- United States

- /

- Banks

- /

- NYSE:RNST

3 Stocks Estimated To Be Up To 48.8% Undervalued Offering A 32.6% Discount Opportunity

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 2.7% over the last week and achieving a 13% increase over the past year, with earnings anticipated to grow by 15% annually. In this environment, identifying stocks that are undervalued can present compelling opportunities for investors seeking potential discounts in a growing market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $31.85 | $62.26 | 48.8% |

| TXO Partners (TXO) | $15.28 | $29.91 | 48.9% |

| StoneCo (STNE) | $14.95 | $29.46 | 49.2% |

| Lincoln Educational Services (LINC) | $23.00 | $44.95 | 48.8% |

| Ligand Pharmaceuticals (LGND) | $115.69 | $225.70 | 48.7% |

| Incyte (INCY) | $70.81 | $139.73 | 49.3% |

| GeneDx Holdings (WGS) | $89.59 | $176.72 | 49.3% |

| Fiverr International (FVRR) | $29.18 | $56.98 | 48.8% |

| EQT (EQT) | $58.15 | $114.38 | 49.2% |

| ACNB (ACNB) | $42.97 | $84.59 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

TowneBank (TOWN)

Overview: TowneBank offers retail and commercial banking services to individuals, businesses, and professionals in Virginia and North Carolina, with a market cap of approximately $2.48 billion.

Operations: The company's revenue is primarily generated from its banking segment, contributing $507.70 million, and its insurance segment, adding $101.49 million.

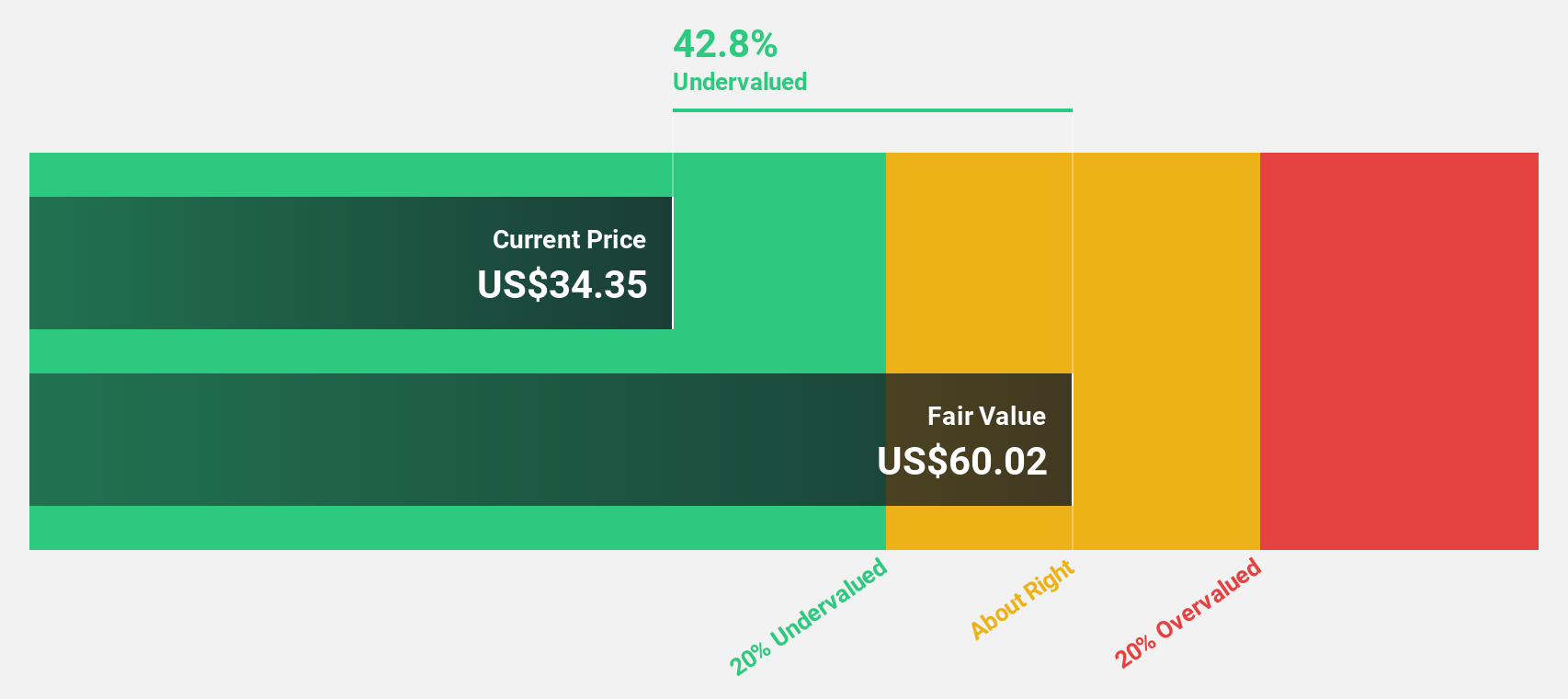

Estimated Discount To Fair Value: 42.6%

TowneBank's stock, trading at US$34.44, is significantly undervalued based on discounted cash flow analysis, with a fair value estimate of US$60.02. Earnings are projected to grow 25.87% annually, surpassing the US market average of 14.7%. Recent first-quarter results show strong performance with net income rising to US$50.59 million from US$34.69 million year-over-year. The company also increased its quarterly dividend by 8%, reflecting financial strength and commitment to shareholder returns.

- Our expertly prepared growth report on TowneBank implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of TowneBank.

WesBanco (WSBC)

Overview: WesBanco, Inc. is a bank holding company for WesBanco Bank, Inc., with a market cap of approximately $2.98 billion.

Operations: The company's revenue is primarily derived from Community Banking, which contributes $559.45 million, and Trust and Investment Services, adding $27.39 million.

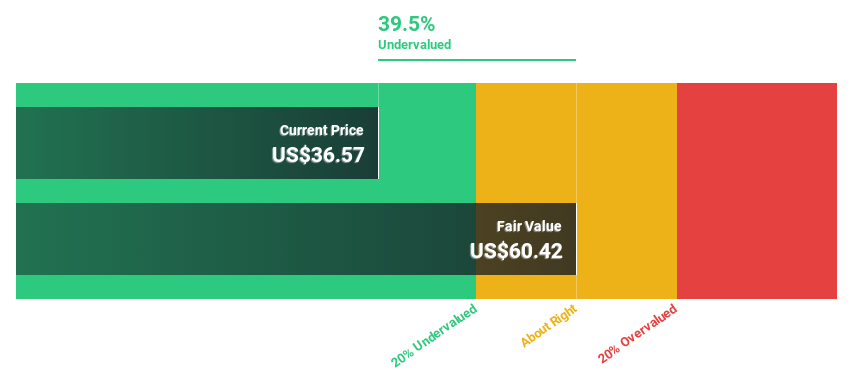

Estimated Discount To Fair Value: 48.8%

WesBanco, trading at US$31.85, is highly undervalued with a fair value estimate of US$62.26 based on discounted cash flow analysis. Despite recent profit margins declining to 17% from 24.7%, earnings are projected to grow significantly at 66.1% annually, far exceeding the US market average of 14.7%. Recent strategic expansions include acquiring Premier Financial Corp., enhancing its regional presence and asset base to over $27 billion across nine states, positioning WesBanco for continued growth amidst evolving market dynamics.

- The analysis detailed in our WesBanco growth report hints at robust future financial performance.

- Get an in-depth perspective on WesBanco's balance sheet by reading our health report here.

Renasant (RNST)

Overview: Renasant Corporation is a bank holding company for Renasant Bank, offering financial, wealth management, fiduciary, and insurance services to retail and commercial clients with a market cap of $3.38 billion.

Operations: The company's revenue segments include $708.08 million from community banking and $27.37 million from wealth management services.

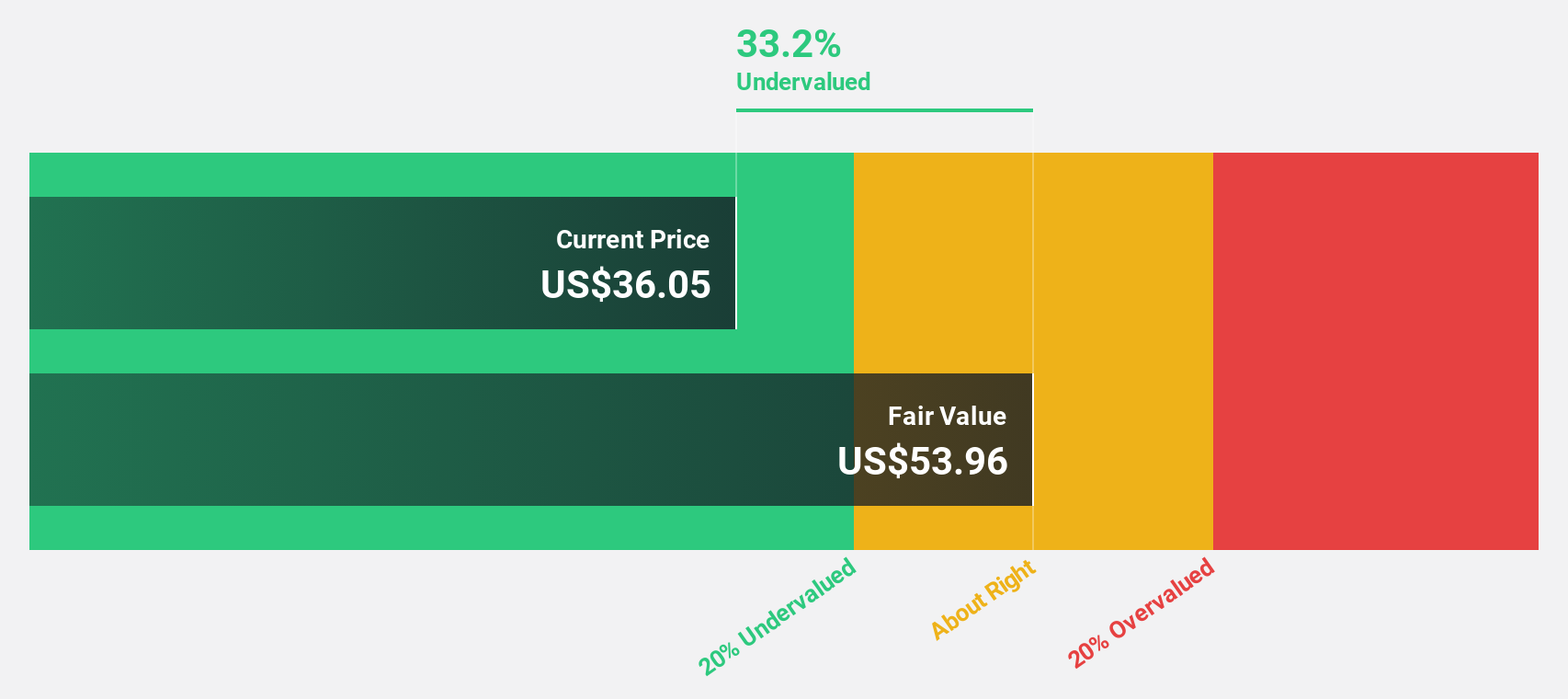

Estimated Discount To Fair Value: 32.6%

Renasant, priced at US$36.38, is significantly undervalued with a fair value estimate of US$53.96 from discounted cash flow analysis. Forecasted revenue growth of 23.7% annually outpaces the US market average, while earnings are expected to grow substantially by 32.41% per year over the next three years. Despite recent shareholder dilution and no share buybacks in early 2025, Renasant maintains a stable dividend yield of 2.42%, with recent leadership changes potentially impacting strategic direction positively.

- Upon reviewing our latest growth report, Renasant's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Renasant with our detailed financial health report.

Where To Now?

- Dive into all 172 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives