- United States

- /

- Diversified Financial

- /

- NYSE:CRBG

Corebridge Financial (NYSE:CRBG) Proposes Board Authorization Amendment to Company Bylaws

Reviewed by Simply Wall St

Corebridge Financial (NYSE:CRBG) has recently proposed an amendment to its bylaws to give the board greater flexibility in managing amendments, with a special stockholder meeting set for July. Over the past month, Corebridge's shares rose by 8%, which contrasts with the broader market's 3% decline. This could be attributed to a combination of the company's share repurchases and dividend announcements during the period. While Corebridge's Q1 earnings showed losses, these governance changes may provide longer-term operational benefits. The positive market movements despite general market declines may indicate supportive investor sentiment.

The proposed amendment to Corebridge Financial's bylaws aims to give the board greater flexibility in governance, potentially influencing long-term operational strategies that drive shareholder sentiment. The governance changes, coupled with share repurchase and dividend announcements, have positively impacted market movements, even amidst broader market declines. Over the past year, total shareholder returns, which include both share price and dividends, reached 9.73%. Compared to the wider US Market return of 9.1% and the US Diversified Financial industry return of 20.3%, Corebridge's performance reflects solid shareholder gains but still underperforms against the industry benchmark.

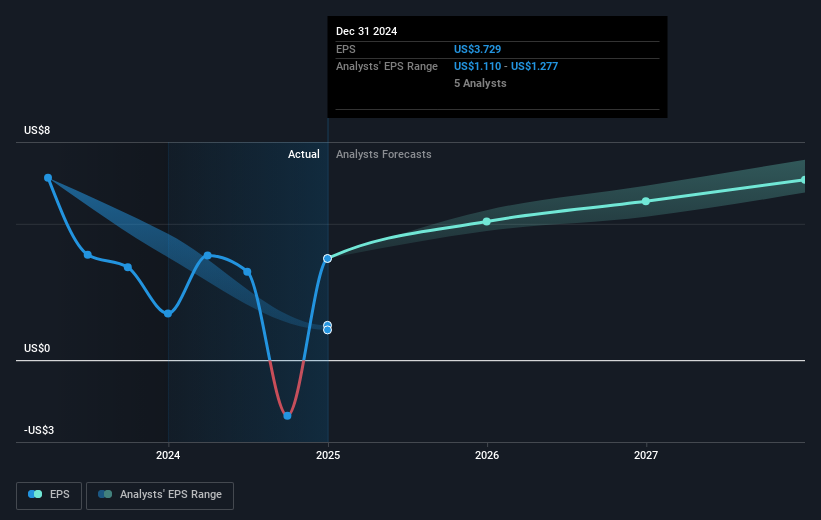

Looking at the company's revenue and earnings forecasts, strategic investments in digital capabilities and expansion in the RILA market are anticipated to contribute significantly to long-term growth. Analysts foresee a revenue increase from $16.56 billion to $24.1 billion by 2028, accompanied by earnings growth to $3 billion. The current share price of $31.29, alongside analysts' consensus price target of $35, suggests a potential upside of 10.6%, indicating room for growth aligned with future earnings capacity. These projections underscore the optimistic investor sentiment as reflected in the company's performance against its industry peers over the past year. Future governance and market strategy shifts could further reinforce the company's growth trajectory, affecting both revenue and earnings potential favorably.

Jump into the full analysis health report here for a deeper understanding of Corebridge Financial.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRBG

Corebridge Financial

Provides retirement solutions and insurance products in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives