- United States

- /

- Household Products

- /

- NYSE:CLX

Clorox (NYSE:CLX) Partners With Miller Lite For Limited-Time Beercoal Charcoal Release

Reviewed by Simply Wall St

Last week, Kingsford, a subsidiary of Clorox (NYSE:CLX), reintroduced the Kingsford x Miller Lite Beercoal, marking its national retail debut due to previous sell-out successes. Despite this product’s anticipated popularity, Clorox shares saw a 2.05% decline over the week. This decrease stood in contrast to broader market trends, with the S&P 500 climbing 4.5% amid positive investor sentiment following the temporary easing of U.S.-China tariffs. The Beercoal launch may have helped offset some of the broader market moves, but it was insufficient to drive Clorox’s stock into positive territory.

We've identified 1 risk for Clorox that you should be aware of.

The reintroduction of Kingsford x Miller Lite Beercoal could potentially align with Clorox's strategy of innovation and active brand investment, aiming to support future sales growth amid challenging market conditions. However, the immediate stock decline last week highlights that investors might be balancing this new product's potential against broader operational challenges, which include macroeconomic uncertainties and competitive pressures.

Over the last three years, Clorox achieved a total shareholder return of 7.83%, reflecting its resilience in a competitive industry landscape. However, compared to the broader market, Clorox's performance over the past year has lagged behind, notably underperforming against the US market's 10.6% return.

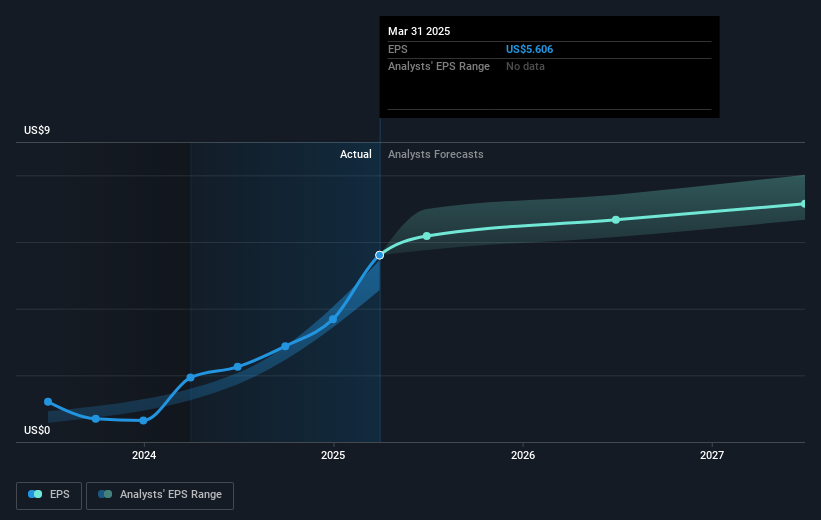

In terms of revenue and earnings forecasts, while the Beercoal represents a positive development, its impact may be limited as analysts anticipate broader challenges around revenue growth, which is forecast at a slower pace of 2.4% annually. Meanwhile, earnings are expected to grow by 10.37% per year over the coming years, subject to fluctuations in consumer demand and broader economic conditions.

With Clorox trading at US$135.05, below the analyst consensus price target of US$150.01, the market reflects caution around the company's ability to meet growth expectations. This situation underscores the importance of Clorox's operational efficiency initiatives and pricing strategies to align closer with its projected fair value and mitigate impact from tariff pressures.

Gain insights into Clorox's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Engages in the manufacture and marketing of consumer and professional products worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives