- United States

- /

- Luxury

- /

- NYSE:AS

Amer Sports (AS) Reports Strong Revenue Growth and Raises 2025 Earnings Guidance

Reviewed by Simply Wall St

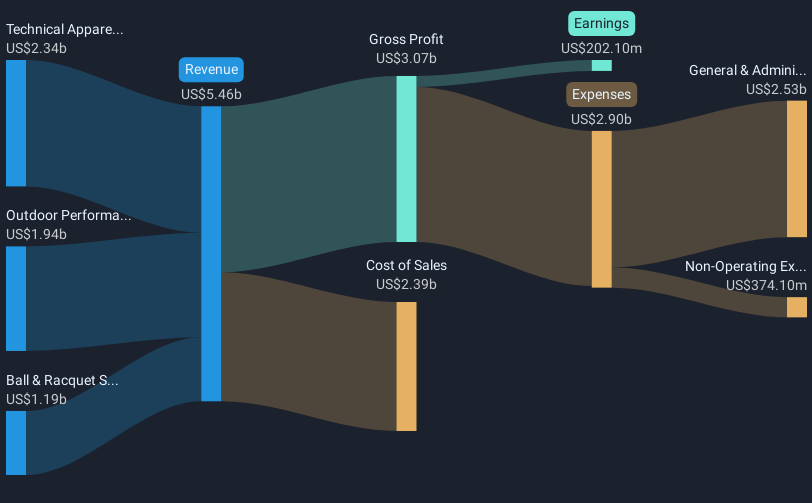

Amer Sports (AS) announced robust second-quarter performance, showing a significant increase in sales and net income, alongside a positive earnings guidance for the remainder of the year. These developments, coupled with executive changes at its Wilson subsidiary, likely reinforced investor confidence, contributing to the company's 2% price rise over the past week. Despite the strengthening position, Amer Sports' movement was in line with the broader market, which enjoyed a 1% increase, indicating that while its specific events provided supportive momentum, they did not diverge significantly from prevailing market trends.

Buy, Hold or Sell Amer Sports? View our complete analysis and fair value estimate and you decide.

The recent developments at Amer Sports, including a promising second-quarter performance and executive changes, have potential implications for the company's forecasted revenue and earnings growth. The strategic focus on the Asia-Pacific and Greater China regions, bolstered by rising incomes and interest in premium products, aligns well with the narrative that highlights significant revenue potential. As the company expands its direct-to-consumer channels, gross margins may see continued strengthening, potentially supporting the optimistic earnings growth analysts have predicted.

Over the past year, Amer Sports delivered substantial total shareholder returns with an increase of over 200%, underscoring a strong performance relative to the industry, which returned 1%. This robust return, chiefly driven by the company's strategic growth initiatives, further enhances its market position. The current share price of US$37.50 is below the consensus price target of US$41.97, suggesting room for potential appreciation. However, the price movement remains closely tied to achieving projected earnings and revenue targets while managing execution risks in new markets.

Explore Amer Sports' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives