertainment, enterprise, and healthcare markets in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives