- United Kingdom

- /

- Chemicals

- /

- LSE:ESNT

3 UK Stocks That May Be Priced Below Their Estimated Value In October 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices reflect challenges stemming from weak trade data out of China, investors in the United Kingdom are navigating a market influenced by global economic uncertainties. In this environment, identifying stocks that may be undervalued can offer potential opportunities; these are companies whose current market prices might not fully reflect their intrinsic value due to external pressures or temporary setbacks.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.414 | £11.61 | 44.8% |

| Pan African Resources (AIM:PAF) | £0.95 | £1.84 | 48.4% |

| On the Beach Group (LSE:OTB) | £2.245 | £4.38 | 48.7% |

| Norcros (LSE:NXR) | £2.89 | £5.50 | 47.5% |

| Likewise Group (AIM:LIKE) | £0.27 | £0.52 | 48.5% |

| Fevertree Drinks (AIM:FEVR) | £8.50 | £15.71 | 45.9% |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £2.22 | 49.6% |

| AstraZeneca (LSE:AZN) | £126.44 | £239.60 | 47.2% |

| AOTI (AIM:AOTI) | £0.40 | £0.78 | 48.6% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.26 | £4.39 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Essentra (LSE:ESNT)

Overview: Essentra plc manufactures and distributes plastic injection moulded, vinyl dip moulded, and metal items across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of £316.25 million.

Operations: Essentra generates revenue through its operations in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal products across various regions including Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

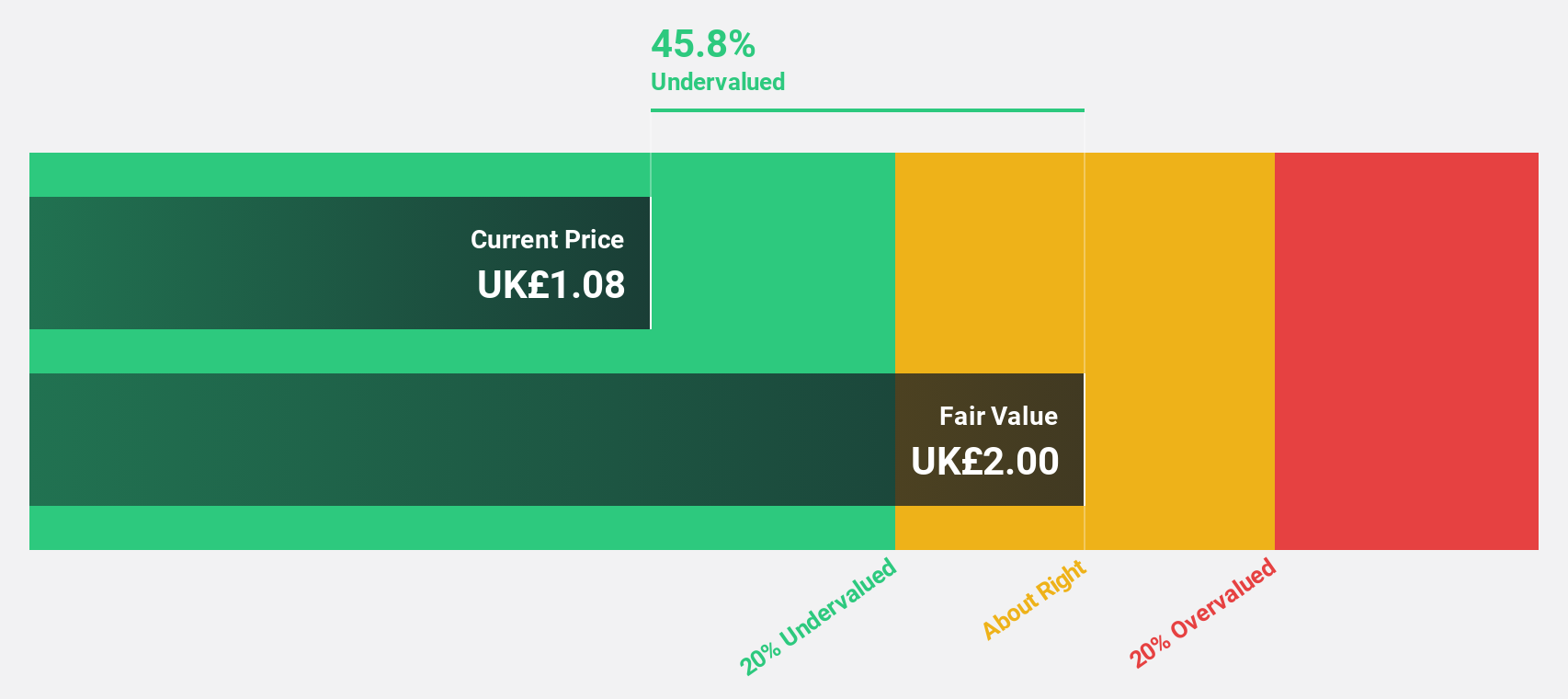

Estimated Discount To Fair Value: 44.3%

Essentra is trading at £1.11, significantly below its estimated fair value of £1.99, indicating potential undervaluation based on cash flows. Despite a challenging dividend track record and large one-off items affecting earnings quality, the company's earnings are expected to grow significantly over the next three years. Recent executive changes aim to strengthen leadership with industry expertise while share buybacks reflect confidence in long-term prospects despite recent declines in sales and net income.

- According our earnings growth report, there's an indication that Essentra might be ready to expand.

- Take a closer look at Essentra's balance sheet health here in our report.

Vistry Group (LSE:VTY)

Overview: Vistry Group PLC, with a market cap of £2.07 billion, operates in the United Kingdom providing housing solutions through its subsidiaries.

Operations: The company's revenue is primarily generated from its Home Builders segment, which focuses on residential and commercial projects, amounting to £3.69 billion.

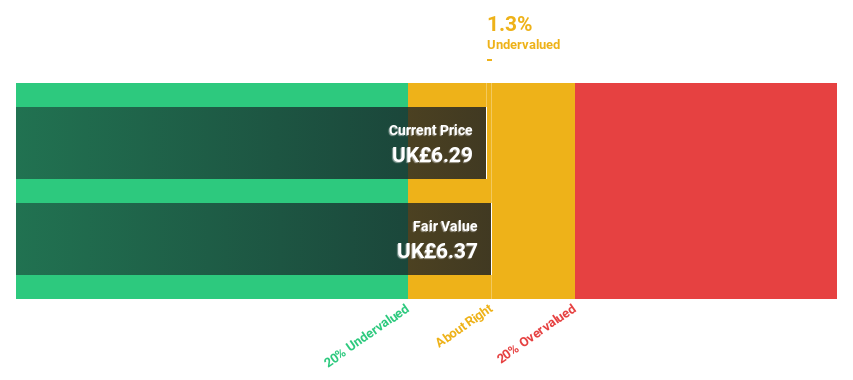

Estimated Discount To Fair Value: 44.8%

Vistry Group is trading at £6.41, well below its estimated fair value of £11.61, suggesting it may be undervalued based on cash flows. Despite a recent drop in net income and profit margins, earnings are projected to grow significantly over the next three years. The strategic joint venture with Homes England aims to enhance residential development capabilities, while share buybacks demonstrate confidence in future growth amidst executive changes and new board appointments.

- Our expertly prepared growth report on Vistry Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Vistry Group here with our thorough financial health report.

Zegona Communications (LSE:ZEG)

Overview: Zegona Communications plc offers integrated telecommunications services in Spain and has a market cap of £9.68 billion.

Operations: The company generates revenue from its integrated telecommunications services in Spain, with the Internet Telephone segment contributing €2.41 billion.

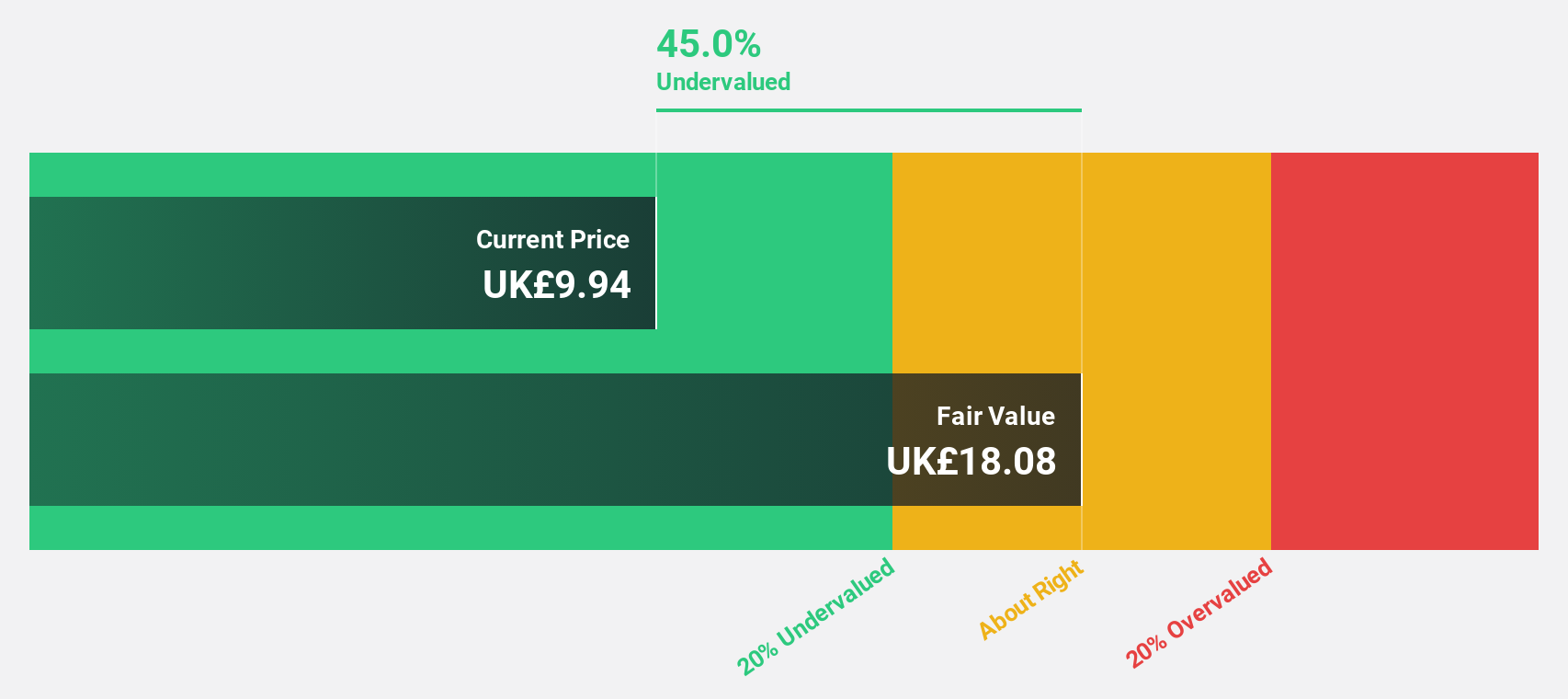

Estimated Discount To Fair Value: 31.7%

Zegona Communications, trading at £12.75, is considered undervalued with an estimated fair value of £18.66 based on cash flows. Despite slower revenue growth compared to the 20% benchmark, its forecasted earnings growth of 64.43% per year and potential profitability within three years are promising. Recent debt refinancing reduces annual interest expenses and enhances financial flexibility, while ongoing discussions about selling data centers acquired from Vodafone Spain could impact future valuations significantly.

- Our comprehensive growth report raises the possibility that Zegona Communications is poised for substantial financial growth.

- Click here to discover the nuances of Zegona Communications with our detailed financial health report.

Next Steps

- Reveal the 48 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essentra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ESNT

Essentra

Engages in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives