- United States

- /

- Beverage

- /

- NYSE:STZ

Constellation Brands (STZ) Completes US$604 Million Share Buyback

Reviewed by Simply Wall St

Constellation Brands (STZ) experienced a 2% price increase last week as it updated investors on a recent share repurchase tranche. The company bought back nearly 1.77 million shares, accounting for about 1% of its total shares, at a cost of $298 million. This update may have bolstered investor confidence, contributing positively against broader market volatility. Amidst sharp declines across tech stocks and macroeconomic uncertainty affecting indices like the Dow and S&P 500, Constellation's update may have helped stabilize its stock, counteracting a challenging wider market environment marked by declines in tech and beer demand.

Be aware that Constellation Brands is showing 2 warning signs in our investment analysis.

Constellation Brands' recent share repurchase may accentuate investor optimism, aligning with its restructuring efforts in the Wine & Spirits division and expansion projects such as the Veracruz brewery. These movements, potentially enhancing operating margins and cash flow, underscore management's confidence in long-term profitability. Over a five-year span, however, the company's total return, including dividends, displayed a 6.71% decline, underscoring past challenges. In the context of a broader market downturn, Constellation's one-year performance underperformed relative to an average US market return of 15.7%.

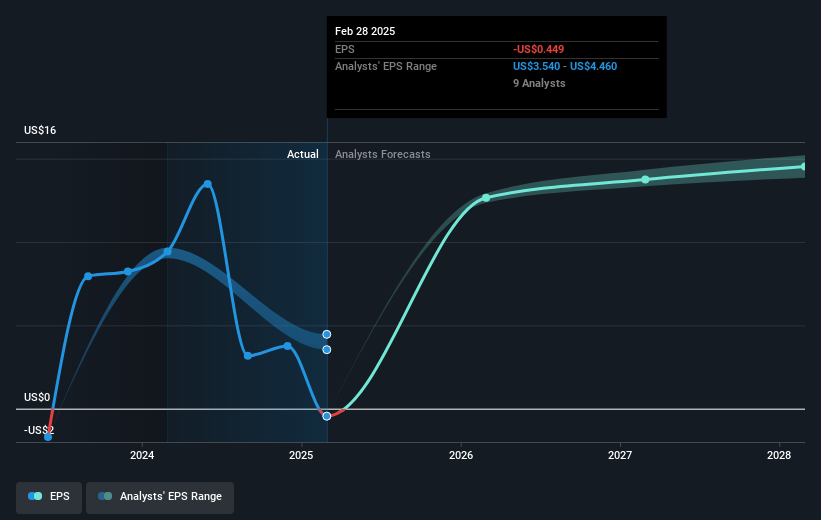

The forecasted revenue and earnings growth reflects analyst expectations that strategic actions will ameliorate recent financial strains, projecting earnings to reach US$2.4 billion by 2028 from current losses of US$442.30 million. Although the current share price of US$161.94 is 25.5% below the consensus price target of US$203.26, suggesting a potential upside, it remains crucial for investors to consider multiple factors, including projected operating margins and cash flows, in their analyses. The projected average annual decline in shares outstanding by 2.9% further supports potential per-share earnings growth, reinforcing a cautiously optimistic outlook.

Take a closer look at Constellation Brands' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives