- United States

- /

- Luxury

- /

- NYSE:VFC

3 Stocks Estimated To Be Trading At Discounts Of Up To 46%

Reviewed by Simply Wall St

As the U.S. stock market experiences a mix of highs and lows, with the Dow Jones Industrial Average touching record levels while the S&P 500 and Nasdaq face declines, investors are keenly observing potential shifts in monetary policy and economic indicators. Amid this environment of fluctuating indices and anticipation surrounding Federal Reserve actions, identifying stocks that may be trading at a discount becomes particularly compelling for those looking to capitalize on market inefficiencies. In such times, focusing on stocks deemed undervalued can offer opportunities for investors seeking to navigate through uncertainty while potentially benefiting from future market corrections.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.93 | $225.65 | 48.6% |

| StoneCo (STNE) | $14.93 | $28.99 | 48.5% |

| Royal Gold (RGLD) | $166.71 | $330.14 | 49.5% |

| Niagen Bioscience (NAGE) | $9.63 | $18.92 | 49.1% |

| Lyft (LYFT) | $15.57 | $30.96 | 49.7% |

| Granite Ridge Resources (GRNT) | $5.19 | $10.24 | 49.3% |

| Fiverr International (FVRR) | $22.96 | $45.45 | 49.5% |

| First Commonwealth Financial (FCF) | $16.74 | $32.97 | 49.2% |

| First Busey (BUSE) | $23.19 | $45.40 | 48.9% |

| Dime Community Bancshares (DCOM) | $28.56 | $56.47 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Sportradar Group (SRAD)

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services to the sports betting and media industries across various regions including Switzerland, the United States, and several others worldwide, with a market cap of approximately $9.35 billion.

Operations: The company's revenue primarily comes from its Data Processing segment, which generated €1.19 billion.

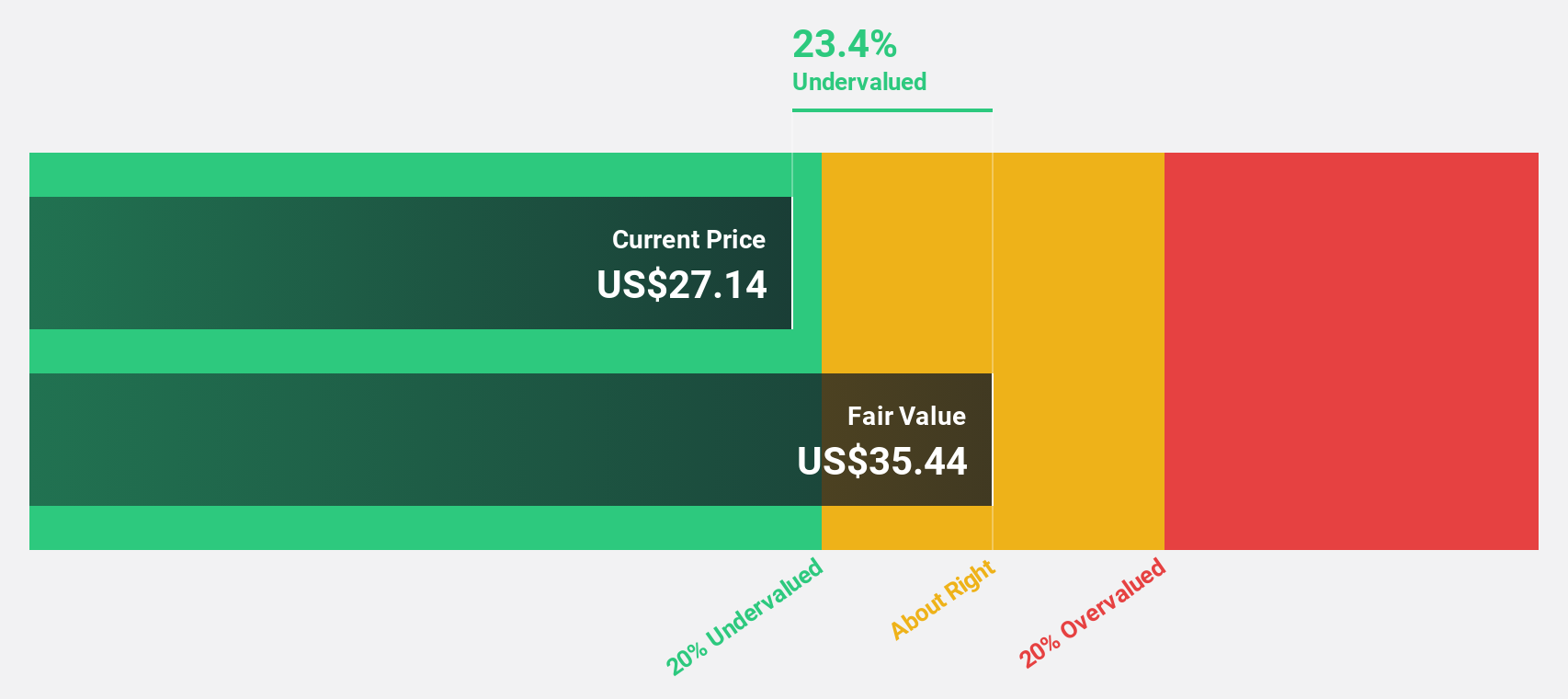

Estimated Discount To Fair Value: 25.9%

Sportradar Group appears undervalued, trading at 25.9% below its estimated fair value of US$40.96. The company has demonstrated strong financial performance, with earnings growing by a very large percentage over the past year and forecasted annual profit growth of 24.5%, outpacing the US market average. Recent partnerships with Bundesliga International and DAZN enhance its offerings in data-driven sports betting, potentially supporting future revenue growth despite a relatively low return on equity forecast of 12.4%.

- Our growth report here indicates Sportradar Group may be poised for an improving outlook.

- Get an in-depth perspective on Sportradar Group's balance sheet by reading our health report here.

McGraw Hill (MH)

Overview: McGraw Hill, Inc. offers information solutions for K-12, higher education, and professional markets both in the United States and internationally, with a market cap of approximately $2.77 billion.

Operations: The company's revenue segments include K-12 at $966.59 million, Higher Education at $805.14 million, International at $194.56 million, and Global Professional at $149.46 million.

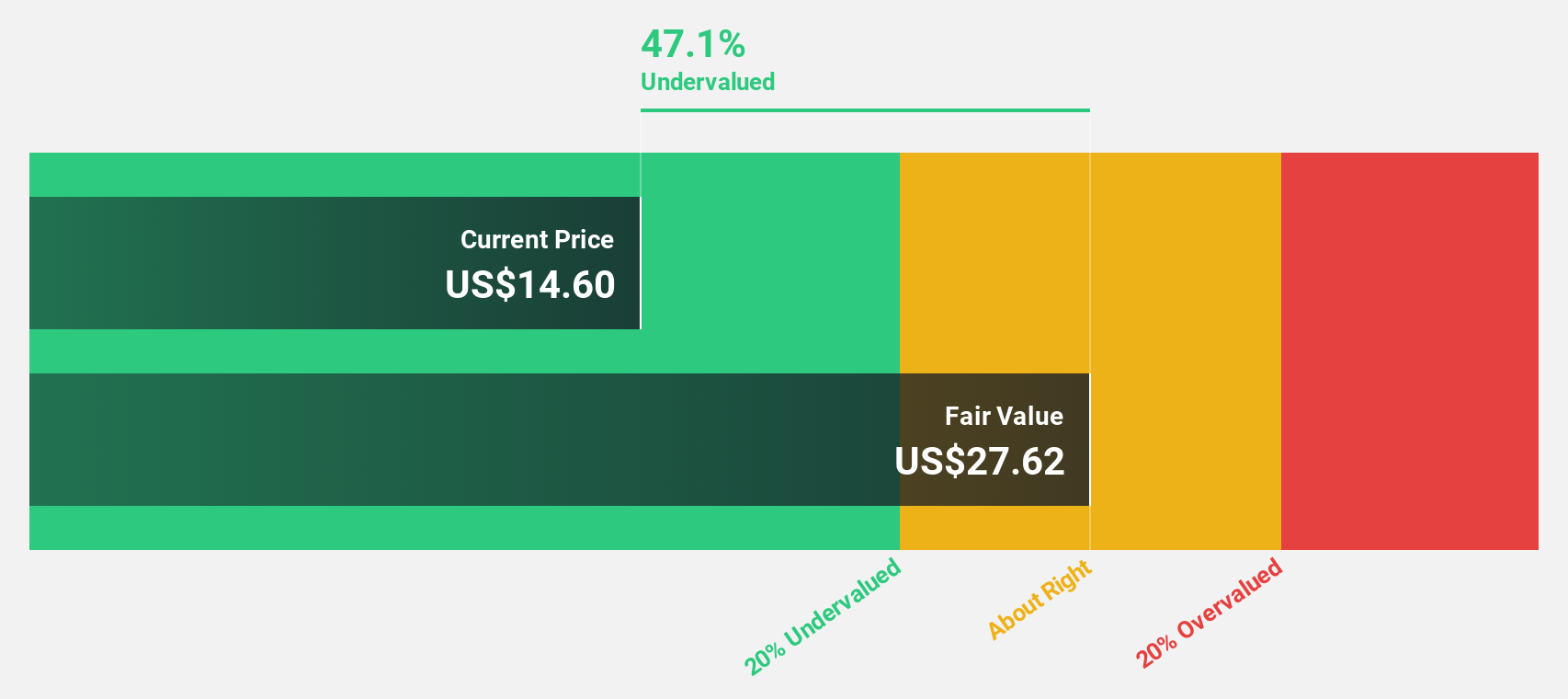

Estimated Discount To Fair Value: 46%

McGraw Hill is trading at 46% below its estimated fair value of US$27.05, highlighting potential undervaluation based on cash flows. The company's recent earnings report shows a turnaround with a net income of US$0.502 million for Q1 2025, compared to a loss last year. While revenue growth is modest at 3.4% annually, the launch of innovative educational products like Emerge! and strategic partnerships could enhance future cash flow stability and profitability prospects.

- Our comprehensive growth report raises the possibility that McGraw Hill is poised for substantial financial growth.

- Click here to discover the nuances of McGraw Hill with our detailed financial health report.

V.F (VFC)

Overview: V.F. Corporation, along with its subsidiaries, provides branded apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific regions with a market cap of approximately $5.13 billion.

Operations: The company's revenue segments include $3.02 billion from Active and $5.64 billion from Outdoor categories.

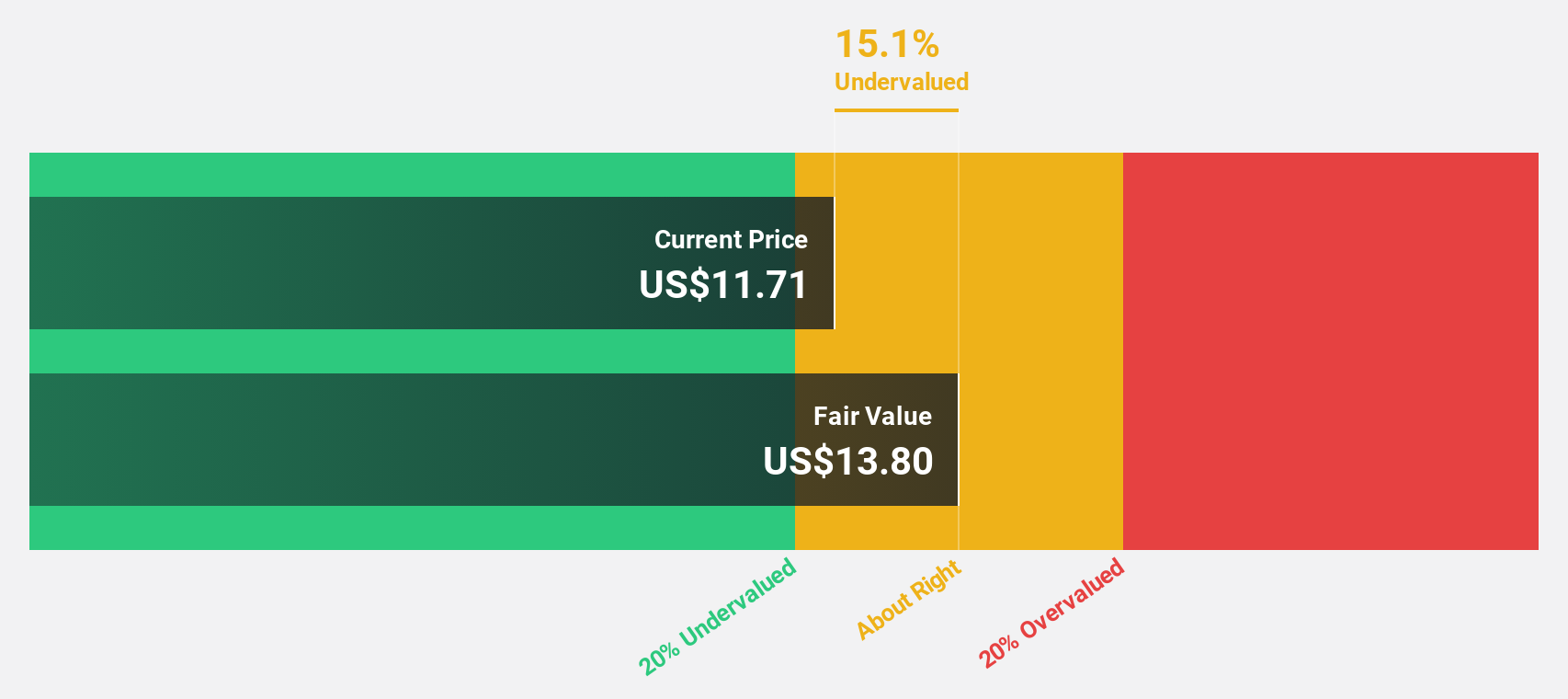

Estimated Discount To Fair Value: 34.8%

V.F. Corporation is trading at 34.8% below its estimated fair value of US$20.1, suggesting undervaluation based on cash flows. Despite a recent net loss of US$116.41 million for Q1 2025, profitability has improved compared to the previous year, and earnings are projected to grow significantly at 32.85% annually over the next three years. However, revenue growth remains modest at 2.9% per year, and debt coverage by operating cash flow is insufficient.

- Insights from our recent growth report point to a promising forecast for V.F's business outlook.

- Dive into the specifics of V.F here with our thorough financial health report.

Taking Advantage

- Get an in-depth perspective on all 196 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives