- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

Atour Lifestyle Holdings (NasdaqGS:ATAT) Announces $400M Share Buyback And New Revenue Guidance

Reviewed by Simply Wall St

Atour Lifestyle Holdings (NasdaqGS:ATAT) saw its stock price rise by 30% over the last month following several key announcements. The company reported increased quarterly revenue despite a decline in net income, which suggests improved operational performance. A new buyback program aiming to repurchase shares and enhance shareholder value could have positively influenced the share price. The dividend decrease may have added some balanced weight contrary to the upward movement, but the overall market momentum, as reflected by broader market rebounds, supported a positive sentiment around the stock's performance.

Recent developments at Atour Lifestyle Holdings, including the initiation of a share buyback program, have garnered positive investor sentiment, potentially contributing to a solid annual total return of 75.52% in a one-year period ending May 2025. While the company's stock surged by 30% in the last month, the one-year return outperformed both the US market's 9.1% and the US Hospitality industry's 10.5% returns over the same period. This highlights the market's favorable response to Atour's operational advancements and planned expansions.

The announcements align well with the company's narrative of expanding its reach through the introduction of the Atour Light 3.0 brand and investments in the sleep economy, suggesting a promising outlook for revenue and earnings growth. However, challenges such as sustaining RevPAR stability and managing increased costs could pose headwinds. The recent decrease in dividends may impact investor attraction despite the anticipated market presence growth through 2,000 premier hotels by 2025, which is critical for revenue enhancement.

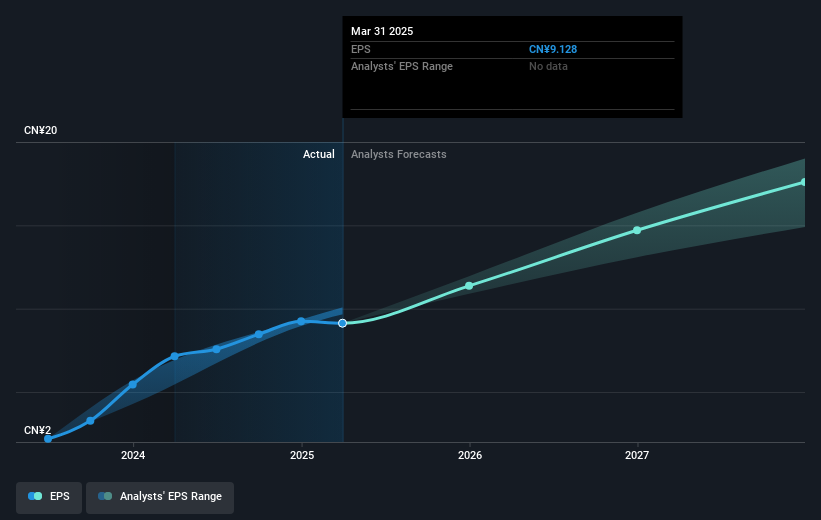

With analysts setting a consensus price target of US$36.39, the stock's current price of US$24.18 suggests a discount of 33.5%, indicating room for possible upward price adjustments if forecasts hold true. Such a move would align with assumptions of 19.5% annual revenue growth and an increase in net margins, driven by strategic initiatives like retail expansion and innovative product offerings in the sleep economy. Investors and stakeholders should consider these factors while evaluating the company's potential to meet or exceed these expectations in the coming years.

Our valuation report here indicates Atour Lifestyle Holdings may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives