- United States

- /

- Machinery

- /

- NYSE:CNH

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In November 2025

Reviewed by Simply Wall St

In the current climate of mixed market performance, with the Dow Jones Industrial Average experiencing fluctuations and tech stocks facing valuation concerns, investors are keenly observing opportunities for potential undervalued assets. As we explore three stocks estimated to be trading below their intrinsic value in November 2025, understanding what constitutes a good investment becomes crucial—particularly in identifying companies that may offer strong fundamentals and growth potential despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $125.29 | $250.51 | 50% |

| Warrior Met Coal (HCC) | $78.78 | $155.79 | 49.4% |

| TransMedics Group (TMDX) | $115.01 | $229.86 | 50% |

| Old National Bancorp (ONB) | $20.76 | $41.20 | 49.6% |

| KORU Medical Systems (KRMD) | $4.32 | $8.44 | 48.8% |

| Huntington Bancshares (HBAN) | $15.73 | $31.23 | 49.6% |

| GeneDx Holdings (WGS) | $128.06 | $253.46 | 49.5% |

| First Busey (BUSE) | $23.16 | $45.34 | 48.9% |

| Fifth Third Bancorp (FITB) | $42.57 | $83.60 | 49.1% |

| CNB Financial (CCNE) | $24.98 | $48.73 | 48.7% |

Let's explore several standout options from the results in the screener.

CNH Industrial (CNH)

Overview: CNH Industrial N.V. is an equipment and services company involved in the design, production, marketing, sale, and financing of agricultural and construction equipment across various global regions with a market cap of $12.53 billion.

Operations: The company's revenue segments include $12.20 billion from Industrial Activities - Agriculture, $2.82 billion from Industrial Activities - Construction, and $2.76 billion from Financial Services.

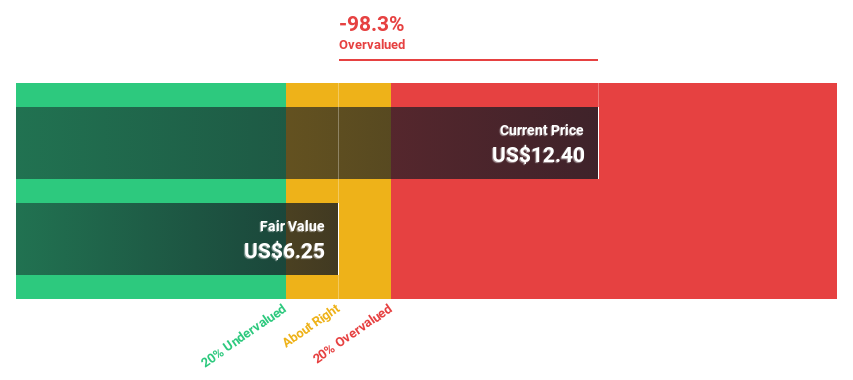

Estimated Discount To Fair Value: 38%

CNH Industrial appears undervalued, trading 38% below its estimated fair value of US$16.20, despite a forecasted 27% annual earnings growth rate outpacing the US market. However, recent earnings show a decline in net income and profit margins compared to the previous year. While cash flow struggles to cover debt adequately, CNH's ongoing share buyback program and strategic product launches like FLEETPRO may support future cash flow improvements.

- According our earnings growth report, there's an indication that CNH Industrial might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of CNH Industrial.

HubSpot (HUBS)

Overview: HubSpot, Inc. offers a cloud-based customer relationship management (CRM) platform to businesses across the Americas, Europe, and the Asia Pacific, with a market cap of approximately $20.76 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, amounting to $2.99 billion.

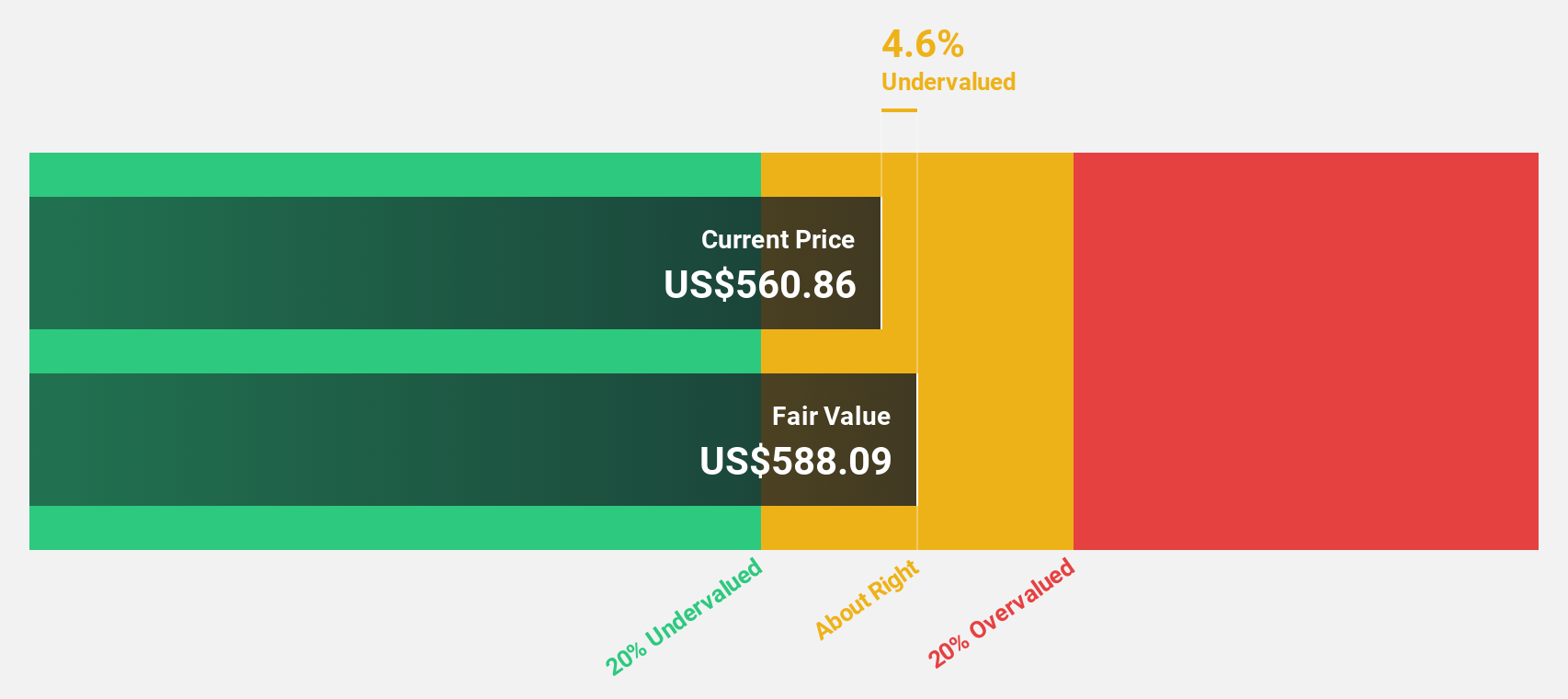

Estimated Discount To Fair Value: 32.6%

HubSpot is trading 32.6% below its estimated fair value of US$588.08, with earnings forecasted to grow significantly over the next three years. Recent guidance indicates robust revenue growth, with full-year revenue expected to reach approximately US$3.11 billion, up 19% year-over-year. Despite a net loss for the nine months ending September 2025, strategic initiatives like AI integration and share buybacks could enhance future cash flow and profitability prospects.

- The analysis detailed in our HubSpot growth report hints at robust future financial performance.

- Take a closer look at HubSpot's balance sheet health here in our report.

On Holding (ONON)

Overview: On Holding AG is involved in the development and distribution of sports products globally, with a market cap of approximately $13.85 billion.

Operations: The company's revenue is primarily generated from its Athletic Footwear segment, which accounts for CHF 2.88 billion.

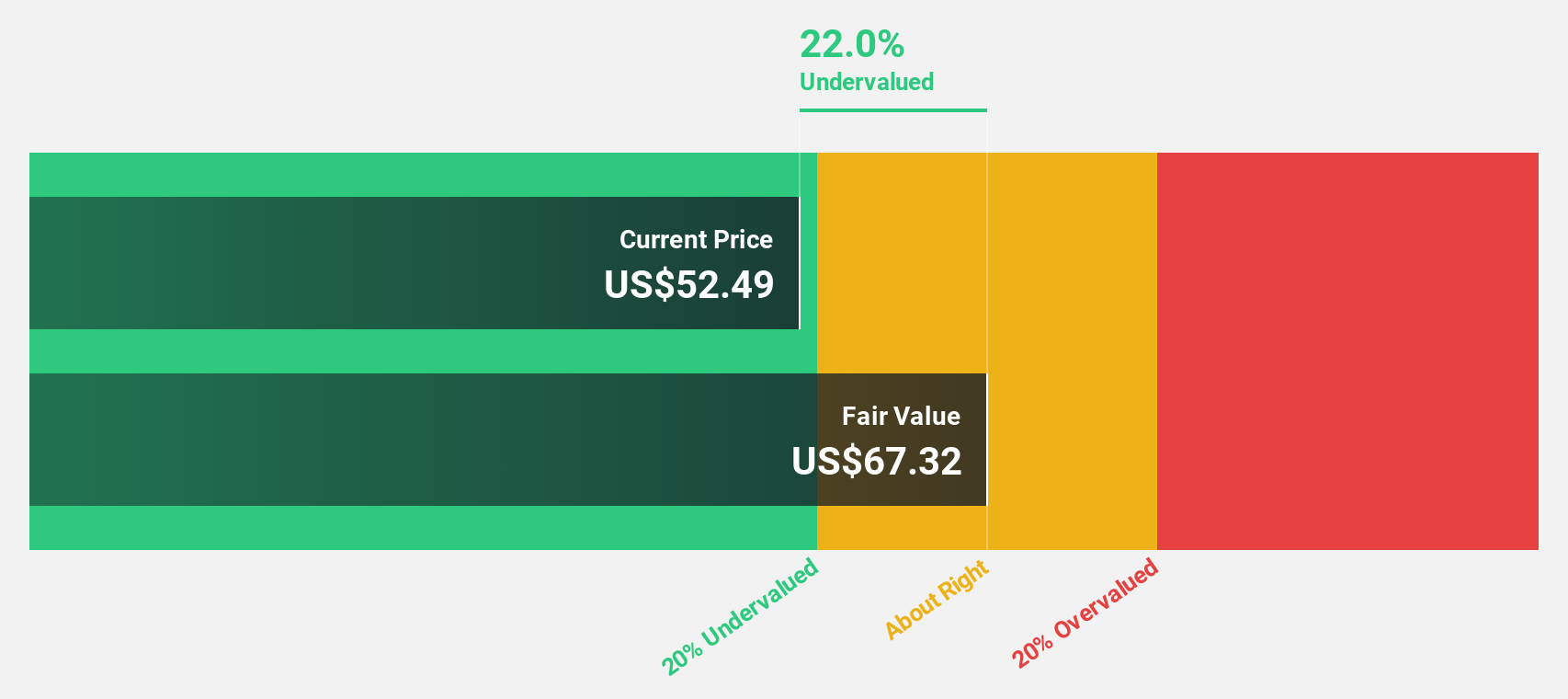

Estimated Discount To Fair Value: 24.7%

On Holding is trading 24.7% below its estimated fair value of US$56.33, with earnings expected to grow significantly over the next three years. Recent earnings reports show strong growth, with Q3 net income at CHF 118.9 million compared to CHF 30.5 million a year earlier and sales reaching CHF 794.4 million from CHF 635.8 million previously. The company has raised its full-year sales guidance to CHF 2.98 billion, reflecting robust revenue expansion prospects.

- Our expertly prepared growth report on On Holding implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of On Holding.

Key Takeaways

- Navigate through the entire inventory of 206 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNH

CNH Industrial

An equipment and services company, engages in the design, production, marketing, sale, and financing of agricultural and construction equipment in North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives