- United States

- /

- Construction

- /

- NYSE:FIX

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 35.5%

Reviewed by Simply Wall St

As the United States stock market reaches record highs, buoyed by a tame inflation report and expectations of an interest rate cut, investors are keenly eyeing opportunities to capitalize on this favorable environment. In such a climate, identifying stocks that may be trading below their intrinsic value can offer potential long-term benefits, as these undervalued assets might provide room for growth when the broader market conditions align positively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.81 | $13.53 | 49.7% |

| Old National Bancorp (ONB) | $21.05 | $42.09 | 50% |

| McGraw Hill (MH) | $12.70 | $25.38 | 50% |

| GeneDx Holdings (WGS) | $128.87 | $248.76 | 48.2% |

| First Busey (BUSE) | $23.48 | $45.91 | 48.9% |

| Fifth Third Bancorp (FITB) | $42.63 | $82.74 | 48.5% |

| Dime Community Bancshares (DCOM) | $27.84 | $55.36 | 49.7% |

| Corpay (CPAY) | $284.38 | $545.71 | 47.9% |

| Constellium (CSTM) | $16.90 | $32.35 | 47.8% |

| Brunswick (BC) | $71.91 | $138.84 | 48.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering various services in countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam; it has a market cap of approximately $23.85 billion.

Operations: The company's revenue is primarily derived from three segments: Mobility ($1.13 billion), Deliveries ($1.64 billion), and Financial Services ($297 million).

Estimated Discount To Fair Value: 24.1%

Grab Holdings is trading at US$5.85, below its estimated fair value of US$7.71, indicating it may be undervalued based on cash flows. The company has become profitable this year and forecasts suggest significant earnings growth of 37.5% annually over the next three years, outpacing the broader U.S. market's expected growth rate. Additionally, Grab's recent partnership with May Mobility to launch autonomous vehicle services in Southeast Asia could enhance future revenue streams and operational capabilities.

- According our earnings growth report, there's an indication that Grab Holdings might be ready to expand.

- Click here to discover the nuances of Grab Holdings with our detailed financial health report.

Comfort Systems USA (FIX)

Overview: Comfort Systems USA, Inc. offers mechanical and electrical installation, renovation, maintenance, repair, and replacement services in the United States with a market cap of $34.55 billion.

Operations: The company generates revenue from two main segments: Electrical Services, which contributed $2.02 billion, and Mechanical Services, which brought in $6.30 billion.

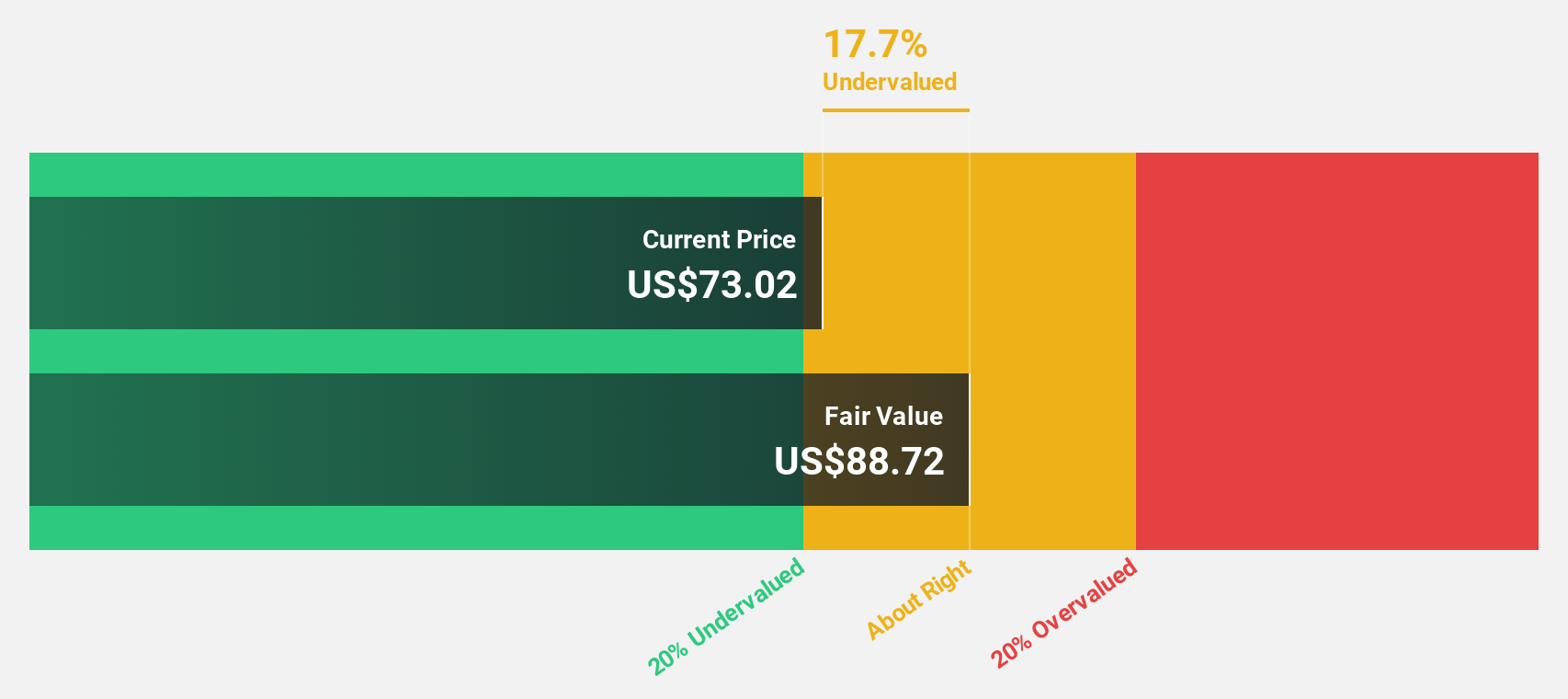

Estimated Discount To Fair Value: 35.5%

Comfort Systems USA is trading at US$981.66, significantly below its estimated fair value of US$1,522.86, highlighting potential undervaluation based on cash flows. Recent earnings reports show robust growth with net income nearly doubling year-over-year to US$291.62 million for Q3 2025. Despite insider selling in the past quarter, revenue is forecasted to grow faster than the U.S. market rate at 12.8% annually, supporting a strong investment thesis amidst recent dividend increases and expanded credit facilities.

- Upon reviewing our latest growth report, Comfort Systems USA's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Comfort Systems USA.

Hexcel (HXL)

Overview: Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials for commercial aerospace, space and defense, and industrial applications with a market cap of approximately $5.79 billion.

Operations: Hexcel's revenue is primarily derived from its Composite Materials segment, which generated $1.58 billion, and its Engineered Products segment, which contributed $381.70 million.

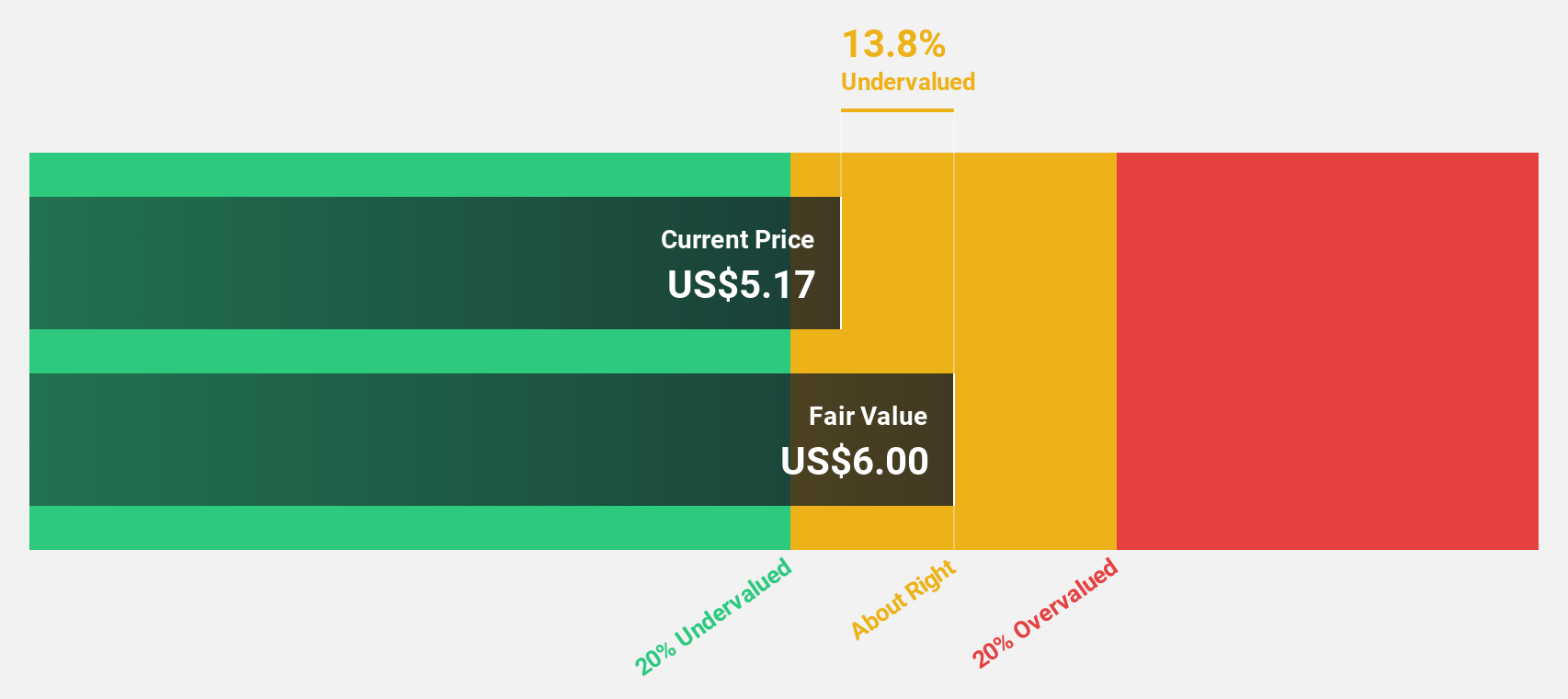

Estimated Discount To Fair Value: 24.6%

Hexcel Corporation, trading at US$72.79, is priced below its estimated fair value of US$96.50, suggesting undervaluation based on cash flows. Despite a decline in net income to US$20.6 million for Q3 2025 and lowered annual sales guidance to US$1.88 billion, earnings are forecasted to grow significantly at 34.7% annually over the next three years, outpacing the broader U.S. market growth rate of 15.5%.

- The analysis detailed in our Hexcel growth report hints at robust future financial performance.

- Navigate through the intricacies of Hexcel with our comprehensive financial health report here.

Seize The Opportunity

- Investigate our full lineup of 182 Undervalued US Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives