As the U.S. market navigates through a period of uncertainty marked by potential new tariffs and fluctuating investor sentiment, dividend stocks continue to attract attention for their ability to provide steady income amidst volatility. In this environment, selecting stocks with a strong track record of consistent dividend payouts can offer investors a measure of stability and potential for long-term financial resilience.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.59% | ★★★★★☆ |

| Universal (UVV) | 5.61% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.63% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.99% | ★★★★★★ |

| Ennis (EBF) | 5.33% | ★★★★★★ |

| Dillard's (DDS) | 5.95% | ★★★★★★ |

| CompX International (CIX) | 4.65% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.72% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.54% | ★★★★★☆ |

| Carter's (CRI) | 9.66% | ★★★★★☆ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Provident Financial Holdings (PROV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Provident Financial Holdings, Inc., with a market cap of $103.75 million, operates as the holding company for Provident Savings Bank, F.S.B.

Operations: Provident Financial Holdings generates its revenue primarily from its Banking segment, which accounts for $39.91 million.

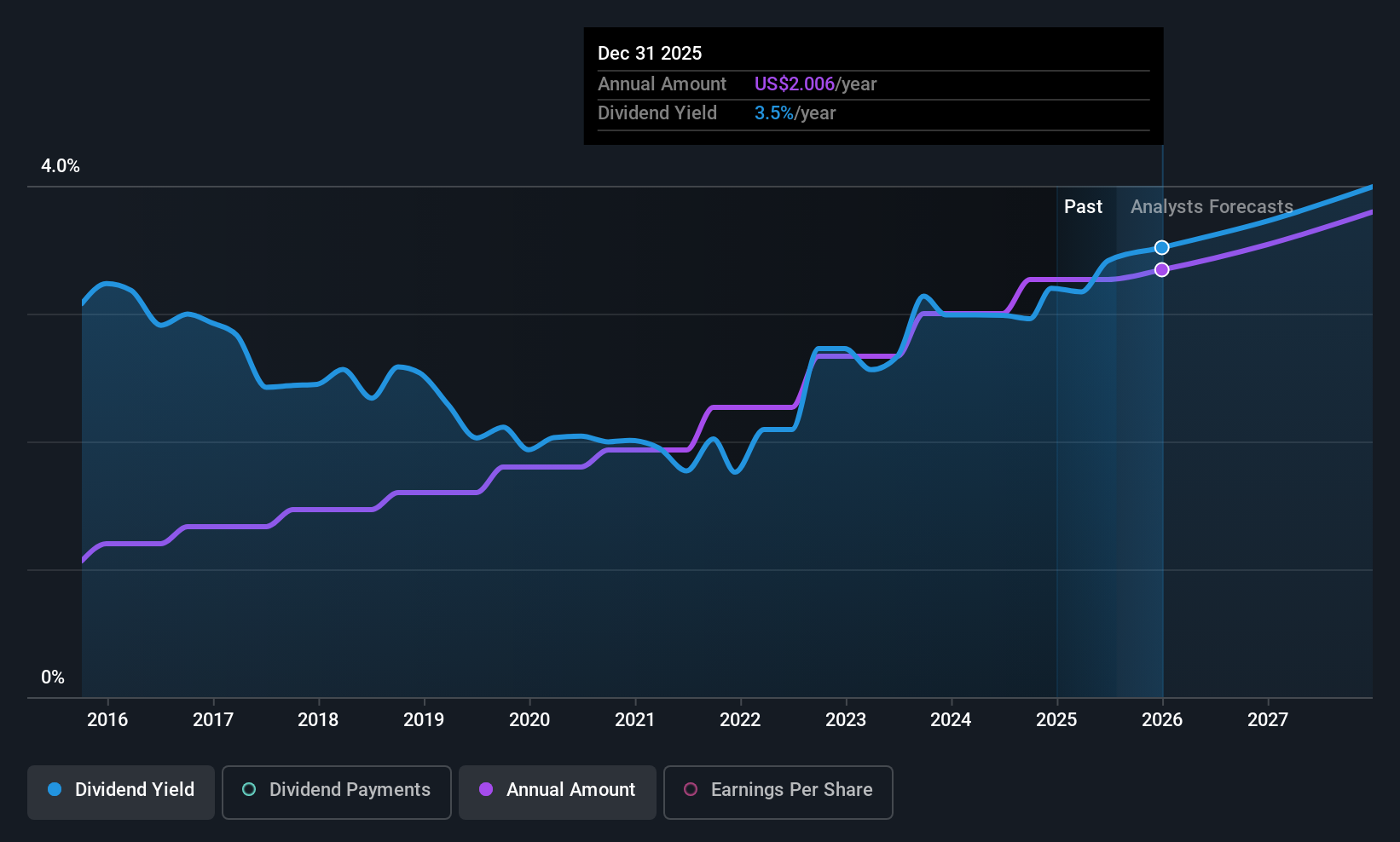

Dividend Yield: 3.5%

Provident Financial Holdings offers a stable dividend history with a current yield of 3.52%, though this is below the top tier in the US market. Its payout ratio of 57.7% suggests dividends are covered by earnings, yet future coverage remains uncertain due to insufficient data. Recent inclusion in multiple Russell indices may enhance visibility and investor interest, while leadership changes and share buybacks indicate strategic adjustments that could impact future financial performance.

- Unlock comprehensive insights into our analysis of Provident Financial Holdings stock in this dividend report.

- Our valuation report unveils the possibility Provident Financial Holdings' shares may be trading at a premium.

Macy's (M)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macy's, Inc. is an omni-channel retail organization that operates stores, websites, and mobile applications in the United States with a market cap of approximately $3.39 billion.

Operations: Macy's, Inc. generates its revenue primarily from its retail department stores segment, which accounts for $22.80 billion.

Dividend Yield: 5.7%

Macy's dividend yield of 5.73% ranks it among the top 25% of US dividend payers, though its history shows volatility with past reductions exceeding 20%. Despite a low payout ratio of 35.1%, indicating dividends are covered by earnings, cash flow coverage is tighter at a 77.7% cash payout ratio. Recent buybacks totaling $726.21 million suggest strategic capital allocation, yet high debt levels and fluctuating dividends highlight potential risks for investors seeking stability.

- Navigate through the intricacies of Macy's with our comprehensive dividend report here.

- According our valuation report, there's an indication that Macy's share price might be on the cheaper side.

Terreno Realty (TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets, with a market cap of approximately $5.79 billion.

Operations: Terreno Realty Corporation generates revenue primarily through its investment in industrial real estate, amounting to $408.01 million.

Dividend Yield: 3.4%

Terreno Realty's dividend yield of 3.4% is below the top 25% of US dividend payers, but its dividends are reliably covered by both earnings and cash flows with payout ratios of 75.8% and 82%, respectively. Recent acquisitions in key locations like Long Island City and Santa Ana bolster its industrial property portfolio, potentially enhancing future income streams. Despite trading at a significant discount to estimated fair value, investors should note the lower yield compared to peers.

- Delve into the full analysis dividend report here for a deeper understanding of Terreno Realty.

- The valuation report we've compiled suggests that Terreno Realty's current price could be quite moderate.

Summing It All Up

- Explore the 135 names from our Top US Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives