ASX Stocks Including Elders That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the ASX 200 hovers just above the 9,000-point mark, traders are cautiously assessing their next moves amid global economic events and domestic earnings reports. In this environment of uncertainty and potential profit-taking, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Reckon (ASX:RKN) | A$0.605 | A$1.19 | 49.1% |

| ReadyTech Holdings (ASX:RDY) | A$2.76 | A$5.07 | 45.6% |

| PointsBet Holdings (ASX:PBH) | A$1.255 | A$2.13 | 41% |

| Hillgrove Resources (ASX:HGO) | A$0.037 | A$0.073 | 49.4% |

| Fenix Resources (ASX:FEX) | A$0.305 | A$0.51 | 39.8% |

| Elders (ASX:ELD) | A$7.57 | A$14.04 | 46.1% |

| Credit Clear (ASX:CCR) | A$0.24 | A$0.40 | 40.4% |

| Collins Foods (ASX:CKF) | A$9.38 | A$16.09 | 41.7% |

| Austal (ASX:ASB) | A$6.81 | A$13.24 | 48.6% |

| Advanced Braking Technology (ASX:ABV) | A$0.10 | A$0.16 | 38.5% |

Let's dive into some prime choices out of the screener.

Elders (ASX:ELD)

Overview: Elders Limited is an Australian company that offers agricultural products and services to rural and regional customers, with a market capitalization of A$1.45 billion.

Operations: Elders generates revenue through its Branch Network (A$2.70 billion), Wholesale Products (A$362.96 million), and Feed and Processing Services (A$142.30 million).

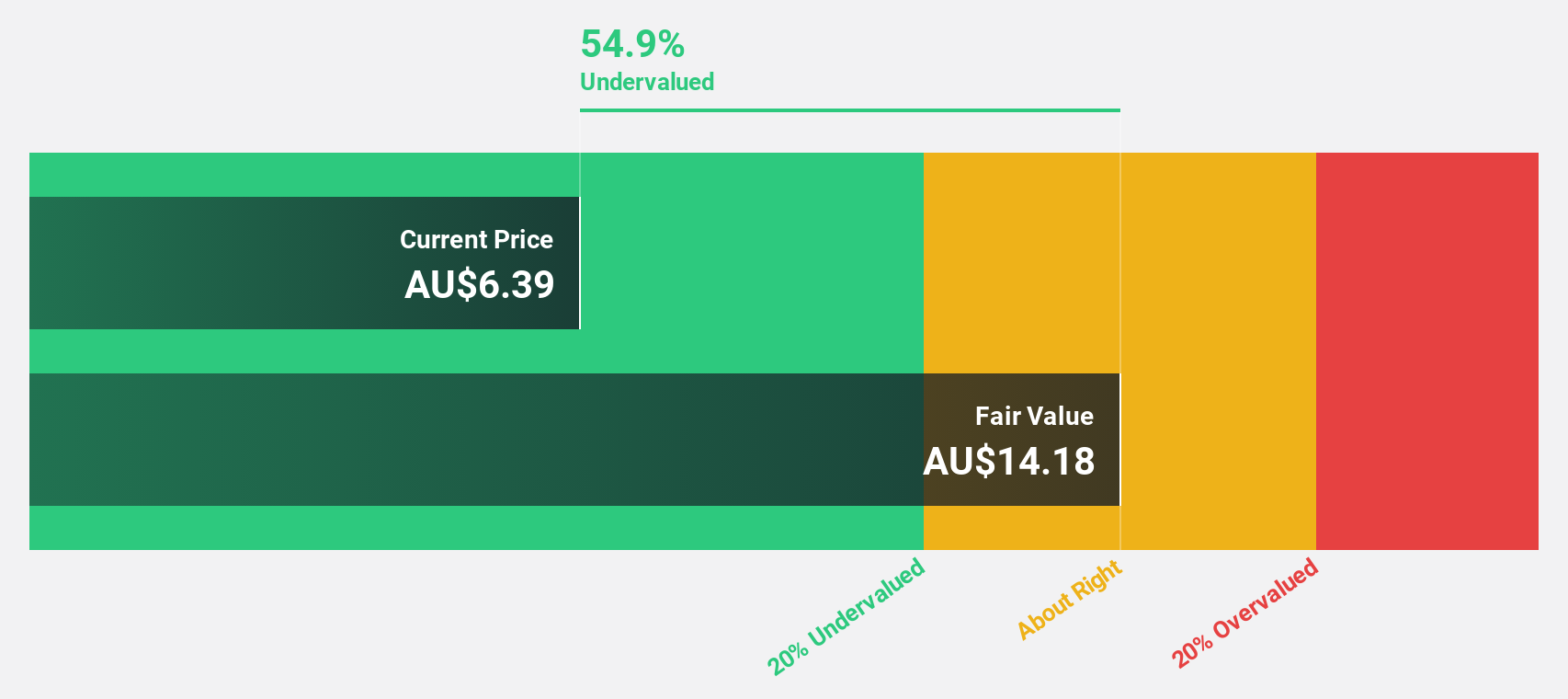

Estimated Discount To Fair Value: 46.1%

Elders Limited's recent earnings report shows a strong performance with net income rising to A$33.62 million, up from A$11.59 million the previous year. The stock is currently trading at A$7.57, significantly below its estimated fair value of A$14.04, indicating it may be undervalued based on cash flows. Despite past shareholder dilution and a modest forecasted return on equity of 10.8%, Elders' revenue and earnings growth projections outpace the broader Australian market expectations.

- In light of our recent growth report, it seems possible that Elders' financial performance will exceed current levels.

- Get an in-depth perspective on Elders' balance sheet by reading our health report here.

Energy One (ASX:EOL)

Overview: Energy One Limited offers software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in Australasia and Europe, with a market cap of A$441.76 million.

Operations: The company's revenue primarily comes from the Energy Software Industry segment, amounting to A$61.12 million.

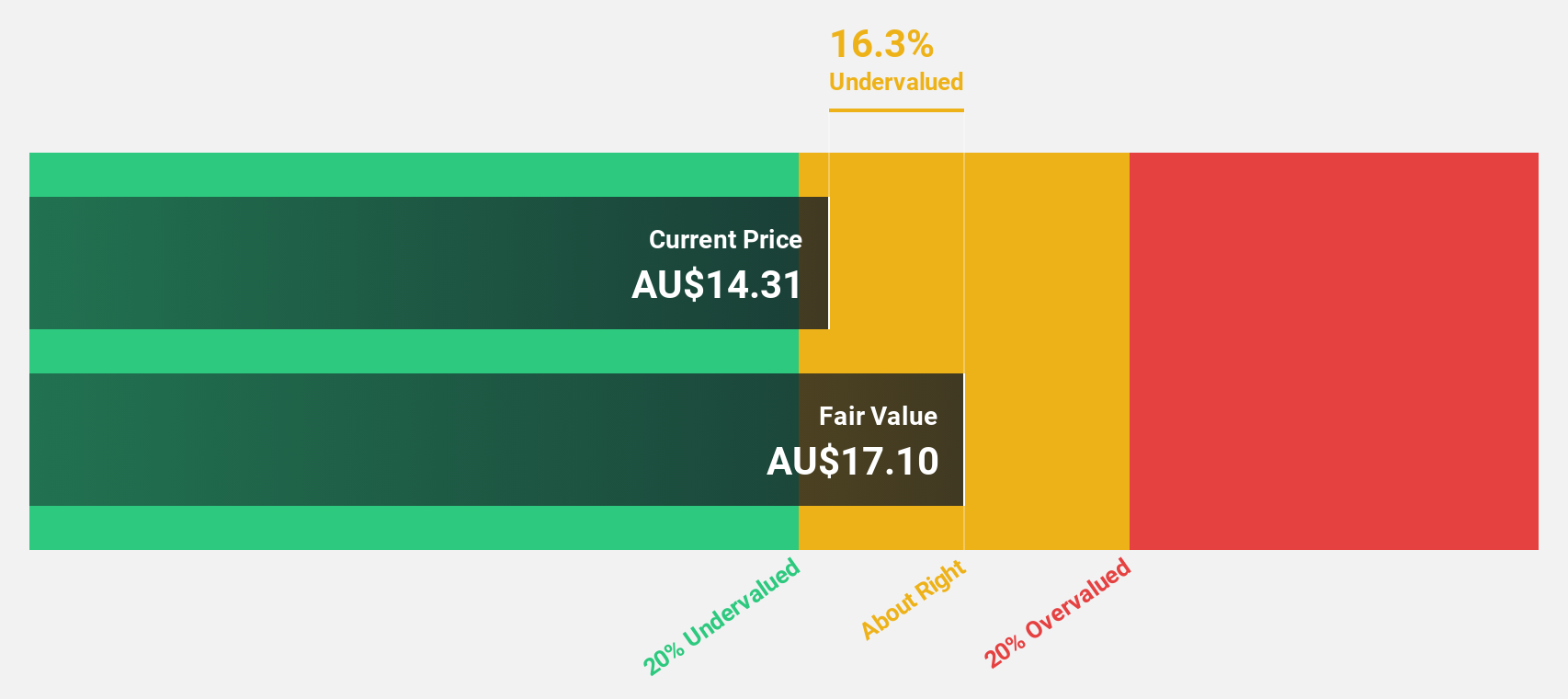

Estimated Discount To Fair Value: 17.5%

Energy One Limited's recent earnings report highlights robust financial performance, with net income rising to A$5.89 million from A$1.44 million the previous year. The stock trades at A$14.10, 17.5% below its estimated fair value of A$17.09, suggesting it is undervalued based on cash flows despite not being significantly below fair value criteria. Earnings are forecasted to grow significantly faster than the market, although revenue growth is expected to be more moderate at 14.6% annually.

- Upon reviewing our latest growth report, Energy One's projected financial performance appears quite optimistic.

- Dive into the specifics of Energy One here with our thorough financial health report.

NRW Holdings (ASX:NWH)

Overview: NRW Holdings Limited, with a market cap of A$1.74 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: The company's revenue is derived from its key segments, with MET generating A$932.02 million, Civil contributing A$823.72 million, and Mining accounting for A$1.54 billion.

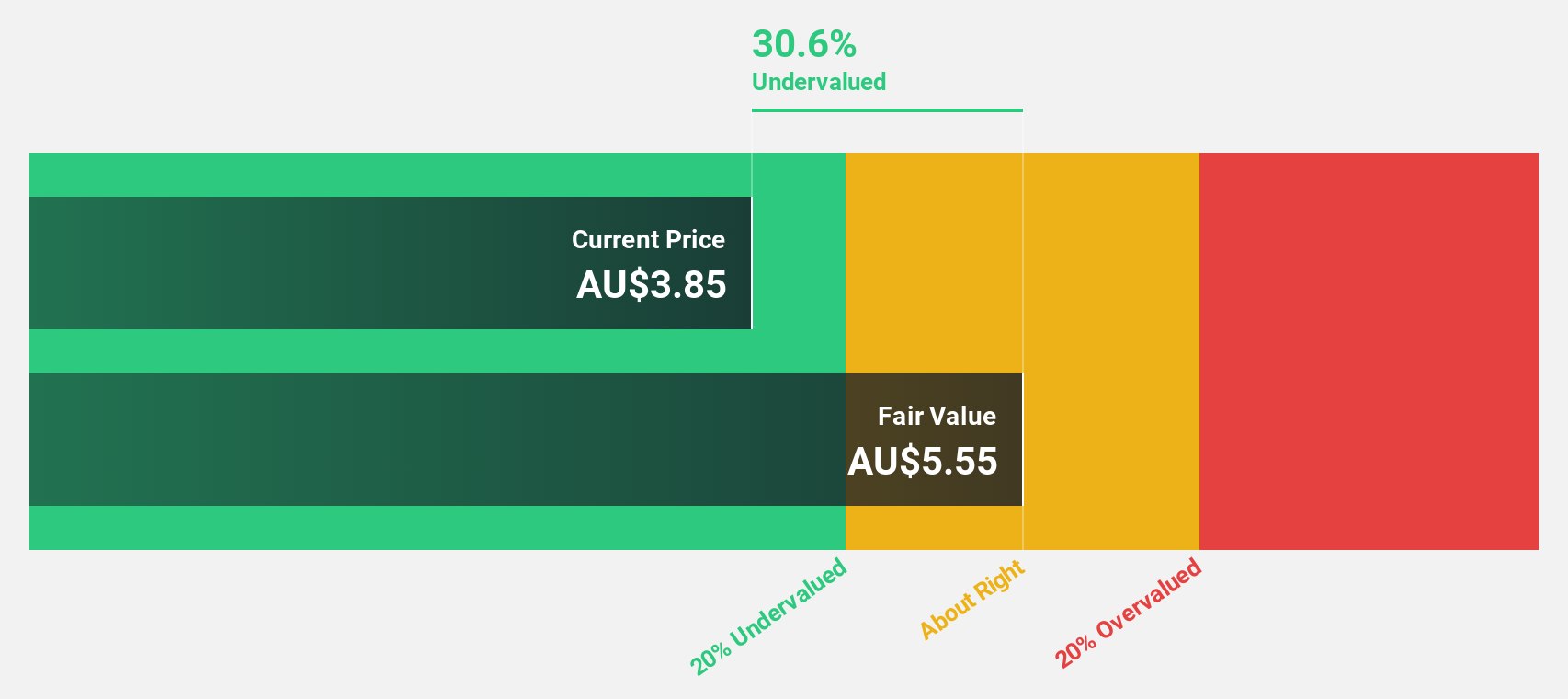

Estimated Discount To Fair Value: 31.3%

NRW Holdings is trading at A$3.81, significantly below its estimated fair value of A$5.55, indicating undervaluation based on cash flows. Despite a decline in net income to A$27.67 million from A$105.1 million last year, earnings are projected to grow at 24.6% annually, outpacing the market average of 10.7%. However, profit margins have decreased and the dividend yield of 4.33% is not well covered by earnings, which may affect sustainability.

- The growth report we've compiled suggests that NRW Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of NRW Holdings.

Make It Happen

- Investigate our full lineup of 34 Undervalued ASX Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EOL

Energy One

Provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives