- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (NYSE:ECL) Unveils AI-Powered Cooling Tech For Expanding Data Centers

Reviewed by Simply Wall St

Ecolab (NYSE:ECL) has launched the 3D TRASAR Technology for Direct-to-Chip Liquid Cooling, a significant innovation aimed at enhancing data center operations through real-time monitoring and AI integration. Over the past month, Ecolab's share price increased by 4%, aligning closely with the broader market's upward movement. This development likely added weight to the company's overall positive performance, alongside the opening of a new biotech laboratory and executive board appointments. Although trending generally with the market, these events underscore Ecolab's focus on technological advancement and business expansion, contributing to investor confidence.

Every company has risks, and we've spotted 1 warning sign for Ecolab you should know about.

Ecolab's recent innovation with its 3D TRASAR Technology for Direct-to-Chip Liquid Cooling could enhance its narrative of growth and technological advancement, bolstering investor confidence. The new technology may contribute positively to revenue and earnings forecasts, aligning with Ecolab's One Ecolab initiative, which targets improved margins and customer value through digital investments.

Over the past three years, Ecolab's total shareholder return, encompassing both share price appreciation and dividends, reached 61.70%. This reflects the company's robust growth strategy and capacity to bolster investor returns. In the short term, the company's shares increased 4% over the last month. In comparison to the US Market, which returned 11.9% over the past year, Ecolab exceeded this benchmark. Additionally, it outperformed its industry, which saw a 7.1% decline in the same period.

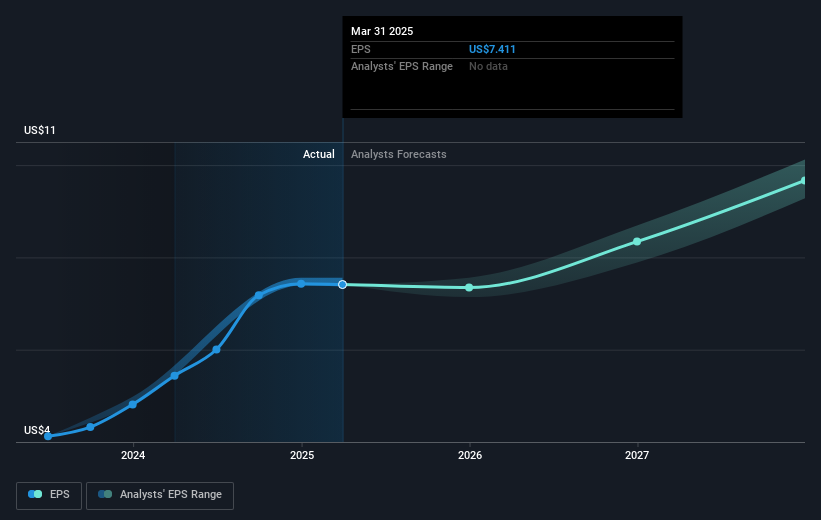

The news could impact Ecolab's projected revenues and earnings, as analysts expect revenue to grow by 4.8% annually over the next three years. The share price currently stands at US$252.65, which is 7.5% below the consensus price target of approximately US$273.27, suggesting a fair outlook by analysts. If you consider analyst projections of US$18.1 billion in revenues and US$2.7 billion in earnings by 2028, these new technological advances could support these growth estimates, maintaining Ecolab's competitive position.

Assess Ecolab's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)