Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:IBCP

Exploring Top Dividend Stocks In The US For April 2024

As the US market shows signs of resilience amid hawkish comments from the Fed and fluctuating crude oil prices, attention is naturally drawn towards dividend stocks. These stocks, with their regular income stream and potential for capital appreciation, can offer a measure of stability in uncertain times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Premier Financial (NasdaqGS:PFC) | 6.51% | ★★★★★★ |

| Lakeland Bancorp (NasdaqGS:LBAI) | 5.15% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 7.34% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 5.42% | ★★★★★★ |

| Arrow Financial (NasdaqGS:AROW) | 4.97% | ★★★★★★ |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.67% | ★★★★★★ |

| Evans Bancorp (NYSEAM:EVBN) | 5.08% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 5.05% | ★★★★★★ |

| West Bancorporation (NasdaqGS:WTBA) | 6.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.57% | ★★★★★★ |

Click here to see the full list of 280 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

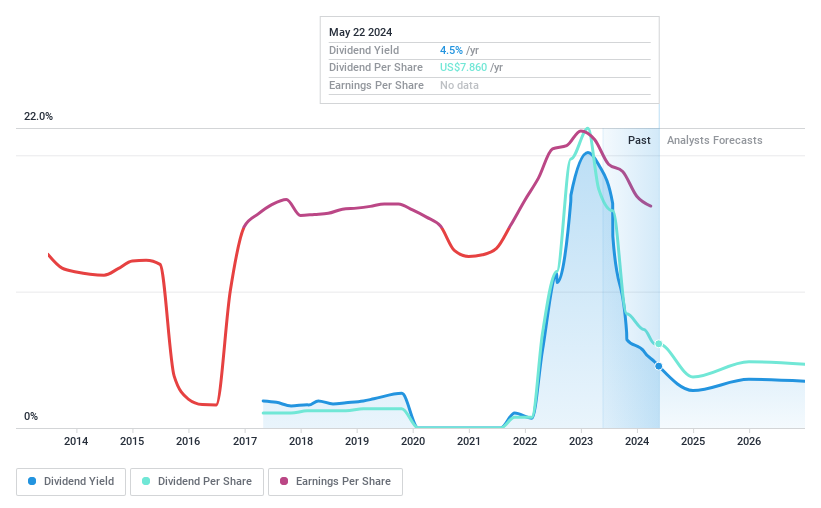

Arch Resources (NYSE:ARCH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arch Resources, Inc., with a market cap of $3.03 billion, is a company that specializes in the production and sale of metallurgical products.

Operations: Arch Resources, Inc., a specialist in metallurgical products, generates its revenue primarily from two segments: Metallurgical (MET) at $1.89 billion and Thermal (Powder River Basin (PRB)) at $1.25 billion.

Dividend Yield: 5.6%

Arch Resources has a relatively low cash payout ratio of 36.6%, indicating its dividend payments are well covered by cash flows. However, the company's profit margins have decreased from last year and there has been significant insider selling over the past three months. Despite this, Arch Resources is trading at a 25.1% discount to its estimated fair value and offers a top-tier dividend yield of 5.6%. Recent executive changes and inclusion in various S&P indices could potentially influence future performance.

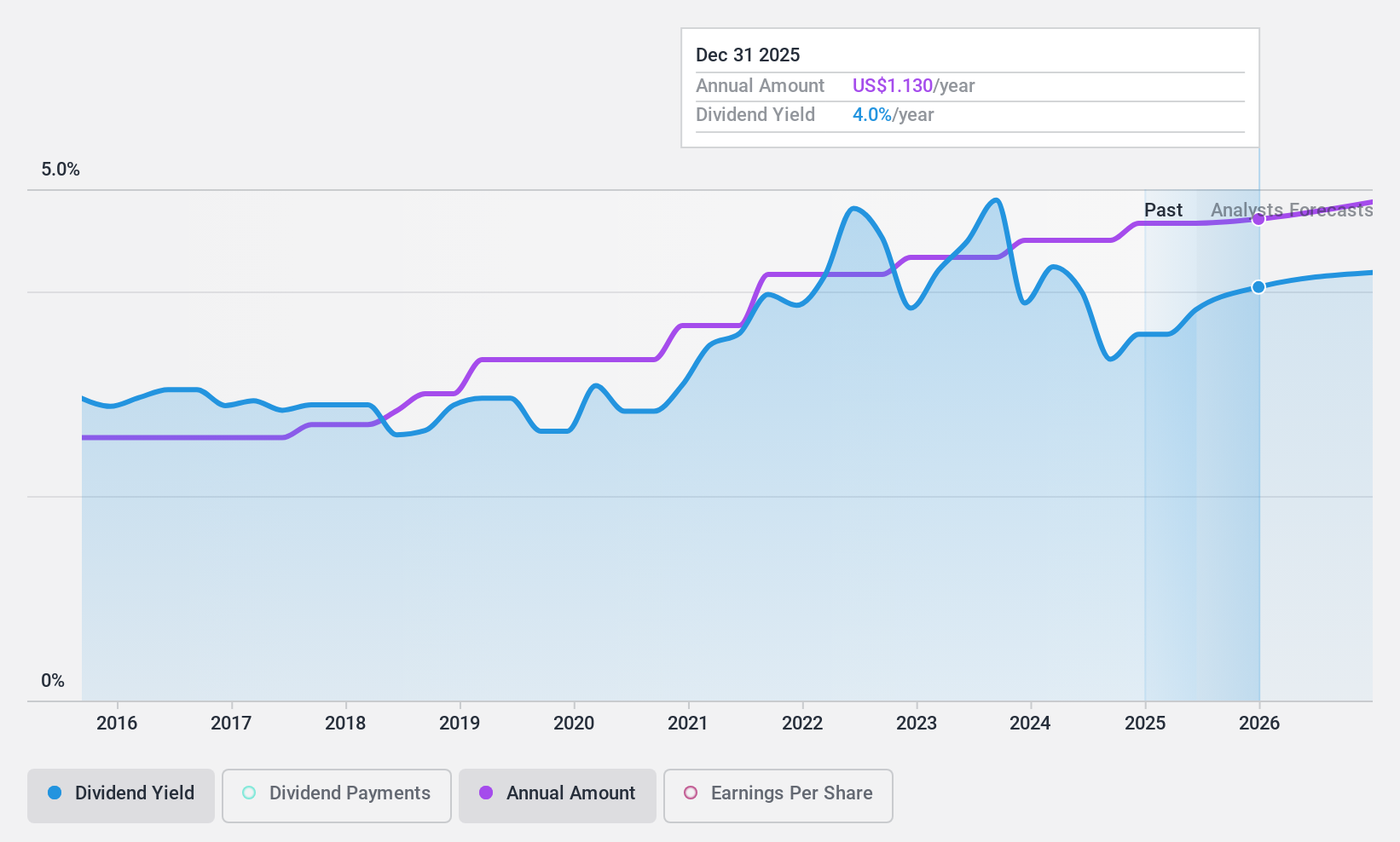

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ChoiceOne Financial Services, Inc., represented by the ticker NasdaqCM:COFS, is a bank holding company for ChoiceOne Bank, which offers banking services to corporations, partnerships and individuals in Michigan and has a market capitalization of $176.83 million.

Operations: ChoiceOne Financial Services, Inc., identified by NasdaqCM:COFS, generates its revenue primarily through banking services, with an impressive income of $80.64 million.

Dividend Yield: 4.6%

ChoiceOne Financial Services, with a 37.2% payout ratio, has its dividends well covered by earnings. The company's dividend payments have been stable and reliable over the past decade, offering a 4.6% yield. Despite this yield being lower than the top tier of US dividend payers (4.88%), it is forecast to grow by 3.05% per year. Trading at a significant discount to its estimated fair value (48.6%), ChoiceOne recently affirmed its quarterly cash dividend of US$0.27 per share.

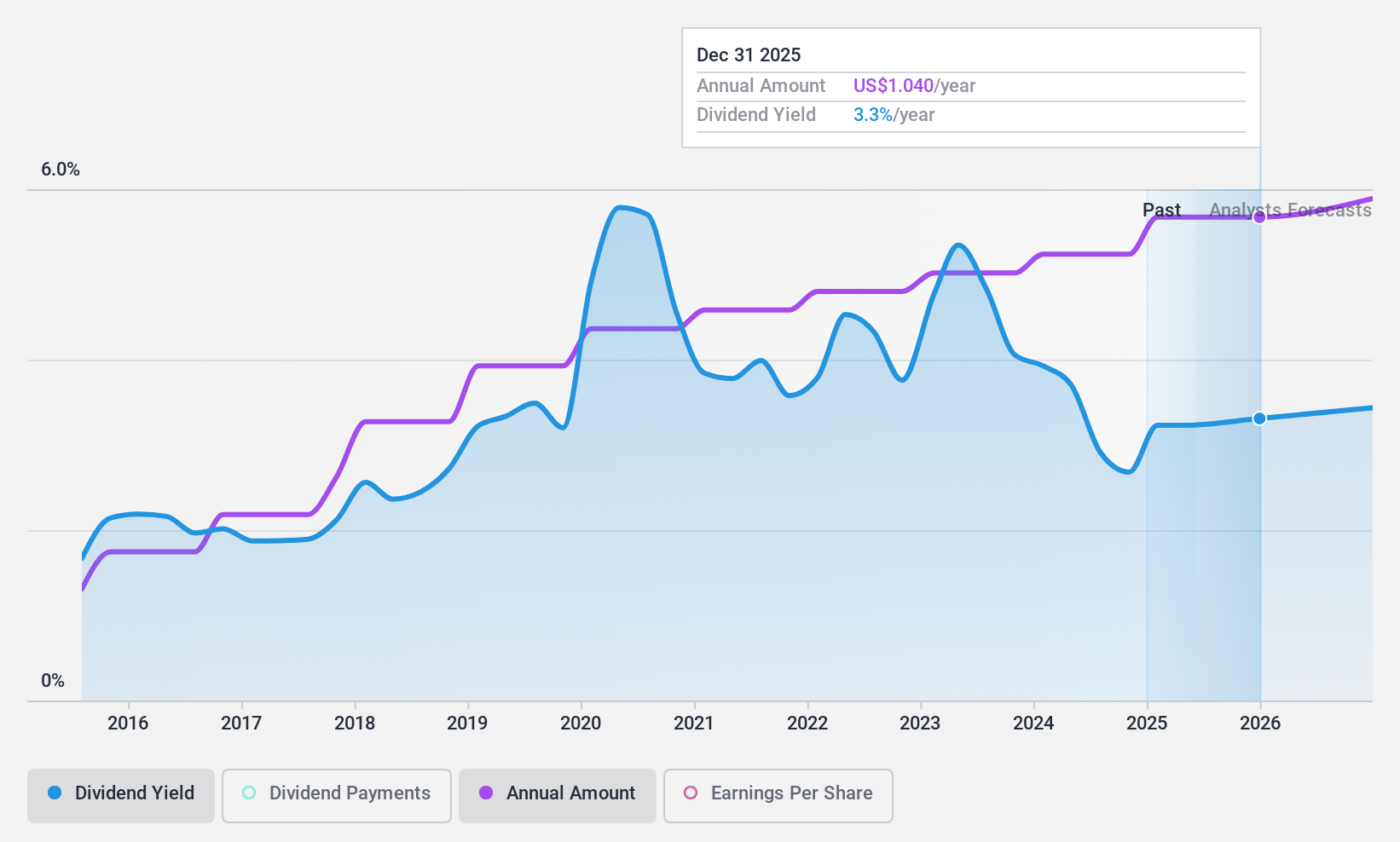

Independent Bank (NasdaqGS:IBCP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corporation, trading under the ticker NasdaqGS:IBCP, is a bank holding company that offers commercial banking services to individuals and businesses in rural and suburban Michigan communities, with a market capitalization of approximately $486.05 million.

Operations: Independent Bank Corporation, identified by NasdaqGS:IBCP, generates its revenue predominantly from its banking services, with a total revenue of approximately $200.80 million.

Dividend Yield: 4.1%

Independent Bank Corporation's dividend yield of 4.14% is lower than the top quartile of US dividend payers, but it has shown consistent growth over the past decade. The company's dividends are well covered by earnings with a payout ratio of 32.7%, and this coverage is forecast to continue into the next three years. Despite recent net charge-offs, Independent Bank reported steady net interest income and recently increased its quarterly cash dividend to US$0.24 per share.

- Click here to discover the nuances of Independent Bank with our detailed analytical dividend report.

Key Takeaways

- Explore the 280 names from our Top Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Independent Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St

About NasdaqGS:IBCP

Independent Bank

Independent Bank Corporation operates as the bank holding company for Independent Bank that provides commercial banking services to individuals and businesses in rural and suburban communities in Michigan.

Flawless balance sheet, undervalued and pays a dividend.