- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

3 Stocks With Estimated Discounts From 15.7% To 32.3% Offering Value Opportunities

Reviewed by Simply Wall St

As U.S. stock indexes have recently experienced a series of declines, investors are closely monitoring economic indicators and inflation data to gauge market direction. In this environment, identifying undervalued stocks can offer potential opportunities for value-focused investors seeking to capitalize on estimated discounts ranging from 15.7% to 32.3%.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| XPEL (XPEL) | $32.17 | $62.97 | 48.9% |

| Udemy (UDMY) | $6.96 | $13.71 | 49.2% |

| Royal Gold (RGLD) | $193.11 | $383.90 | 49.7% |

| Peapack-Gladstone Financial (PGC) | $28.28 | $56.54 | 50% |

| Northwest Bancshares (NWBI) | $12.46 | $24.41 | 49% |

| Niagen Bioscience (NAGE) | $9.41 | $18.68 | 49.6% |

| Metropolitan Bank Holding (MCB) | $76.02 | $150.26 | 49.4% |

| Horizon Bancorp (HBNC) | $16.11 | $31.77 | 49.3% |

| Glaukos (GKOS) | $81.47 | $161.57 | 49.6% |

| Customers Bancorp (CUBI) | $66.83 | $130.64 | 48.8% |

We're going to check out a few of the best picks from our screener tool.

CuriosityStream (CURI)

Overview: CuriosityStream Inc. is a media and entertainment company that offers factual content through various channels, with a market cap of $301.81 million.

Operations: The company generates revenue primarily from its Curiosity Stream segment, which amounted to $60.84 million.

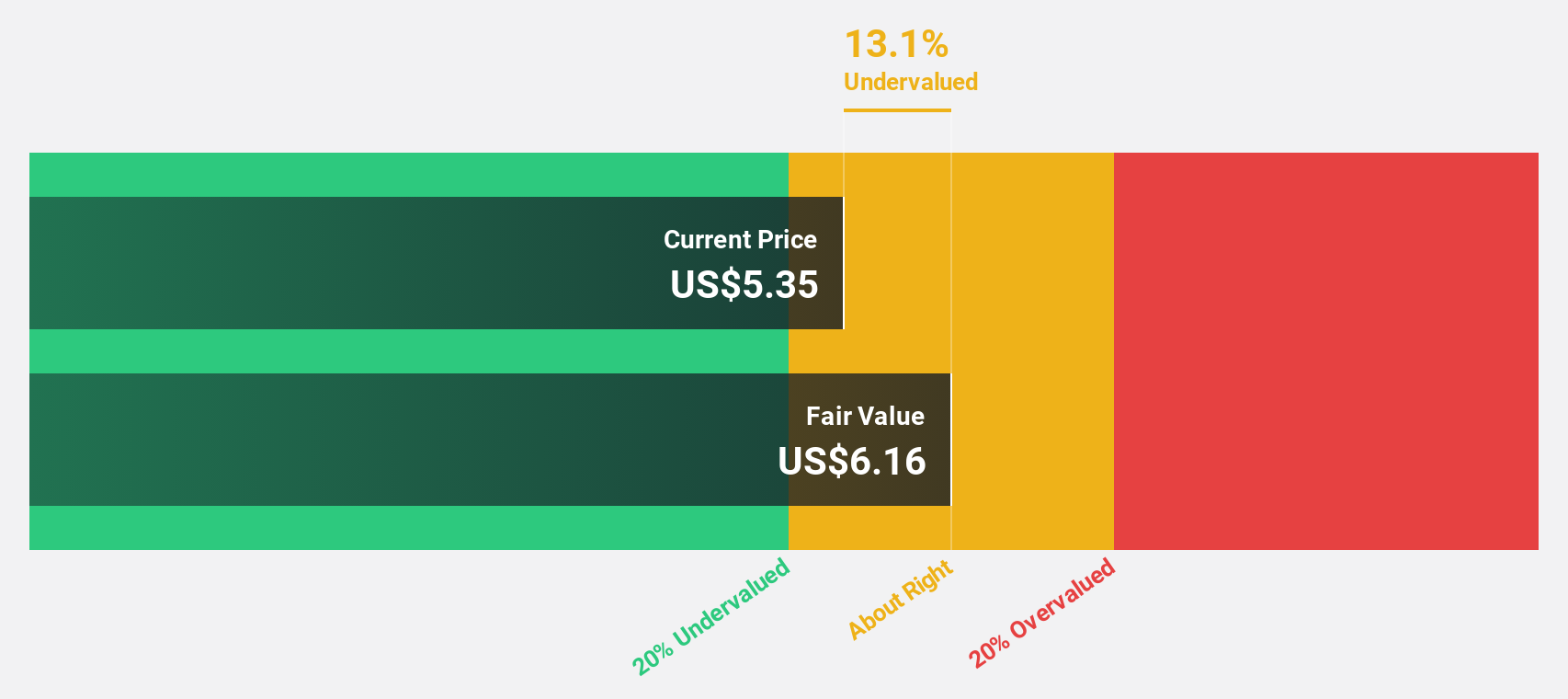

Estimated Discount To Fair Value: 15.7%

CuriosityStream, trading at US$5.18, is considered undervalued with a fair value estimate of US$6.15. Recent strategic expansions, including the launch of its FAST channel on Prime Video and a distribution agreement with DIRECTV, enhance its revenue growth prospects. Despite insider selling and a dividend not covered by earnings or cash flows, the company shows potential for profitability within three years and has been added to multiple indices like S&P Global BMI Index.

- Our earnings growth report unveils the potential for significant increases in CuriosityStream's future results.

- Unlock comprehensive insights into our analysis of CuriosityStream stock in this financial health report.

Array Technologies (ARRY)

Overview: Array Technologies, Inc. manufactures and sells solar tracking technology products across the United States, Spain, Brazil, Australia, and other international markets with a market cap of approximately $1.25 billion.

Operations: Array Technologies generates revenue primarily from two segments: STI Operations, contributing $304.06 million, and Array Legacy Operations, accounting for $867.19 million.

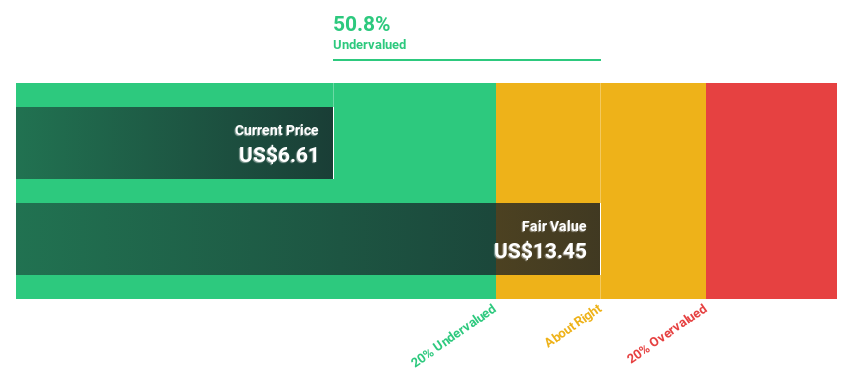

Estimated Discount To Fair Value: 22.5%

Array Technologies is trading at US$8.17, below its estimated fair value of US$10.54, suggesting it is undervalued based on cash flows. The company reported strong earnings growth and raised its revenue guidance for 2025 to between US$1.18 billion and US$1.215 billion. Recent product validations support cost efficiency in solar projects, enhancing appeal despite volatile share prices and slower-than-market revenue growth forecasts of 7.6% annually over the next three years.

- Our expertly prepared growth report on Array Technologies implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Array Technologies with our detailed financial health report.

Energy Recovery (ERII)

Overview: Energy Recovery, Inc. designs, manufactures, and sells energy efficiency technology solutions across various global regions and has a market cap of approximately $812.87 million.

Operations: The company generates revenue primarily from its Water segment, which accounts for $141.21 million, and Emerging Technologies, contributing $0.57 million.

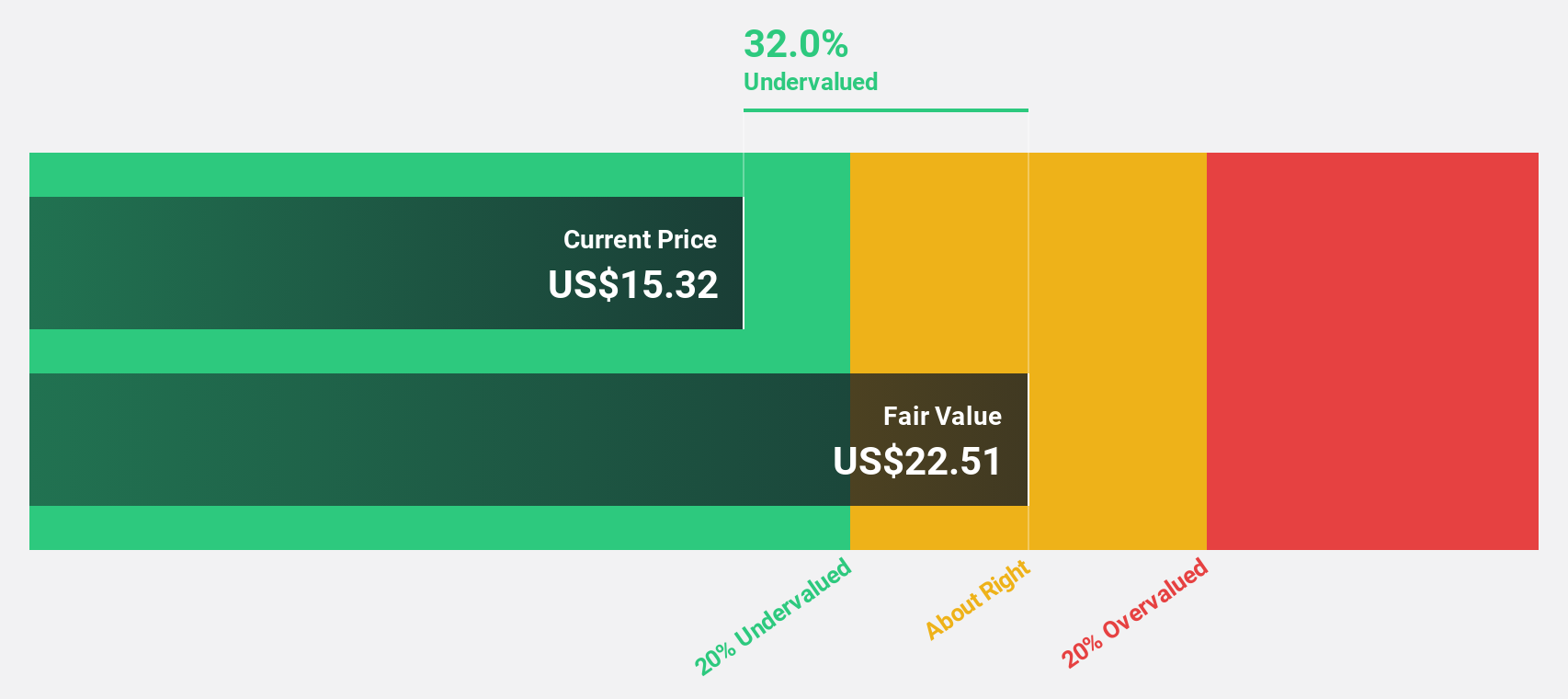

Estimated Discount To Fair Value: 32.3%

Energy Recovery, Inc. is trading at US$15.24, significantly below its estimated fair value of US$22.5, highlighting its potential undervaluation based on cash flows. The company reported improved earnings for Q2 2025 with a net income of US$2.05 million compared to a loss last year and has initiated a share repurchase program up to US$25 million funded by cash on hand, reflecting strong financial positioning despite slower revenue growth forecasts than earnings projections.

- Insights from our recent growth report point to a promising forecast for Energy Recovery's business outlook.

- Take a closer look at Energy Recovery's balance sheet health here in our report.

Key Takeaways

- Navigate through the entire inventory of 196 Undervalued US Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives