- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

3 Stocks That Might Be Undervalued And Present An Investment Opportunity

Reviewed by Simply Wall St

As the U.S. stock market navigates a turbulent landscape marked by political tensions and mixed economic signals, investors are keeping a close eye on potential opportunities amid volatility. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $14.87 | $29.36 | 49.4% |

| Roku (ROKU) | $89.28 | $173.99 | 48.7% |

| Rapid7 (RPD) | $22.53 | $43.82 | 48.6% |

| MoneyHero (MNY) | $1.23 | $2.40 | 48.8% |

| Ligand Pharmaceuticals (LGND) | $124.30 | $240.64 | 48.3% |

| Hess Midstream (HESM) | $38.08 | $73.49 | 48.2% |

| Definitive Healthcare (DH) | $3.95 | $7.83 | 49.6% |

| Carter Bankshares (CARE) | $17.89 | $35.50 | 49.6% |

| Bridgewater Bancshares (BWB) | $16.05 | $30.95 | 48.1% |

| ACNB (ACNB) | $42.35 | $84.33 | 49.8% |

We'll examine a selection from our screener results.

Atour Lifestyle Holdings (ATAT)

Overview: Atour Lifestyle Holdings Limited, with a market cap of $4.89 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

Operations: The company's revenue segment, Atour Group, generated CN¥7.69 billion.

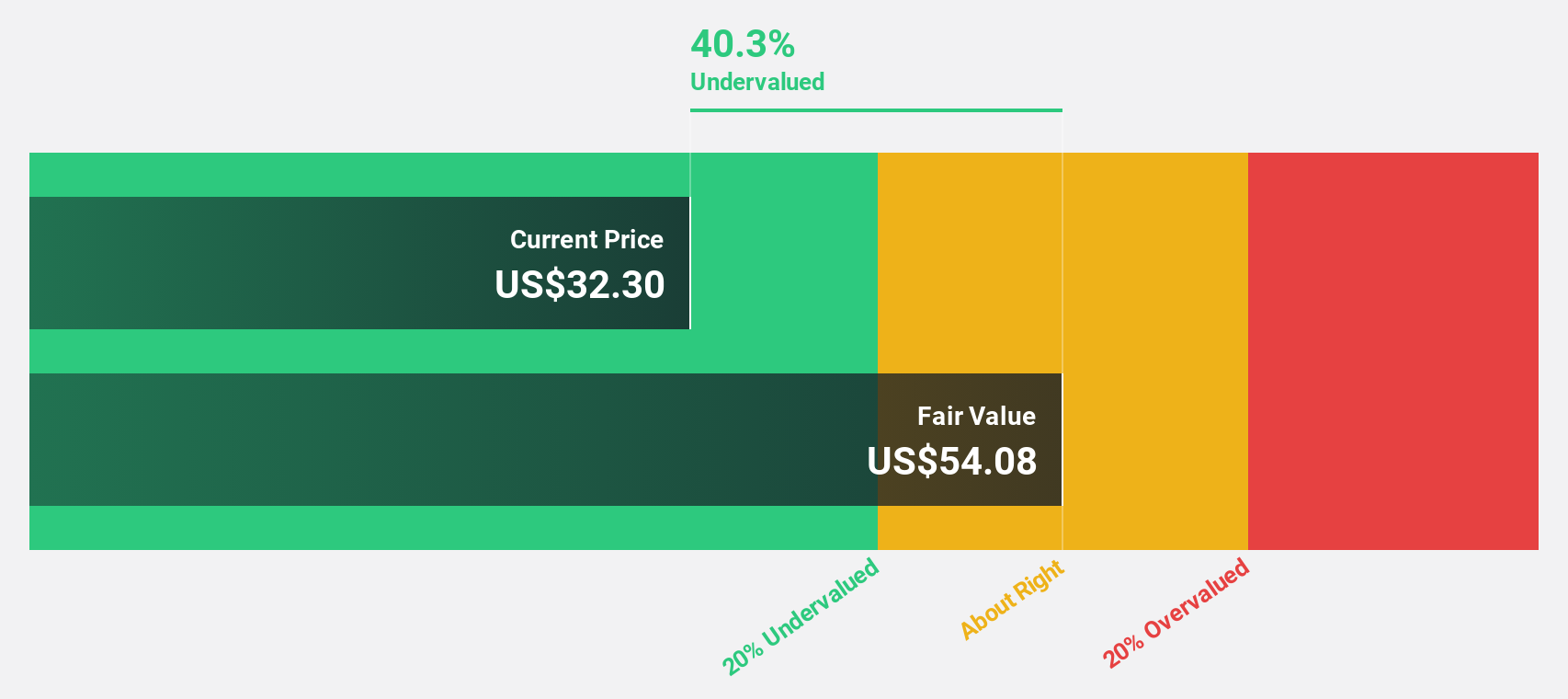

Estimated Discount To Fair Value: 34.9%

Atour Lifestyle Holdings appears undervalued, trading at US$35.93, below its estimated fair value of US$55.17. Despite a recent dividend decrease, the company has initiated a significant US$400 million share buyback program to enhance shareholder value. With forecasted revenue growth of 20.6% annually and earnings expected to grow significantly over the next three years, Atour's strong cash flow potential makes it an attractive consideration for investors seeking undervalued opportunities based on cash flows.

- Insights from our recent growth report point to a promising forecast for Atour Lifestyle Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in Atour Lifestyle Holdings' balance sheet health report.

Globalstar (GSAT)

Overview: Globalstar, Inc. offers mobile satellite services across various regions including the United States, Canada, Europe, Central and South America with a market cap of $3.50 billion.

Operations: The company's revenue is primarily derived from its Mobile Satellite Services (MSS) Business, totaling $253.90 million.

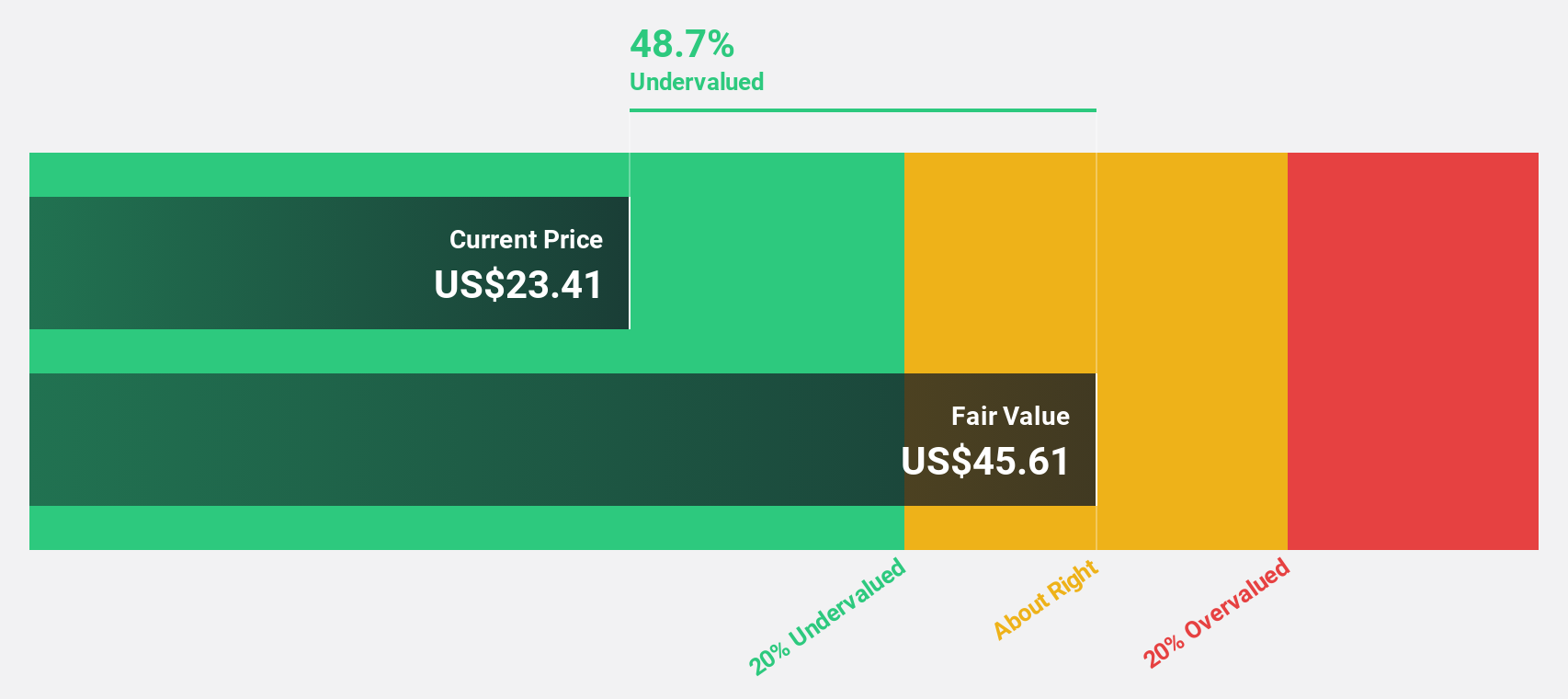

Estimated Discount To Fair Value: 42%

Globalstar, trading at US$27.63, is significantly undervalued compared to its estimated fair value of US$47.68. Despite recent index drops, the company has strategic alliances like the CRADA with the U.S. Army and infrastructure expansions in Spain supporting its growth trajectory. With expected profitability within three years and earnings projected to grow substantially annually, Globalstar's cash flow potential presents an opportunity for investors focused on undervalued stocks based on cash flows.

- The growth report we've compiled suggests that Globalstar's future prospects could be on the up.

- Click here to discover the nuances of Globalstar with our detailed financial health report.

BBB Foods (TBBB)

Overview: BBB Foods Inc., with a market cap of $2.79 billion, operates a chain of grocery retail stores in Mexico through its subsidiaries.

Operations: The company generates revenue of MX$61.89 billion from the sale, acquisition, and distribution of all types of products and consumer goods through its grocery retail stores in Mexico.

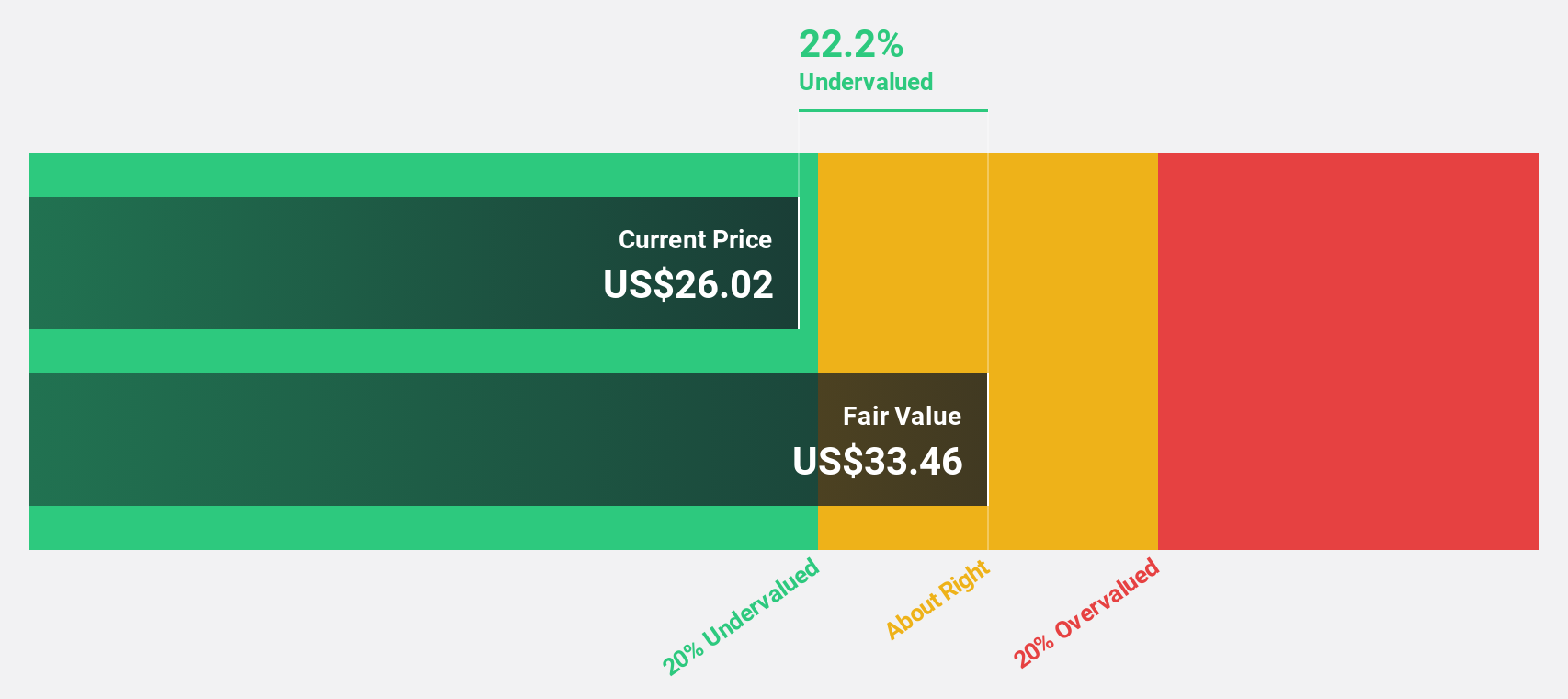

Estimated Discount To Fair Value: 21%

BBB Foods, trading at $26.60, is undervalued with an estimated fair value of $33.67. The company recently became profitable and forecasts indicate revenue growth of 20.2% per year, outpacing the U.S. market's 8.8%. Earnings are projected to grow significantly at 34.65% annually over the next three years despite a recent net loss reduction from MXN 230.86 million to MXN 86.98 million in Q1 2025 results, reflecting improved financial health and potential for investors focused on cash flow undervaluation opportunities.

- Our comprehensive growth report raises the possibility that BBB Foods is poised for substantial financial growth.

- Dive into the specifics of BBB Foods here with our thorough financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 173 Undervalued US Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives