- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

August 2025's Top Three Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches new heights and the S&P 500 and Nasdaq experience declines amidst a tech slump, investors are closely monitoring Federal Reserve signals for potential rate cuts. In this climate of fluctuating indices and economic uncertainty, identifying stocks that may be undervalued can offer opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.67 | $225.65 | 48.7% |

| Udemy (UDMY) | $6.96 | $13.23 | 47.4% |

| StoneCo (STNE) | $15.44 | $29.30 | 47.3% |

| Royal Gold (RGLD) | $171.55 | $329.41 | 47.9% |

| Lyft (LYFT) | $16.02 | $30.95 | 48.2% |

| Granite Ridge Resources (GRNT) | $5.31 | $10.24 | 48.1% |

| Fiverr International (FVRR) | $23.62 | $44.95 | 47.5% |

| First Commonwealth Financial (FCF) | $16.79 | $32.97 | 49.1% |

| First Busey (BUSE) | $23.19 | $45.40 | 48.9% |

| Dime Community Bancshares (DCOM) | $28.67 | $56.56 | 49.3% |

Let's dive into some prime choices out of the screener.

Array Technologies (ARRY)

Overview: Array Technologies, Inc. manufactures and sells solar tracking technology products across the United States, Spain, Brazil, Australia, and other international markets with a market cap of approximately $1.16 billion.

Operations: The company's revenue is derived from two main segments: STI Operations, contributing $304.06 million, and Array Legacy Operations, generating $867.19 million.

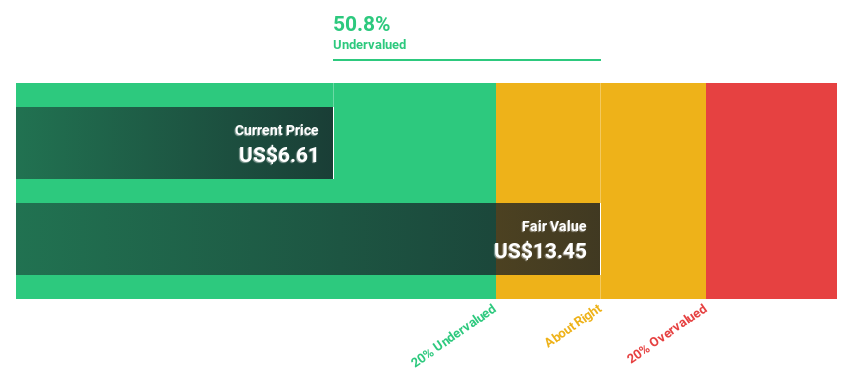

Estimated Discount To Fair Value: 20.5%

Array Technologies is trading at a significant discount to its estimated fair value, with shares priced at US$8.42 against a fair value estimate of US$10.59. Despite slower-than-market revenue growth projections, the company has shown strong recent earnings performance and raised its annual revenue guidance to between $1.18 billion and $1.215 billion for 2025. Its profitability outlook is robust, with expected profit growth outpacing market averages over the next three years.

- Upon reviewing our latest growth report, Array Technologies' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Array Technologies with our detailed financial health report.

Trade Desk (TTD)

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for digital ad buyers, with a market cap of approximately $25.48 billion.

Operations: The company's revenue primarily comes from its advertising technology platform, generating approximately $2.68 billion.

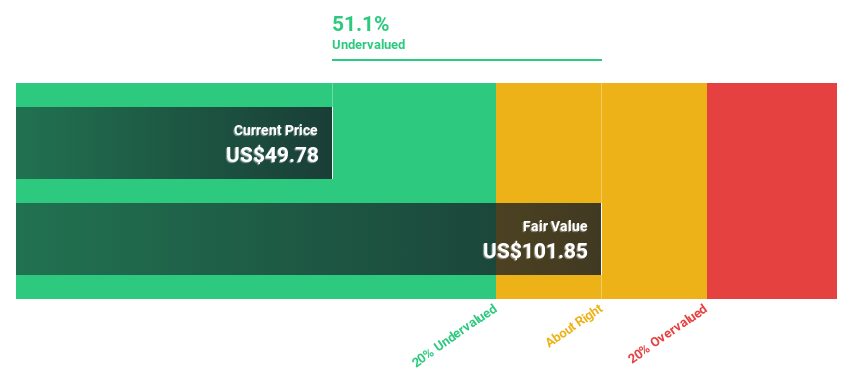

Estimated Discount To Fair Value: 43.1%

Trade Desk is trading at a substantial discount to its estimated fair value, with shares priced at US$54.95 versus a fair value estimate of US$96.53. Recent earnings results show strong revenue growth, reaching US$694.04 million in Q2 2025, up from US$584.55 million the previous year. Despite high share price volatility, the company's profitability outlook remains promising with projected earnings growth surpassing market averages over the next three years, driven by strategic partnerships and AI innovations.

- The analysis detailed in our Trade Desk growth report hints at robust future financial performance.

- Get an in-depth perspective on Trade Desk's balance sheet by reading our health report here.

Mobileye Global (MBLY)

Overview: Mobileye Global Inc. develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies worldwide, with a market cap of approximately $11.33 billion.

Operations: The company's revenue primarily comes from its Mobileye segment, which generated $1.88 billion.

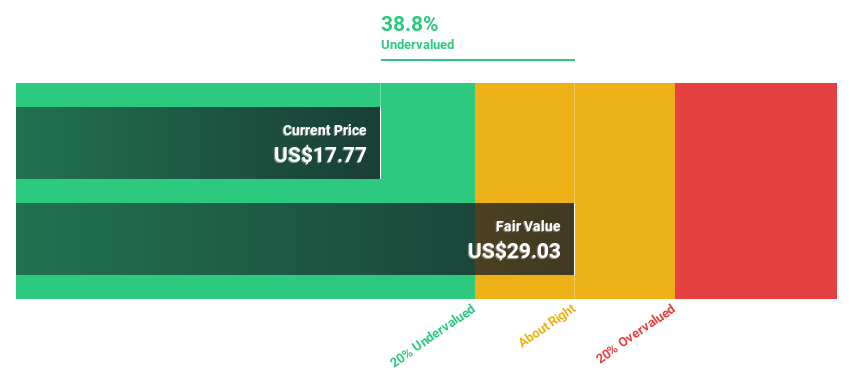

Estimated Discount To Fair Value: 39.1%

Mobileye Global is trading at a significant discount to its estimated fair value, with shares priced at US$14.3 against a fair value estimate of US$23.47. The company's revenue growth is forecasted to outpace the broader U.S. market, driven by increased shipments of EyeQ and SuperVision systems. Despite current losses, Mobileye's profitability outlook is strong, supported by advanced autonomous driving technologies and a substantial follow-on equity offering of US$825 million enhancing financial flexibility.

- Our comprehensive growth report raises the possibility that Mobileye Global is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Mobileye Global stock in this financial health report.

Summing It All Up

- Investigate our full lineup of 193 Undervalued US Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives