- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

3 Stocks That May Be Undervalued According To Analysts In June 2025

Reviewed by Simply Wall St

As the United States stock market experiences modest gains amid ongoing trade negotiations and economic data releases, investors are keenly observing the potential impacts of these developments on various sectors. In this environment, identifying undervalued stocks can offer opportunities for growth, especially when considering companies that may benefit from improving trade relations and strong corporate earnings.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wolverine World Wide (WWW) | $16.65 | $32.45 | 48.7% |

| Verra Mobility (VRRM) | $24.29 | $47.93 | 49.3% |

| Valley National Bancorp (VLY) | $8.68 | $17.32 | 49.9% |

| TXO Partners (TXO) | $15.00 | $29.94 | 49.9% |

| Peoples Financial Services (PFIS) | $47.40 | $93.66 | 49.4% |

| MetroCity Bankshares (MCBS) | $27.37 | $53.18 | 48.5% |

| Horizon Bancorp (HBNC) | $14.67 | $29.11 | 49.6% |

| Hims & Hers Health (HIMS) | $53.61 | $106.29 | 49.6% |

| Central Pacific Financial (CPF) | $26.43 | $51.99 | 49.2% |

| Arrow Financial (AROW) | $25.06 | $49.74 | 49.6% |

Let's review some notable picks from our screened stocks.

Teradyne (TER)

Overview: Teradyne, Inc. is a company that designs, develops, manufactures, and sells automated test systems and robotics products across various regions including the United States, Asia Pacific, Europe, the Middle East, and Africa with a market cap of approximately $13.07 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Test segment at $2.23 billion and Robotics segment at $346.18 million.

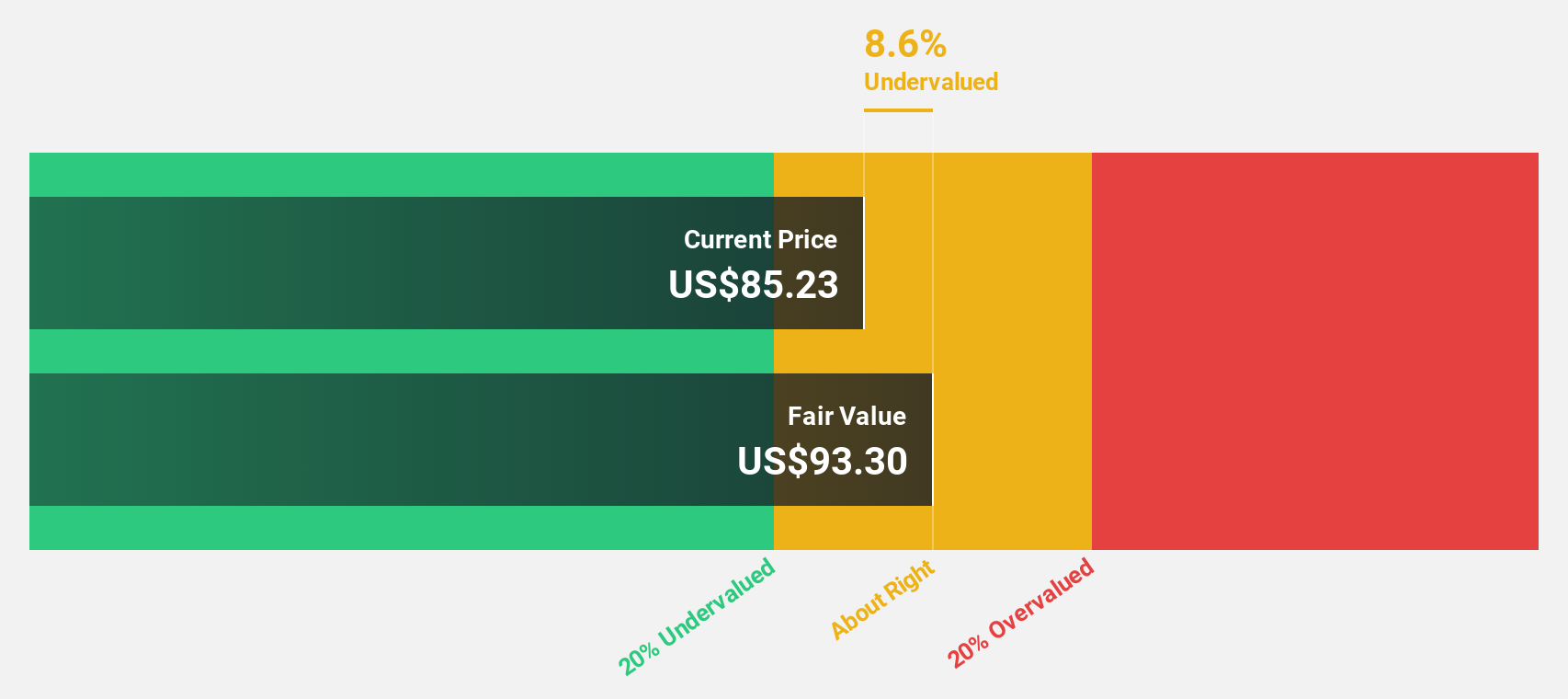

Estimated Discount To Fair Value: 12.2%

Teradyne is trading 12.2% below its estimated fair value of US$93.42, suggesting it may be undervalued based on cash flows. Recent earnings growth of 34.3% and a forecasted annual profit growth rate of 18.1%, faster than the US market average, support this view. The company has also completed significant share buybacks worth US$759.63 million, enhancing shareholder value while maintaining strong revenue performance with Q1 sales at US$685.68 million.

- According our earnings growth report, there's an indication that Teradyne might be ready to expand.

- Get an in-depth perspective on Teradyne's balance sheet by reading our health report here.

MINISO Group Holding (MNSO)

Overview: MINISO Group Holding Limited is an investment holding company involved in the retail and wholesale of lifestyle and pop toy products across China, Asia, the Americas, Europe, Indonesia, and other international markets with a market cap of approximately $5.26 billion.

Operations: The company's revenue segments include the MINISO Brand, excluding Africa and Germany, which generated CN¥16.60 billion, and the TOP TOY Brand, which contributed CN¥1.12 billion.

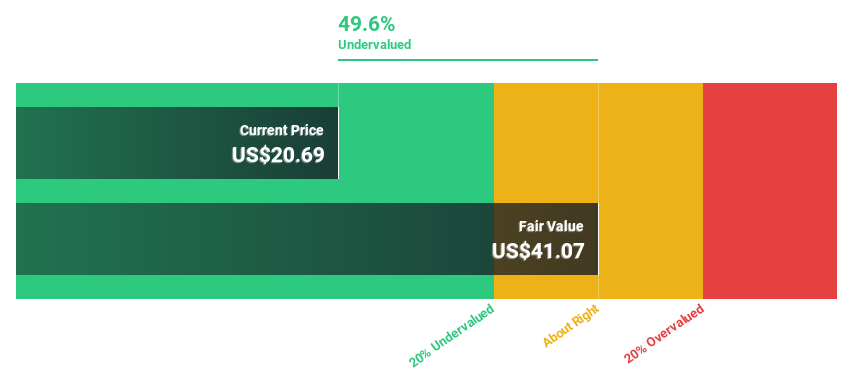

Estimated Discount To Fair Value: 40.8%

MINISO Group Holding is trading at US$18.17, significantly below its estimated fair value of US$30.69, highlighting potential undervaluation based on cash flows. With earnings projected to grow 21.7% annually, exceeding the US market average, and a strong return on equity forecasted at 27%, the company shows promising financial health despite a dividend not fully covered by free cash flows. Recent strategic expansions and share buybacks further strengthen its position in the market.

- Our expertly prepared growth report on MINISO Group Holding implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of MINISO Group Holding.

REV Group (REVG)

Overview: REV Group, Inc. designs, manufactures, and distributes specialty vehicles and related aftermarket parts and services in North America and internationally, with a market cap of approximately $1.92 billion.

Operations: REV Group's revenue segments include the design, manufacturing, and distribution of specialty vehicles and related aftermarket parts and services across North America and international markets.

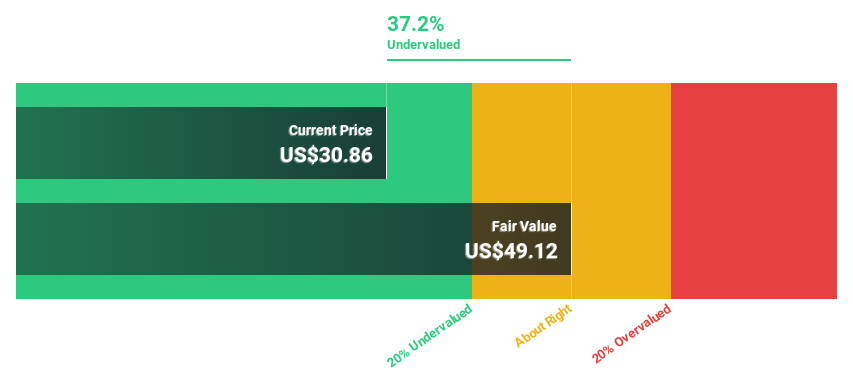

Estimated Discount To Fair Value: 24.4%

REV Group is trading at US$42.94, well below its estimated fair value of US$56.82, suggesting undervaluation based on cash flows. Despite a forecasted revenue growth of 5.9% per year, slower than the market average, earnings are expected to grow significantly at 25.2% annually, surpassing market expectations. Recent earnings guidance was raised with net income projected between US$88 million and US$107 million for 2025 amidst ongoing share buybacks enhancing shareholder value.

- Our earnings growth report unveils the potential for significant increases in REV Group's future results.

- Unlock comprehensive insights into our analysis of REV Group stock in this financial health report.

Make It Happen

- Investigate our full lineup of 160 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives