- United States

- /

- Software

- /

- NasdaqGS:IREN

3 Stocks Estimated To Be Up To 46.5% Below Intrinsic Value

Reviewed by Simply Wall St

In recent days, major U.S. stock indexes have experienced sharp declines, with technology shares leading the downturn amid concerns about high valuations and broader market volatility. As investors navigate these turbulent times, identifying undervalued stocks can be an effective strategy for those seeking to capitalize on potential market inefficiencies. Understanding intrinsic value is crucial in this environment, as it allows investors to assess whether a stock is trading below its true worth despite current market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zeta Global Holdings (ZETA) | $16.70 | $31.76 | 47.4% |

| WesBanco (WSBC) | $30.06 | $57.77 | 48% |

| TransMedics Group (TMDX) | $122.21 | $231.88 | 47.3% |

| TowneBank (TOWN) | $32.58 | $64.47 | 49.5% |

| So-Young International (SY) | $3.52 | $6.82 | 48.4% |

| SolarEdge Technologies (SEDG) | $31.82 | $63.37 | 49.8% |

| Northwest Bancshares (NWBI) | $11.77 | $22.75 | 48.3% |

| Niagen Bioscience (NAGE) | $6.95 | $13.43 | 48.3% |

| Duolingo (DUOL) | $262.04 | $506.20 | 48.2% |

| CF Bankshares (CFBK) | $23.36 | $45.20 | 48.3% |

Let's review some notable picks from our screened stocks.

Caris Life Sciences (CAI)

Overview: Caris Life Sciences, Inc. is an artificial intelligence TechBio company offering molecular profiling services both in the United States and internationally, with a market cap of $8.42 billion.

Operations: The company generates revenue of $533.85 million from its biotechnology segment.

Estimated Discount To Fair Value: 35.6%

Caris Life Sciences is currently trading at US$31.18, significantly below its estimated fair value of US$48.39, indicating potential undervaluation based on discounted cash flow analysis. With a forecasted revenue growth rate of 22.8% per year, outpacing the broader U.S. market, and expected profitability within three years, Caris shows strong financial prospects. Recent inclusion in multiple Russell indices highlights growing recognition in the investment community despite recent bylaw amendments affecting shareholder proceedings.

- In light of our recent growth report, it seems possible that Caris Life Sciences' financial performance will exceed current levels.

- Dive into the specifics of Caris Life Sciences here with our thorough financial health report.

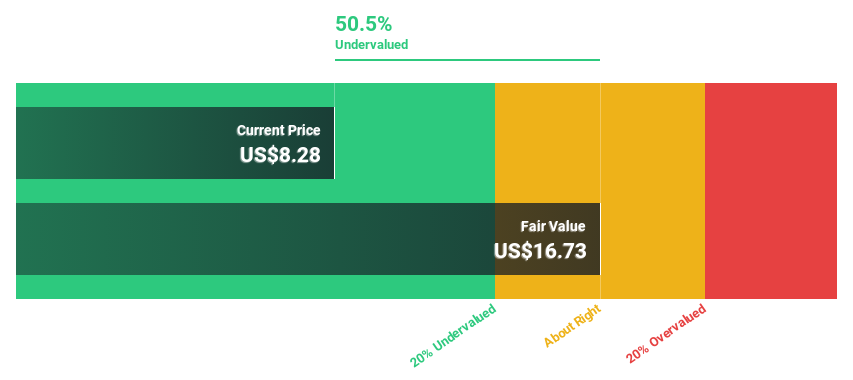

IREN (IREN)

Overview: IREN Limited operates in the vertically integrated data center business across Australia and Canada, with a market cap of $18.26 billion.

Operations: The company's revenue primarily comes from building and operating data center sites for bitcoin mining, generating $501.02 million.

Estimated Discount To Fair Value: 37.4%

IREN Limited is trading at US$66.63, substantially below its estimated fair value of US$106.44, suggesting undervaluation based on discounted cash flow analysis. The company anticipates revenue growth of 30.2% annually, surpassing the U.S. market average, with earnings projected to grow significantly by 62% per year over the next three years. Recent strategic agreements with Microsoft and other AI firms bolster its cash flow potential despite prior shareholder dilution and share price volatility concerns.

- The growth report we've compiled suggests that IREN's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of IREN stock in this financial health report.

Super Group (SGHC) (SGHC)

Overview: Super Group (SGHC) Limited operates as an online sports betting and gaming operator with a market cap of approximately $5.32 billion.

Operations: Super Group (SGHC) Limited generates revenue primarily from its online sports betting and gaming operations.

Estimated Discount To Fair Value: 46.5%

Super Group (SGHC) is trading at US$12.21, significantly below its estimated fair value of US$22.84, highlighting potential undervaluation based on cash flows. The company's recent earnings report showed a substantial increase in net income to US$96 million for Q3 2025, up from US$10 million the previous year. With earnings projected to grow by 32.2% annually, SGHC's strong cash flow prospects are supported by raised revenue guidance for the full year 2025.

- The analysis detailed in our Super Group (SGHC) growth report hints at robust future financial performance.

- Get an in-depth perspective on Super Group (SGHC)'s balance sheet by reading our health report here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 171 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IREN

IREN

Operates in the vertically integrated data center business in Australia and Canada.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives