- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) and AWS Expand AI Solutions Partnership with FICO Collaboration

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) saw a 6% price increase over the past month, a performance that aligns with broader market trends marked by a tech sector rally. Recent partnerships, such as the AWS collaboration with FICO, enhance Amazon's strategic positioning in AI-driven solutions. Additionally, the significant infrastructure expansions announced by AWS, including a new region in Chile, bolster long-term growth potential. The positive Q1 earnings report further supports investor confidence, with increased revenue and net income reflecting robust business fundamentals. These developments collectively contribute to Amazon's favorable performance amid the market's recovery.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent advancements in Amazon's AWS partnerships and infrastructure expansion support its narrative of enhanced operational efficiency and strategic growth. These developments align with Amazon's focus on optimizing its fulfillment network and expanding AI-driven services, potentially boosting future revenue. Over the past three years, including dividends, Amazon has experienced a total return of 67.20%, indicating strong performance over this period. However, when comparing Amazon to the US Multiline Retail industry over the past year, Amazon underperformed with an annual return that trailed the industry's 12%. This underperformance may highlight market challenges or competitive pressures within the sector.

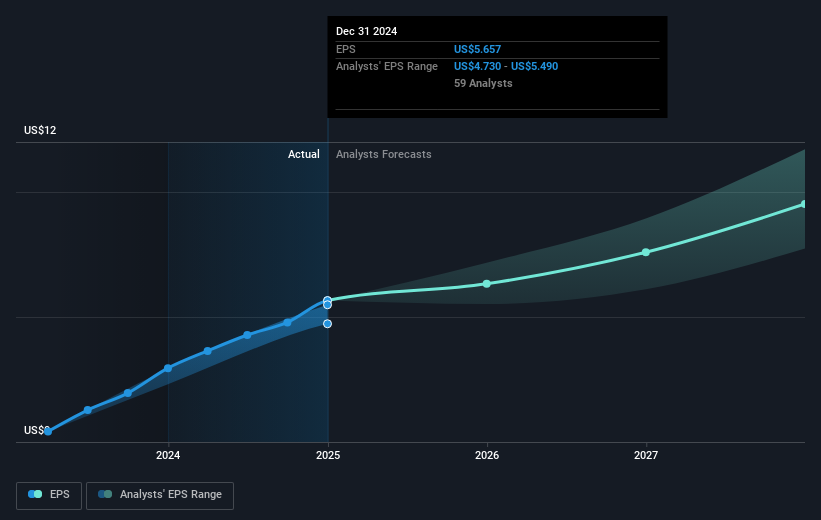

Amazon's recent stock price climb and broader market trends contribute positively to earnings forecasts, with analysts anticipating a rise in profit margins and revenue supported by AI and AWS expansions. Nevertheless, with the current share price at US$185.01 and an analyst price target of US$239.33, the stock is trading at a 22.7% discount. This suggests room for potential growth if the company's strategic initiatives successfully translate into financial performance. Investors should consider these dynamics when evaluating Amazon's long-term returns and market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives