- United Kingdom

- /

- Electrical

- /

- LSE:LUCE

3 UK Penny Stocks With Over £100M Market Cap

Reviewed by Simply Wall St

The UK market has recently seen a dip, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market fluctuations, investors can find potential opportunities in penny stocks, a term that may seem outdated but still points to promising investment areas. By focusing on smaller or newer companies with solid financial foundations, investors might uncover hidden value and growth potential that larger firms sometimes miss.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.565 | £511.08M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.85 | £230.24M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.47 | £430.93M | ✅ 4 ⚠️ 1 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.86 | £293.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.01 | £108.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £186.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.50 | £76.17M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.894 | £715.34M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 300 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Auction Technology Group (LSE:ATG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Auction Technology Group plc operates online auction marketplaces in the United Kingdom, North America, and Germany, with a market cap of £396.69 million.

Operations: Auction Technology Group's revenue is derived from Auction Services ($8.04 million), Arts and Antiques (A&A) ($91.86 million), and Industrial and Commercial (I&C) ($73.58 million).

Market Cap: £396.69M

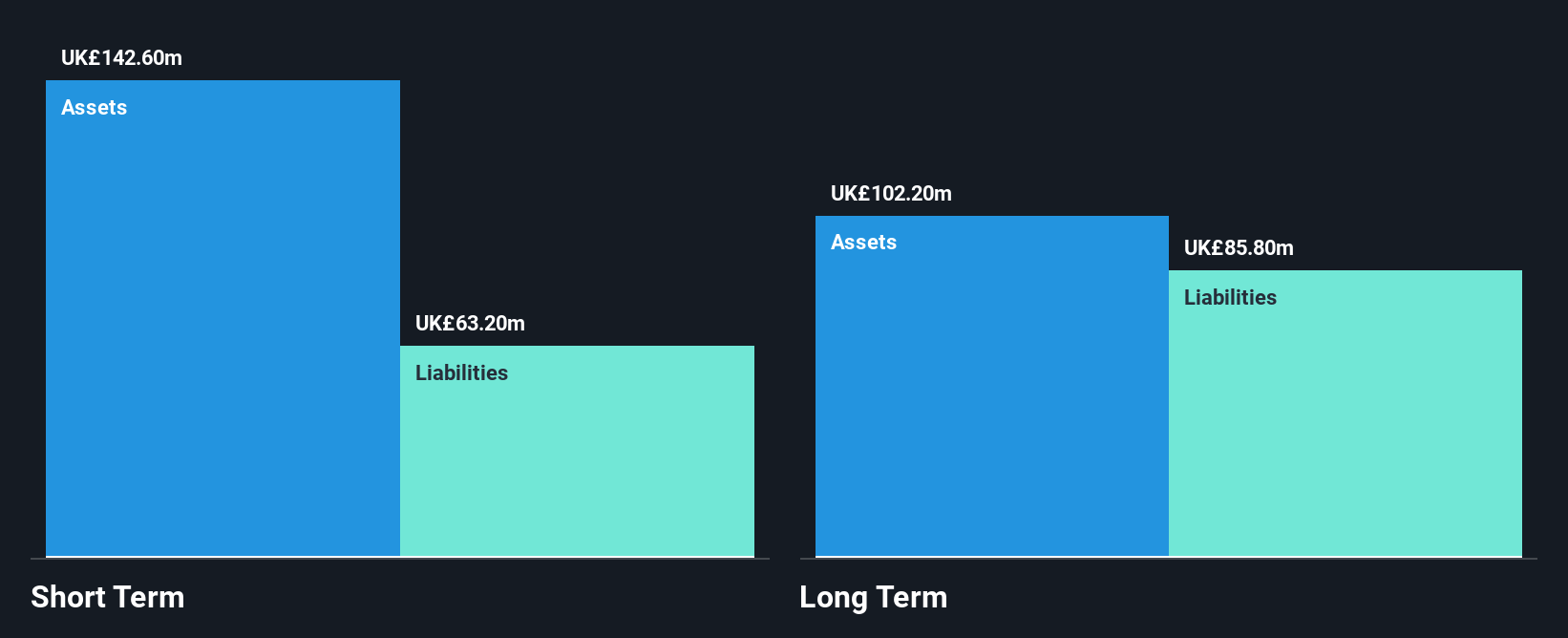

Auction Technology Group plc, with a market cap of £396.69 million, has shown significant earnings growth of 90% over the past year, surpassing the Consumer Services industry's average. Despite this growth and improved profit margins from 7.6% to 14%, its Return on Equity remains low at 3.6%. The company's short-term assets cover its liabilities well but fall short against long-term obligations ($149.3M). Its net debt to equity ratio is satisfactory at 15.7%, with debt well covered by operating cash flow (56.8%). However, earnings are forecasted to decline by an average of 2% annually over the next three years.

- Get an in-depth perspective on Auction Technology Group's performance by reading our balance sheet health report here.

- Assess Auction Technology Group's future earnings estimates with our detailed growth reports.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the United Kingdom, Ireland, and several Nordic countries, with a market cap of £1.45 billion.

Operations: The company generates revenue from its operations in the Nordic region, contributing £3.42 billion, and from the UK & Ireland, which accounts for £5.35 billion.

Market Cap: £1.45B

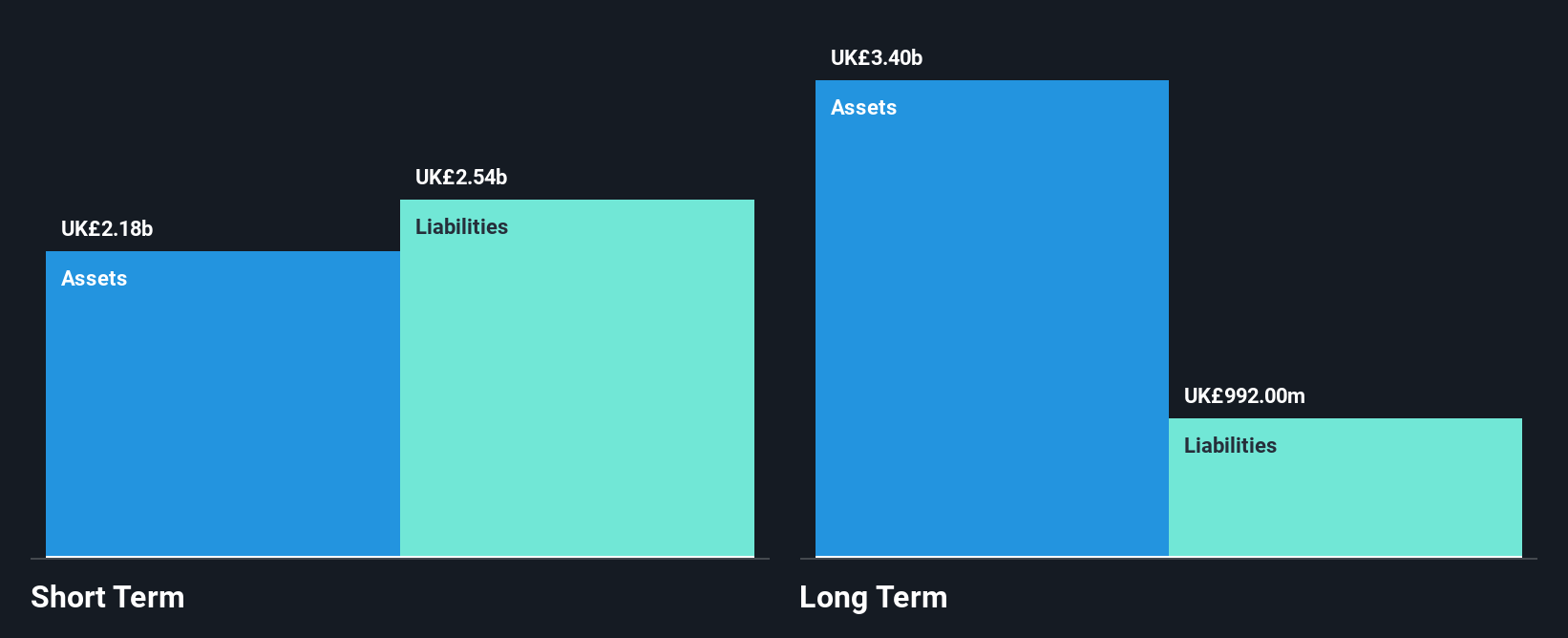

Currys plc, with a market cap of £1.45 billion, has demonstrated robust earnings growth of 286.2% over the past year, significantly outpacing the Specialty Retail industry. Despite this impressive growth and improved net profit margins from 0.3% to 1.2%, its Return on Equity remains low at 4.8%. The company's financial health is supported by short-term assets exceeding long-term liabilities and debt being well covered by operating cash flow (1812%). Recent strategic moves include a £50 million share buyback program aimed at returning surplus capital to shareholders, alongside maintaining dividend payments of 1.5 pence per share.

- Jump into the full analysis health report here for a deeper understanding of Currys.

- Examine Currys' earnings growth report to understand how analysts expect it to perform.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Luceco plc is a company that manufactures and distributes wiring accessories, LED lighting, and portable power products across various regions including the United Kingdom, the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £197.64 million.

Operations: Luceco plc has not reported any specific revenue segments.

Market Cap: £197.64M

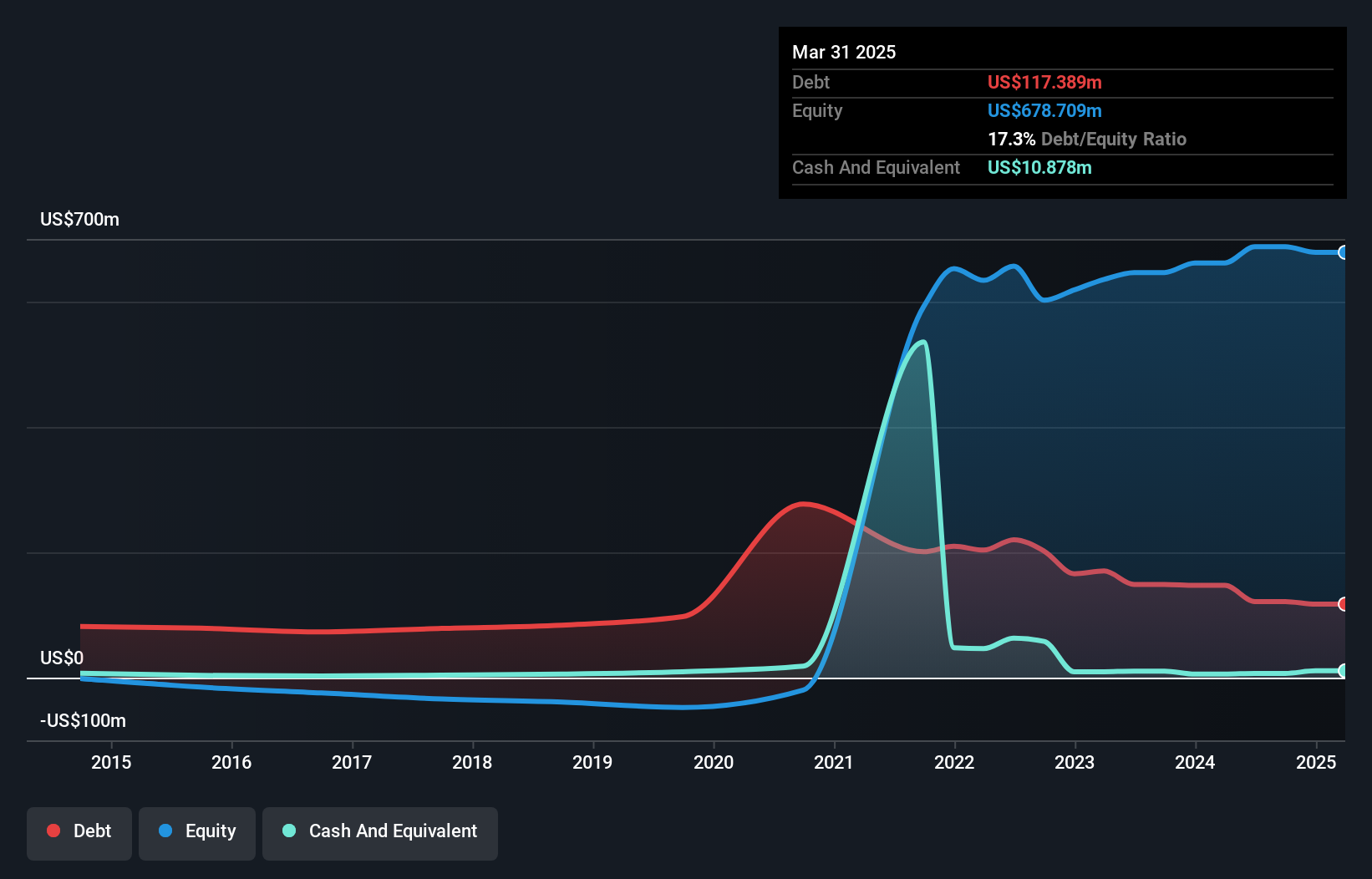

Luceco plc, with a market cap of £197.64 million, has faced challenges with negative earnings growth of 12.6% over the past year and a declining five-year earnings trend. Despite this, it trades at good value relative to peers and below its estimated fair value by 42.2%. The company's debt level is high with a net debt to equity ratio of 70.7%, though interest payments are well covered by EBIT (5.4x). Recent financial results show sales growth but slightly decreased net income compared to the previous year, highlighting ongoing profitability pressures amidst stable weekly volatility and experienced board leadership changes.

- Take a closer look at Luceco's potential here in our financial health report.

- Gain insights into Luceco's future direction by reviewing our growth report.

Key Takeaways

- Explore the 300 names from our UK Penny Stocks screener here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LUCE

Luceco

Manufactures and distributes wiring accessories, LED lighting, and portable power products in the United Kingdom, the Americas, Europe, the Middle East, Africa, the Asia Pacific.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives