- United States

- /

- Software

- /

- NasdaqGS:PANW

Discover September 2025's Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As of September 2025, the U.S. stock market is experiencing a mixed performance, with the S&P 500 and Nasdaq reaching new closing highs while the Dow Jones Industrial Average sees a decline ahead of key inflation data releases. In this environment of fluctuating indices and economic indicators, identifying stocks that may be trading below their estimated value can provide investors with potential opportunities for growth. Understanding what constitutes an undervalued stock in such conditions involves looking at factors like earnings potential, market position, and broader economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Perfect (PERF) | $1.87 | $3.65 | 48.8% |

| Peapack-Gladstone Financial (PGC) | $28.85 | $56.54 | 49% |

| Northwest Bancshares (NWBI) | $12.49 | $24.41 | 48.8% |

| Niagen Bioscience (NAGE) | $9.60 | $18.66 | 48.6% |

| Metropolitan Bank Holding (MCB) | $78.02 | $150.26 | 48.1% |

| McGraw Hill (MH) | $14.46 | $28.77 | 49.7% |

| Investar Holding (ISTR) | $22.88 | $45.15 | 49.3% |

| Horizon Bancorp (HBNC) | $16.37 | $31.83 | 48.6% |

| AGNC Investment (AGNC) | $10.25 | $20.41 | 49.8% |

| Advanced Flower Capital (AFCG) | $4.50 | $8.76 | 48.6% |

Let's take a closer look at a couple of our picks from the screened companies.

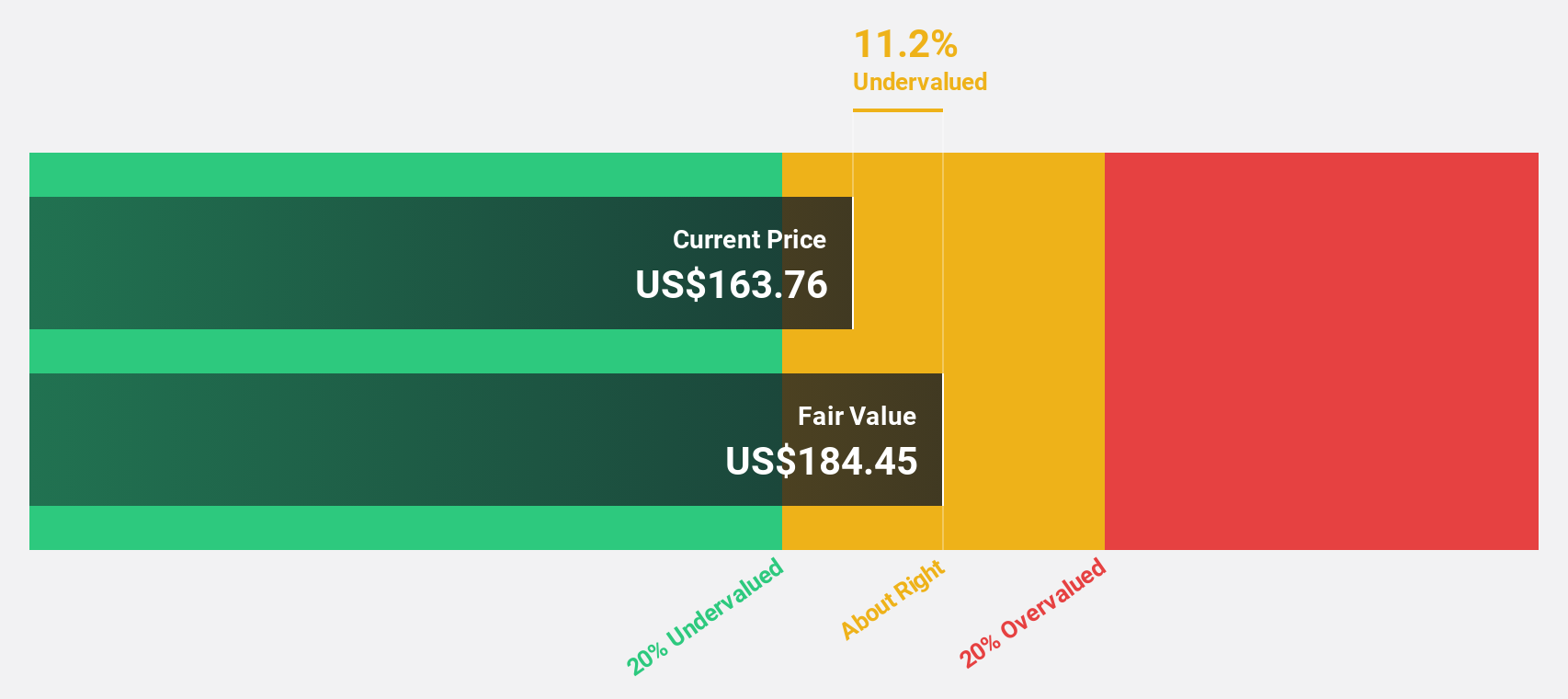

Natera (NTRA)

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally, with a market cap of $23.30 billion.

Operations: The company generates $1.96 billion from its molecular testing services segment worldwide.

Estimated Discount To Fair Value: 12.5%

Natera, Inc. is trading at 12.5% below its estimated fair value of US$194.1, indicating potential undervaluation based on cash flows. Despite significant insider selling recently and being dropped from the Russell 2500 Index, Natera's revenue is forecast to grow faster than the US market at 13.3% annually, with expectations of profitability in three years. Recent product launches and clinical trials further underscore its innovative approach in oncology diagnostics and personalized medicine solutions.

- Upon reviewing our latest growth report, Natera's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Natera with our comprehensive financial health report here.

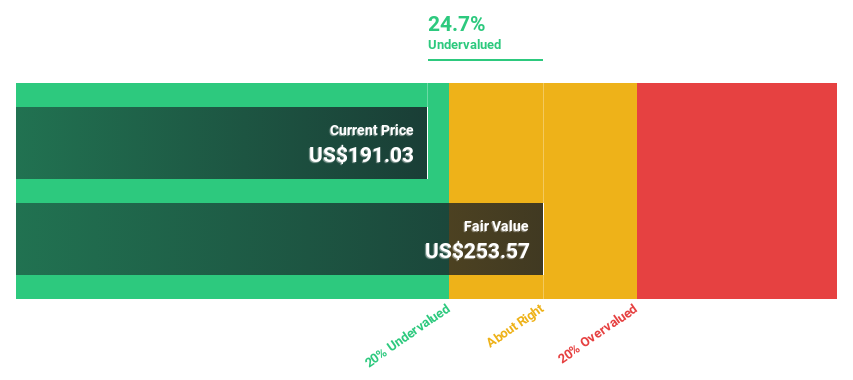

Palo Alto Networks (PANW)

Overview: Palo Alto Networks, Inc. offers cybersecurity solutions across the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market cap of approximately $132.14 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which totals $9.22 billion.

Estimated Discount To Fair Value: 17.4%

Palo Alto Networks trades at US$197.33, below its estimated fair value of US$238.89, suggesting it may be undervalued based on cash flows. Recent innovations in AI-driven security solutions and a strong position in the SASE market highlight its growth potential. Despite a decline in profit margins from 32.1% to 12.3%, earnings are forecast to grow faster than the broader US market at 16.8% annually, supported by strategic acquisitions and product advancements like Prisma® SASE 4.0.

- The analysis detailed in our Palo Alto Networks growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Palo Alto Networks' balance sheet health report.

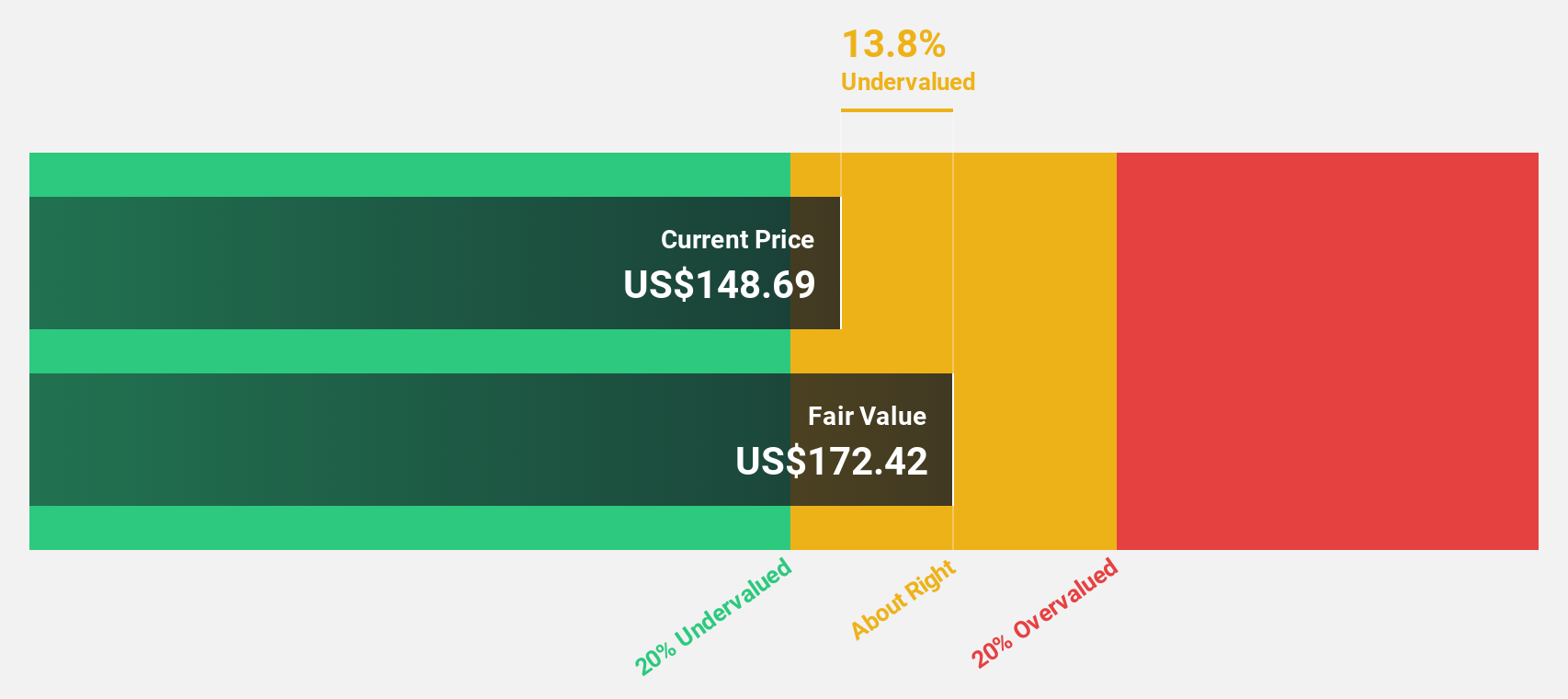

Apollo Global Management (APO)

Overview: Apollo Global Management, Inc. is a private equity firm that specializes in investments across credit, private equity, infrastructure, secondaries and real estate markets with a market cap of $76.89 billion.

Operations: Apollo Global Management's revenue is primarily derived from three segments: Asset Management ($5.24 billion), Principal Investing ($1.15 billion), and Retirement Services ($21.40 billion).

Estimated Discount To Fair Value: 26.9%

Apollo Global Management is trading at US$133.64, below its estimated fair value of US$182.75, indicating potential undervaluation based on cash flows. Despite a forecasted revenue decline, earnings are expected to grow significantly at 27.8% annually over the next three years, outpacing the broader US market. Recent executive changes and strategic expansions in Japan and homebuilder finance underscore Apollo's commitment to growth and diversification across global markets despite challenges in profit margins and insider selling activities.

- According our earnings growth report, there's an indication that Apollo Global Management might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Apollo Global Management.

Summing It All Up

- Get an in-depth perspective on all 195 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives