- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

Booking Holdings (BKNG) Q2 Revenue Climbs to US$6,798 Million Amidst Lower Earnings

Reviewed by Simply Wall St

Booking Holdings (BKNG) saw a significant price move of 10% in the last quarter, likely influenced by mixed Q2 2025 financial results where revenue increased but net income and EPS declined. Despite these declines, the company's revenue performance was strong, hinting at solid sales momentum. This period also coincided with a broader market rally driven by strong corporate earnings reports, with the S&P 500 and Nasdaq hitting record highs. As wider tech stock performance buoyed markets, Booking's revenue resilience and strategic public offerings might have provided added weight, aligning with the generally positive market sentiment.

Building on the recent 10% share price movement, Booking Holdings demonstrates resilience despite mixed financial results in Q2 2025. Over the past five years, the company achieved a total return of 238%, illustrating substantial long-term shareholder value. Comparatively, over the past year, Booking Holdings managed to outperform the broader US market, which returned 17.5%, indicating robust performance amid industry and market fluctuations. This performance could reflect the positive impact of AI integration and global partnerships previously outlined in their narrative, underpinning both revenue and earnings growth prospects.

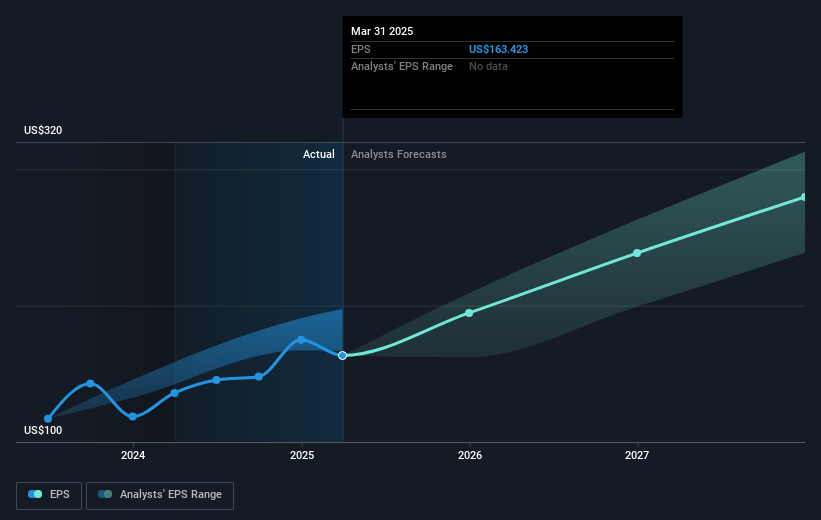

The recent price increase might underscore investor confidence in the company’s growth trajectory, even as earnings faltered. With revenue growth expectations of 8.9% annually over the next three years, analysts are optimistic about future earnings, predicting a rise from US$5.44 billion to US$9.0 billion by July 2028. The current share price of $5590.77 is close to the consensus analyst price target of $5862.50, a 4.86% discount, suggesting room for potential appreciation. This alignment between current price and target reflects balanced market sentiment and the anticipation of growth from AI advancements and strategic partnerships, despite the risks posed by geopolitical and economic uncertainties.

Explore Booking Holdings' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives