Quote of the Week: “We have this handy fusion reactor in the sky called the sun; you don’t have to do anything, it just works. It shows up every day.” – Elon Musk

Last week’s solar eclipse cut solar power generation in the US by as much as 30 gigawatts , which was enough to require utilities to plan for supplementary sources of power. This was a reminder that solar power now accounts for a meaningful chunk of power generation in many countries.

While solar capacity continues to grow, investors have discovered that investing in the industry isn’t quite as straightforward. This week, we are checking in on the current outlook for solar stocks, and the key factors affecting the industry.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🇨🇳 EU launches probe into Chinese wind turbine companies ( FT )

- Our take: First it was Chinese EVs, now it’s wind turbines. Both Europe and the US are looking to prevent China flooding markets with renewable energy products subsidized by the government. Janet Yellen has also stated that she’s not ruling out tariffs on ‘green imports’ from China. This could help local industries, but would also remove some of the deflation the West is importing from Asia.

-

📱 TSMC Will Receive $6.6 billion to Bolster US Chip Manufacturing ( NYT )

- Our take: This is the latest grant from ‘The CHIPS and Science Act’, which will provide a total of $39 billion in subsidies to US semiconductor manufacturing projects. TSMC is receiving the $6.6 billion grant as well as a $5 billion loan. Intel recently received $8.5 billion, and GlobalFoundries $1.5 billion. Importantly, the commerce department still has nearly $20 billion more to allocate!

-

💽 Amazon says it will spend $150 billion on Data Center CapEx over the next 15 years ( Magzter )

- Our take: A 15-year estimate is prone to change a lot. But for what it's worth, this number does imply capex will drop from current levels. That’s $10 billion a year, compared to an estimated $25 to $30 billion for AWS in 2023.

-

💹 Copper futures trade at new record high ( CNBC )

- Our take: Copper futures in Shanghai printed a new record high, though prices in London and the US are still lower than their 2022 highs. At the start of the year, analysts were optimistic about copper, and so far they seem to be right. Analysts at Citi believe a new secular bull market in copper is now underway.

And some of the key economic data released recently:

- 🇩🇪 Germany’s trade surplus narrowed more than expected in February, falling from €27.5 billion to €21.4 billion.

- Exports fell by 2%, while imports increased by 3.2% this month. Industrial production rose by 2.1% in February too, well ahead of the 0.3% expected.

- 🇺🇸 Consumer inflation came in hotter than investors were hoping to see. Consumer prices rose 3.5% in the year to March, up from 3.2% in February and higher than the 3.4% expected.

- Energy and shelter costs were the main driver, but a measure of core services inflation was also up sharply at 4.8% YoY .

- 🇺🇸 The minutes from the last FOMC meeting also disappointed investors. Committee members “expressed concern that inflation wasn’t moving lower quickly enough.”

- The first rate-cut that was expected in March, and then in June, is now only expected in September. Fed-funds-futures prices now imply just a 23% probability of a rate cut in June .

- 🇪🇺 The ECB has kept the interest rates steady at 4.5%.

☀️ Solar Stocks: The Challenges and Tailwinds

In May last year we touched on solar stocks, which at the time were the most unloved industry group in the market . Over the last 6 months stock prices have stablized and investors appear to be cautiously optimistic.

However, the industry may not be out of the woods yet. There are still several major challenges - but there are also a few tailwinds which should lead to long term growth for the industry leaders.

Solar is both cyclical and a growth industry. This is actually good news for investors, as cycles can create opportunities that may not occur as often in other growth industries. But you do need to have a good handle on the fundamentals behind each business, rather than extrapolating trends into the future.

We’ll start with the bad news, and then come back to the tailwinds and potential positive catalysts.

⚠️ The Challenges Facing Solar

💱 Interest rates

For solar companies, interest rates have been the major headwind over the last few years. For just about every solar company, interest rates affect sales volumes, margins and valuations.

Residential installations are typically financed in some way; either by the customer or the vendor. Financing costs vary widely, but with rates at current levels, some installations are unlikely to offer savings over the entire life of the installation - even with available incentives. If saving money is the main reason for installing a solar system, a lot of potential sales have been put on hold until rates fall, as there’s simply no economic benefit to installing solar right now.

The stock prices of residential solar installers like Sunrun and SunPower have become very correlated to expectations around rate cuts. As mentioned above in the updated about FOMC Minutes, rate cuts are now likely further away than first thought, which doesn’t help the short-term pricing. Ultimately, when the time comes for rate cuts, it’ll be the magnitude of those cuts that will determine how affordable installations become.

✨Commercial projects are a little less sensitive to rates as they should be able to secure cheaper financing costs, and they plan further ahead.

💸 Feed-In Tariffs

Last year, California changed the way utilities paid homeowners for electricity they fed back into the grid . Rather than paying the full retail rate, utilities now pay a rate determined by demand.

Attractive feed-in tariffs are a great incentive to get homeowners to install solar panels. However, when the number of homes supplying power to the grid increases, the tariffs need to make economic sense for the utilities. In California, some have expected the amount paid out to homeowners is now 75% lower when feeding back into the grid. It’s a balancing act between adequately compensating the homeowners to entice more solar installations and not paying out too much that it becomes economically unviable.

Similar scenarios are, or will, play out elsewhere in the US and around the world.

💲Costs

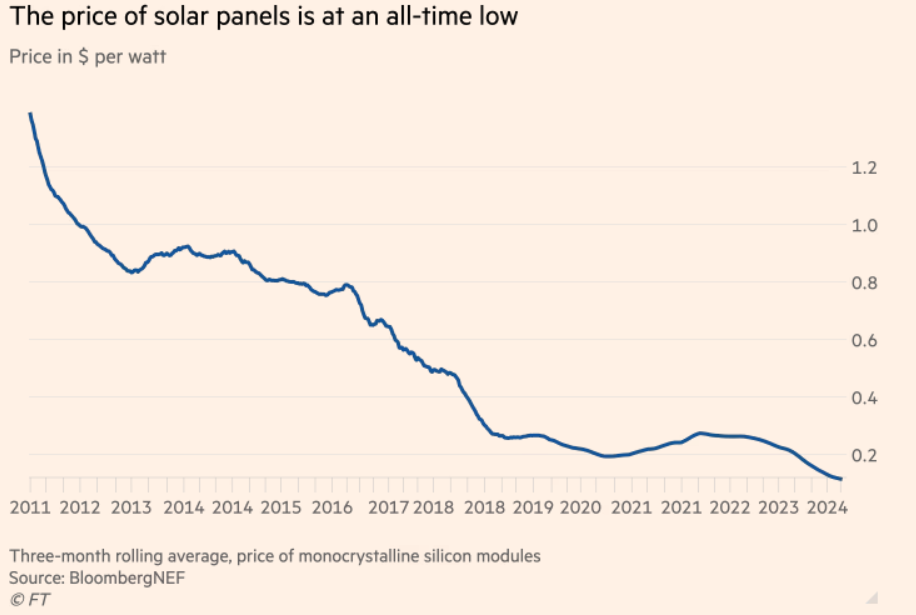

One of the major tailwinds that have driven the solar industry over the last 15 years has been the rapid fall in the price of solar panels. The cheaper panels are, the more people can afford them, and the higher the potential savings.

Falling prices were the result of technical advances and economies of scale. Going forward, improvements in efficiency are likely to be smaller and prices may not fall at the same rate.

As this chart reflects, prices have recently fallen to a new low - but this seems to be the result of a glut in supply, as well as government subsidies in China. The US is now considering new tariffs, which would lead to higher prices. It’s worth noting that if that happens, other countries might continue to benefit from lower prices.

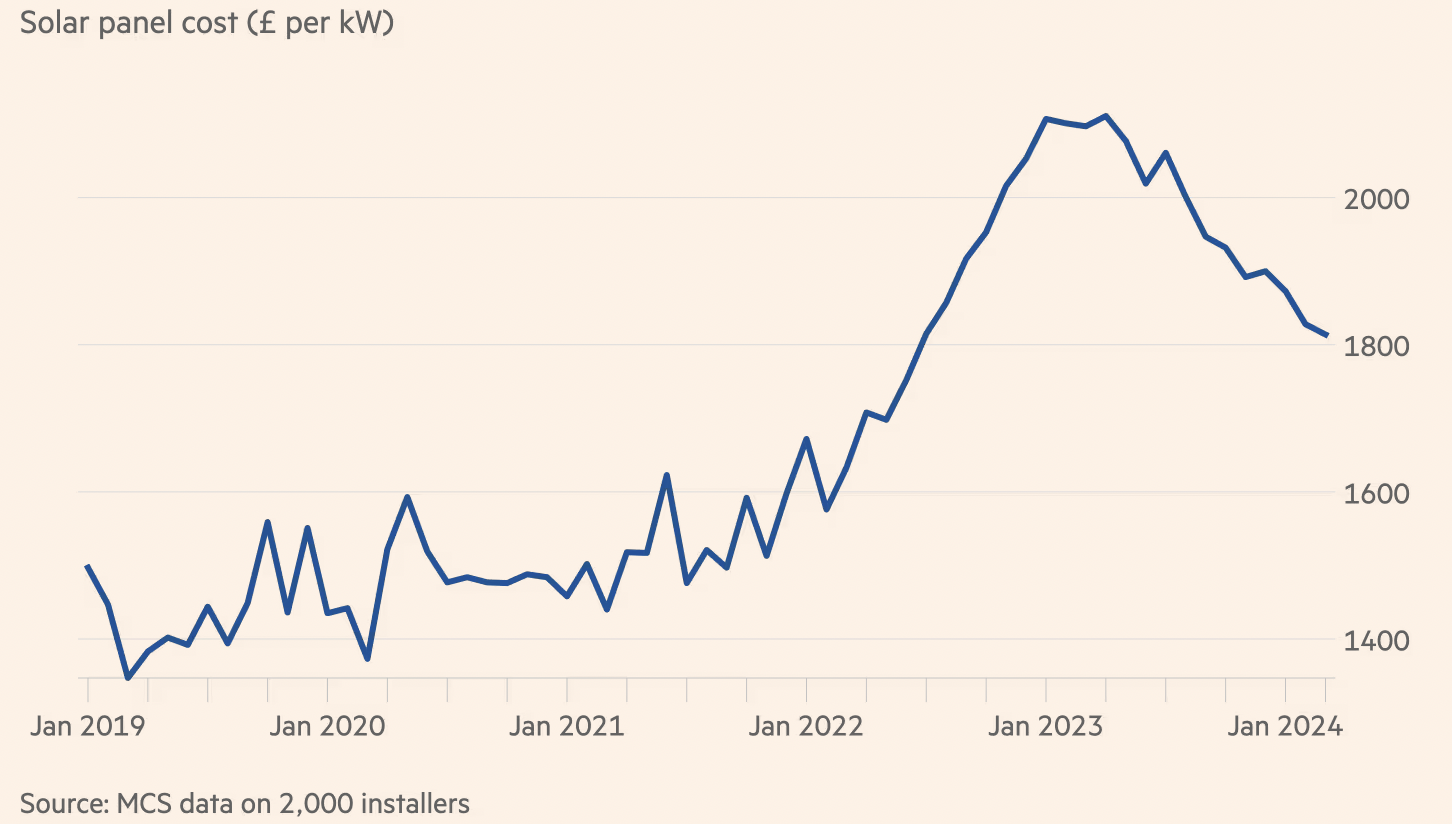

The cost of solar installations hasn’t benefitted as much as you might expect from cheaper panels. As the prices of panels fell, they became a smaller percentage of the total cost, which includes labor, other equipment and financing. Most of these other costs have risen in the last few years.

As you can see in the chart above, installation costs of solar panels has risen dramatically over the last few years, and so consumers are unlikely to have benefitted meaningfully from a drop in the price of solar panels.

✨ Battery storage is one component which could get cheaper and more efficient, which could make the economics more compelling.

✅ The Tailwinds and (Potential) Positive Catalysts

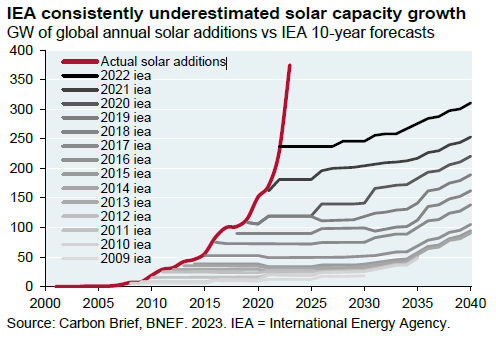

While the solar industry is facing several challenges, there are some secular tailwinds. Capacity is still being added at record rates across the globe, driven primarily by utility scale installations and commercial projects. Businesses, including data centers, are increasingly looking to secure their energy requirements, while investors and governments continue to invest in large scale installations.

The International Energy Agency and other institutions have consistently underestimated the growth in capacity. As an example, the 2040 projection they set in 2015 was exceeded within five years.

The other tailwind is electricity prices, which have risen consistently around the world. In the US, price increases have averaged 2.8% annually for the last 40 years. Most economies have experienced similar increases.

Electricity demand continues to rise in line with GDP growth - but should increase at an even faster rate as more of the global economy is electrified. This increased demand should keep prices rising, which makes solar (and wind) increasingly compelling - even if this needs to be supplemented with base-load power generated from natural gas and other fossil fuels. While nuclear is another option, reactors typically take up to ten years to build after a lengthy approval process, so solar remains the most economic and easily deployable form of non-Fossil fuel energy.

As mentioned, advances in battery storage would act as another catalyst for both wind and solar.

💡 The Insight: Keep An Eye On Margins When Investing In Solar

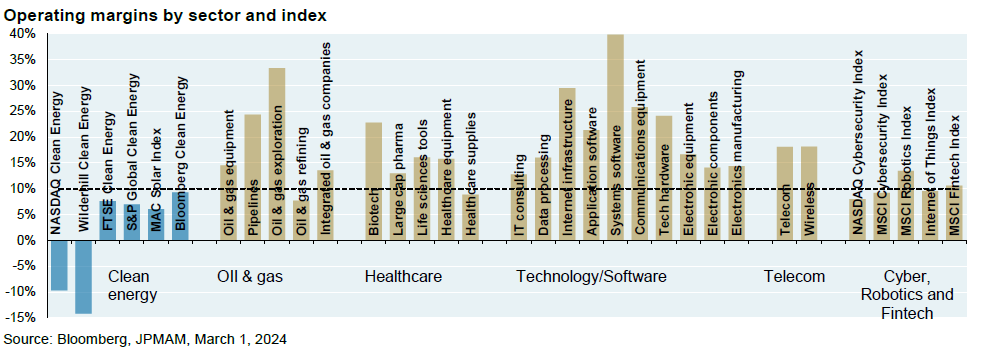

JP Morgan Asset Management's recent energy paper pointed out how poor margins are for the clean energy industry. This chart from the report compares operating margins for clean energy indexes with margins in other growth industries, and the oil and gas industry.

The chart reflects margins for these industries as a whole, and there are exceptions within the solar industry that earn much higher margins. But it underscores the fact that investors really need to be very selective when considering gaining exposure to clean energy stocks

One of the reasons for the lower margins is that solar panels (and batteries) have become commoditized.

✨ When a product becomes a commodity, margins quickly disappear. Once a product becomes commoditized, differentiation between companies drastically reduces and price alone becomes the determining factor behind consumer choice. This tends to lead to a price war that causes profit margins to evaporate.

For a company to have a sustainable margin, it needs to be able to differentiate its product or service to develop a competitive advantage. In the solar industry, companies are differentiating themselves by selling unique technology to convert, charge and manage solar arrays and storage solutions. These include:

- Inverters: SolarEdge

- Micro-inverters: Enphase (see below)

- Solar trackers: Array Technologies , Nextracker

Offering differentiated and unique services and products is a good start, but doesn’t guarantee long term success. Take a look at this brand-new narrative for Enphase Energy which breaks down the critical factors likely to drive returns for investors. This is a good example of how investors can approach companies in the industry to figure out how investible they are, and the right price to pay.

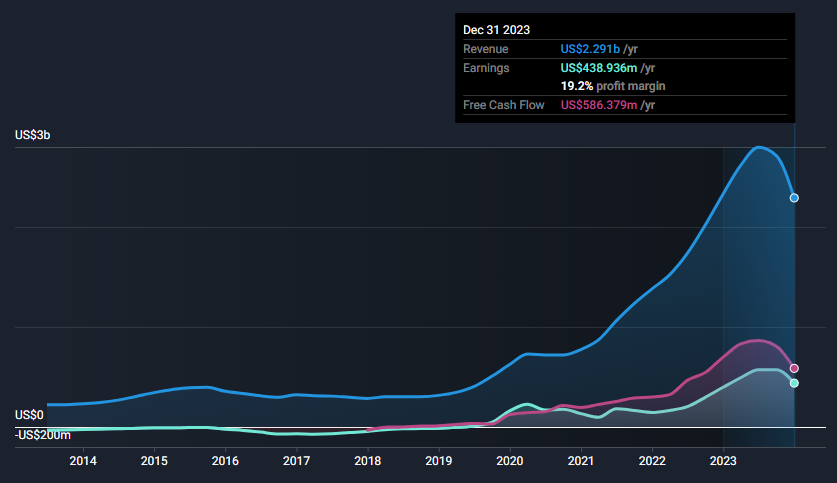

This chart below shows Enphase’s revenue, earnings and cash flow over the last 10 years, and reflects the fact that you can’t simply extrapolate recent trends.

✨ When investing in an industry that can be classified as both cyclical and growth, it’s crucial to understand the business model, competitive advantage and technology.

Enphase Energy: Revenue, Earnings and Cashflows - Image Credit: Simply Wall St

Key Events During The Next Week

Monday

- 🇺🇲 US R etail Sales are due. Economists expect a slight decrease during the month, but expect annual growth to rise from 1.5% to 2.5%.

Tuesday

- 🇨🇳 China’s GDP growth rate is due, and forecasts expect Q1 GDP growth to fall from 5.2% in the prior quarter to 5%.

- 🇬🇧 The UK’s unemployment rate for February will be published and is expected to rise from 3.9% to 4%.

- 🇨🇦 Canada’s year-on-year inflation rate is forecast to fall to 2.7% from 2.8% in March.

- 🇺🇸 US Building Permits and Housing starts are due. Both are expected to fall marginally to 1.51 million for the month of March.

Wednesday

- 🇬🇧 UK’s year-on-year inflation rate is forecast to fall from 3.4% to 3.1% in the month of March.

Friday

- 🇯🇵 Japan’s March inflation rate will be published, and is expected to be steady at 2.8%.

- 🇬🇧 UK retail sales are forecast to be slightly higher at 0.2% for the month and 0.7% higher over 12 months.

It’s week two of earnings season, with the remaining large banks, and the first of the technology and healthcare companies due to report:

- Morgan Stanley

- Bank of America

- Goldman Sachs

- Charles Schwab

- American Express

- HDFC Bank Limited

- United Health

- Abbott Labs

- Johnson & Johnson

- ASML

- IBM

- TSMC

- Netflix

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.