3 Stocks That May Be Undervalued By Up To 43.4% According To Intrinsic Value Estimates

Reviewed by Simply Wall St

As U.S. markets navigate the complexities of trade talks and economic data, investors are keenly observing fluctuations in major indices like the Dow Jones Industrial Average, which recently edged closer to record highs. In such a climate, identifying undervalued stocks can be particularly advantageous for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $25.65 | $51.02 | 49.7% |

| TXO Partners (TXO) | $15.09 | $29.56 | 49% |

| Mid Penn Bancorp (MPB) | $29.10 | $57.45 | 49.3% |

| MAC Copper (MTAL) | $12.11 | $23.97 | 49.5% |

| Hess Midstream (HESM) | $37.96 | $73.68 | 48.5% |

| Granite Ridge Resources (GRNT) | $6.34 | $12.41 | 48.9% |

| Carter Bankshares (CARE) | $17.80 | $35.50 | 49.9% |

| Camden National (CAC) | $41.88 | $82.62 | 49.3% |

| BioLife Solutions (BLFS) | $21.66 | $42.65 | 49.2% |

| Acadia Realty Trust (AKR) | $18.62 | $36.48 | 49% |

We'll examine a selection from our screener results.

Trade Desk (TTD)

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform for digital ad buyers, with a market cap of approximately $35.39 billion.

Operations: The company's revenue segment includes its Advertising Technology Platform, generating $2.57 billion.

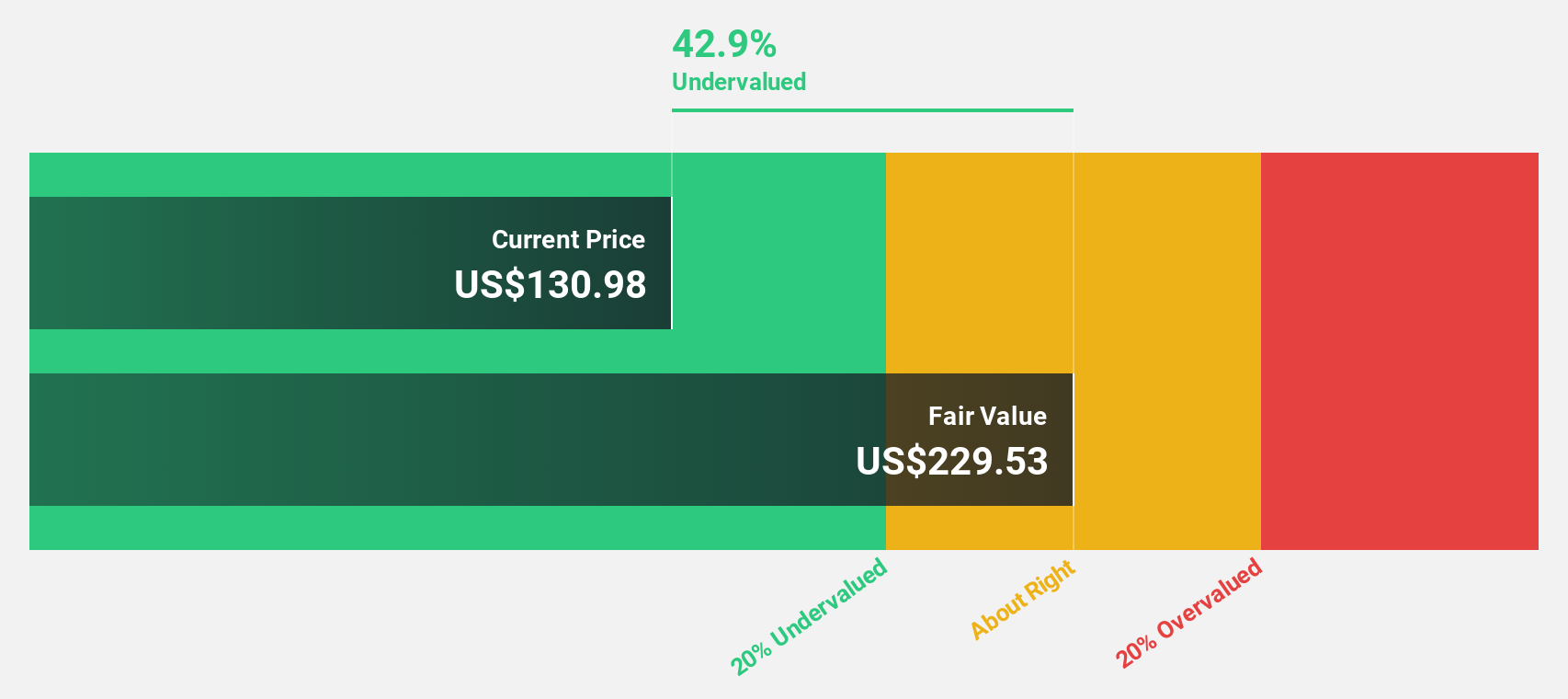

Estimated Discount To Fair Value: 16.1%

Trade Desk is trading at US$73.49, below its estimated fair value of US$87.61, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 21.4% annually, outpacing the broader U.S. market's growth rate of 14.6%. Recent strategic partnerships and innovations in AI-driven advertising solutions bolster its market position and could enhance revenue growth prospects, which are expected to surpass overall U.S. market trends.

- Insights from our recent growth report point to a promising forecast for Trade Desk's business outlook.

- Click here to discover the nuances of Trade Desk with our detailed financial health report.

Coherent (COHR)

Overview: Coherent Corp. specializes in the development, manufacturing, and marketing of engineered materials, optoelectronic components and devices, as well as optical and laser systems for various global markets including industrial, communications, electronics, and instrumentation, with a market cap of approximately $13.87 billion.

Operations: Coherent's revenue is primarily derived from its Networking segment at $3.21 billion, followed by Materials at $1.52 billion, and Lasers at $1.45 billion.

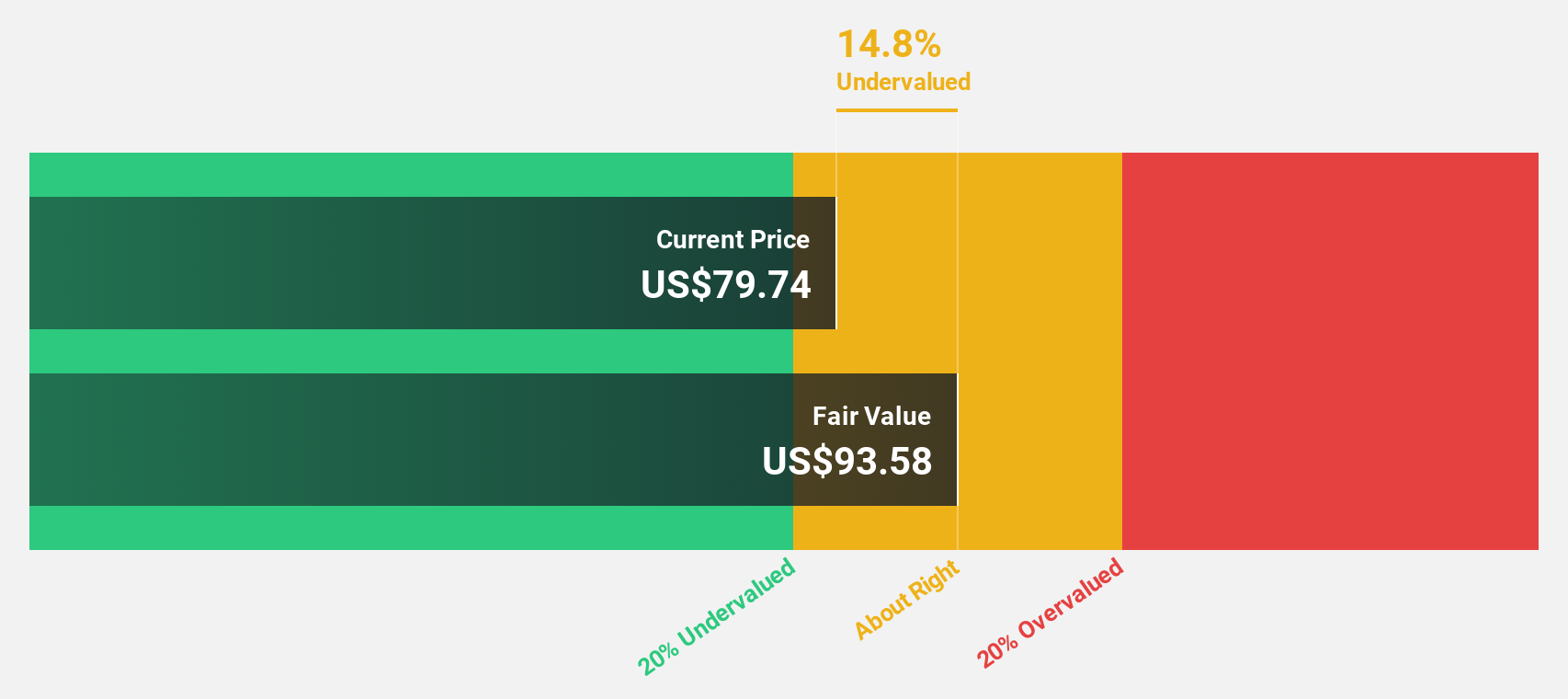

Estimated Discount To Fair Value: 10.8%

Coherent is trading at US$86.64, slightly below its estimated fair value of US$97.1, indicating potential undervaluation based on cash flows. Despite a volatile share price recently, the company's revenue and earnings are expected to grow faster than the U.S. market over the next three years, with profitability anticipated in this period. Recent product launches in medical and industrial lasers could enhance Coherent's growth prospects by leveraging its proprietary technologies and vertically integrated manufacturing capabilities.

- Our expertly prepared growth report on Coherent implies its future financial outlook may be stronger than recent results.

- Take a closer look at Coherent's balance sheet health here in our report.

e.l.f. Beauty (ELF)

Overview: e.l.f. Beauty, Inc. is a global beauty company offering cosmetics and skin care products, with a market cap of approximately $7.01 billion.

Operations: The company's revenue is derived from its Personal Products segment, which generated $1.31 billion.

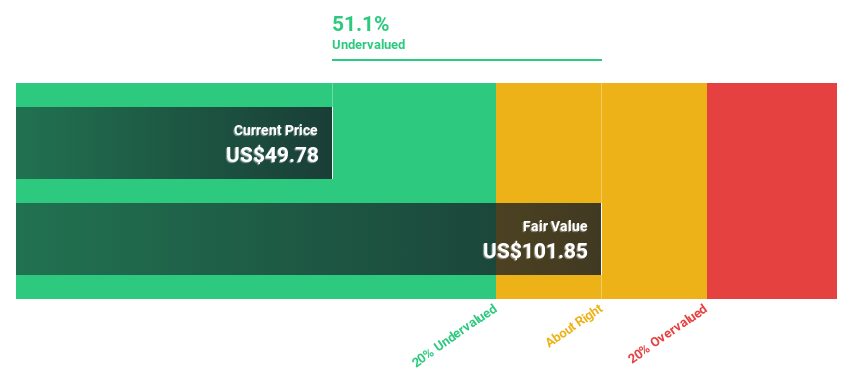

Estimated Discount To Fair Value: 43.4%

e.l.f. Beauty, trading at US$126.67, is significantly below its estimated fair value of US$223.82, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow faster than the U.S. market, with revenue growth also outpacing the market average. However, recent insider selling and lower profit margins compared to last year present concerns. Recent index reclassifications highlight a shift towards value recognition in the market perception of e.l.f.'s stock.

- The analysis detailed in our e.l.f. Beauty growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of e.l.f. Beauty.

Taking Advantage

- Access the full spectrum of 174 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives