- United States

- /

- Banks

- /

- NasdaqGS:COLB

3 Reliable Dividend Stocks With Up To 6% Yield

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 1.6% in the last week and up 12% over the past year, with earnings expected to grow by 14% annually in the coming years. In this environment, reliable dividend stocks offering yields of up to 6% can provide a steady income stream while potentially benefiting from overall market growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.94% | ★★★★★☆ |

| Universal (UVV) | 5.41% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.82% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.74% | ★★★★★★ |

| Ennis (EBF) | 5.39% | ★★★★★★ |

| Dillard's (DDS) | 6.46% | ★★★★★★ |

| CompX International (CIX) | 4.99% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.02% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.03% | ★★★★★☆ |

| Chevron (CVX) | 4.88% | ★★★★★★ |

Click here to see the full list of 144 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

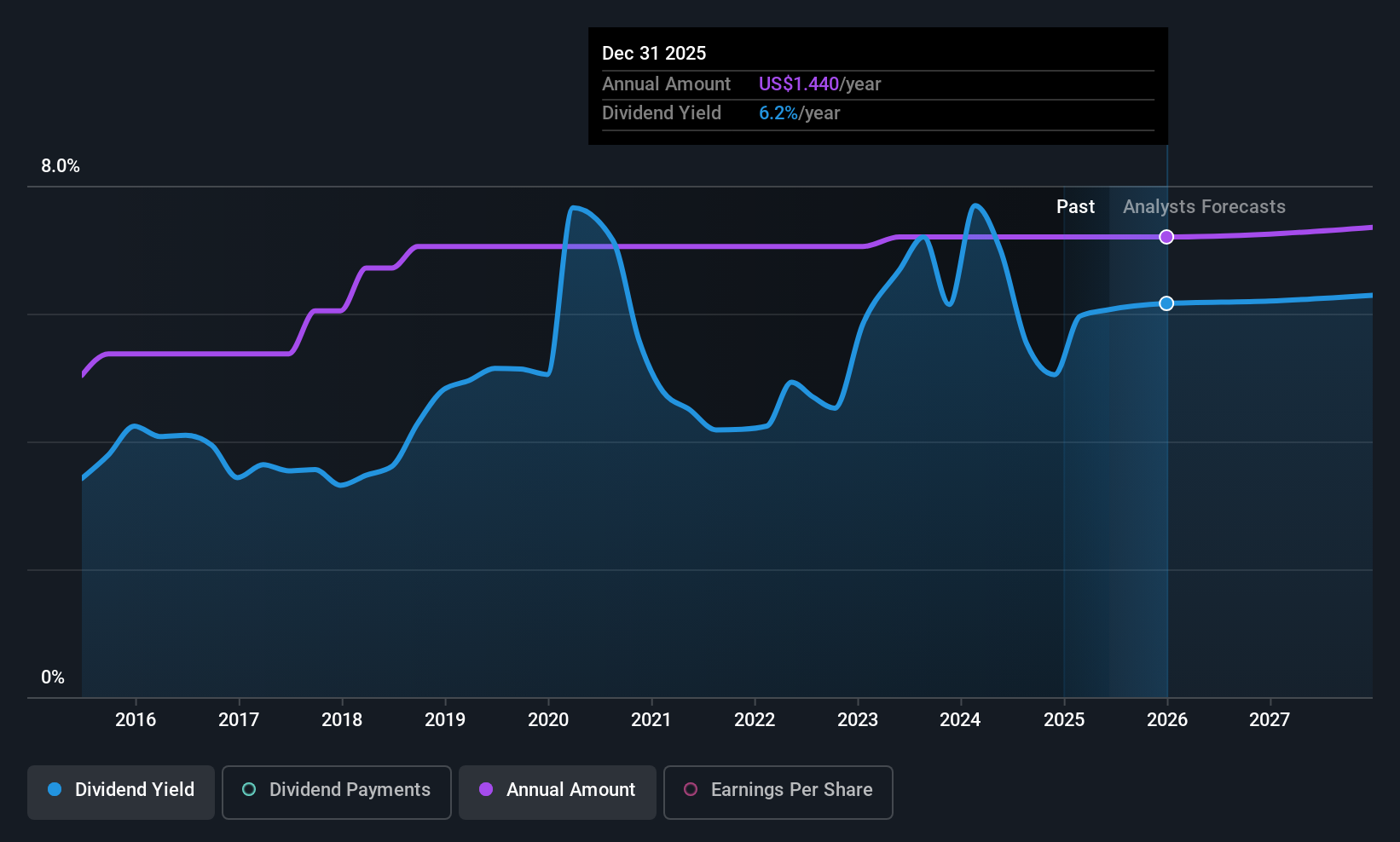

Columbia Banking System (COLB)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Columbia Banking System, Inc. is a bank holding company for Umpqua Bank, offering banking, private banking, mortgage, and financial services in the United States with a market cap of approximately $5.03 billion.

Operations: Columbia Banking System, Inc.'s revenue is primarily derived from its banking segment, which generated $1.83 billion.

Dividend Yield: 6%

Columbia Banking System maintains a stable and attractive dividend yield of 6.02%, ranking in the top 25% of US dividend payers. Despite a recent drop in quarterly net income to US$86.61 million, its dividends remain well-covered by earnings with a payout ratio of 60.5%. Recent board changes reflect post-merger integration success with Umpqua Holdings, potentially strengthening governance under new leadership. The company affirmed its next quarterly dividend at US$0.36 per share, payable June 2025.

- Click to explore a detailed breakdown of our findings in Columbia Banking System's dividend report.

- Our valuation report unveils the possibility Columbia Banking System's shares may be trading at a discount.

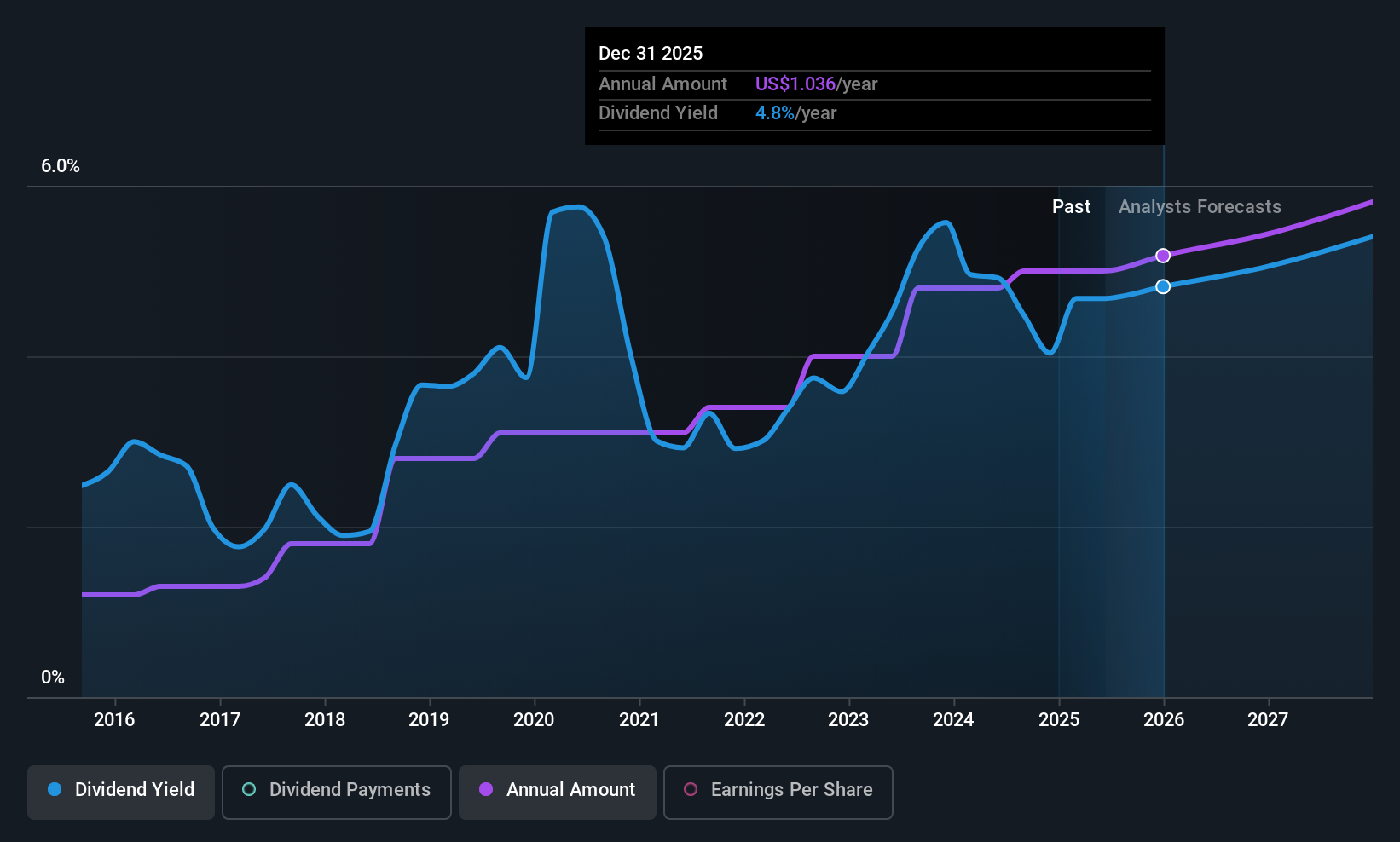

Independent Bank (INDB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Independent Bank Corp. is the bank holding company for Rockland Trust Company, offering commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of $2.72 billion.

Operations: Independent Bank Corp. generates revenue through its Community Banking segment, which amounted to $654.16 million.

Dividend Yield: 3.7%

Independent Bank Corp. offers a reliable dividend yield of 3.7%, though it falls short of the top 25% in the US market. Recent earnings showed net interest income growth to US$145.51 million, despite a slight dip in net income to US$44.42 million. The payout ratio stands at a reasonable 51.8%, indicating dividends are well-covered by earnings, while its stable dividend history over the past decade adds appeal for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Independent Bank.

- Upon reviewing our latest valuation report, Independent Bank's share price might be too pessimistic.

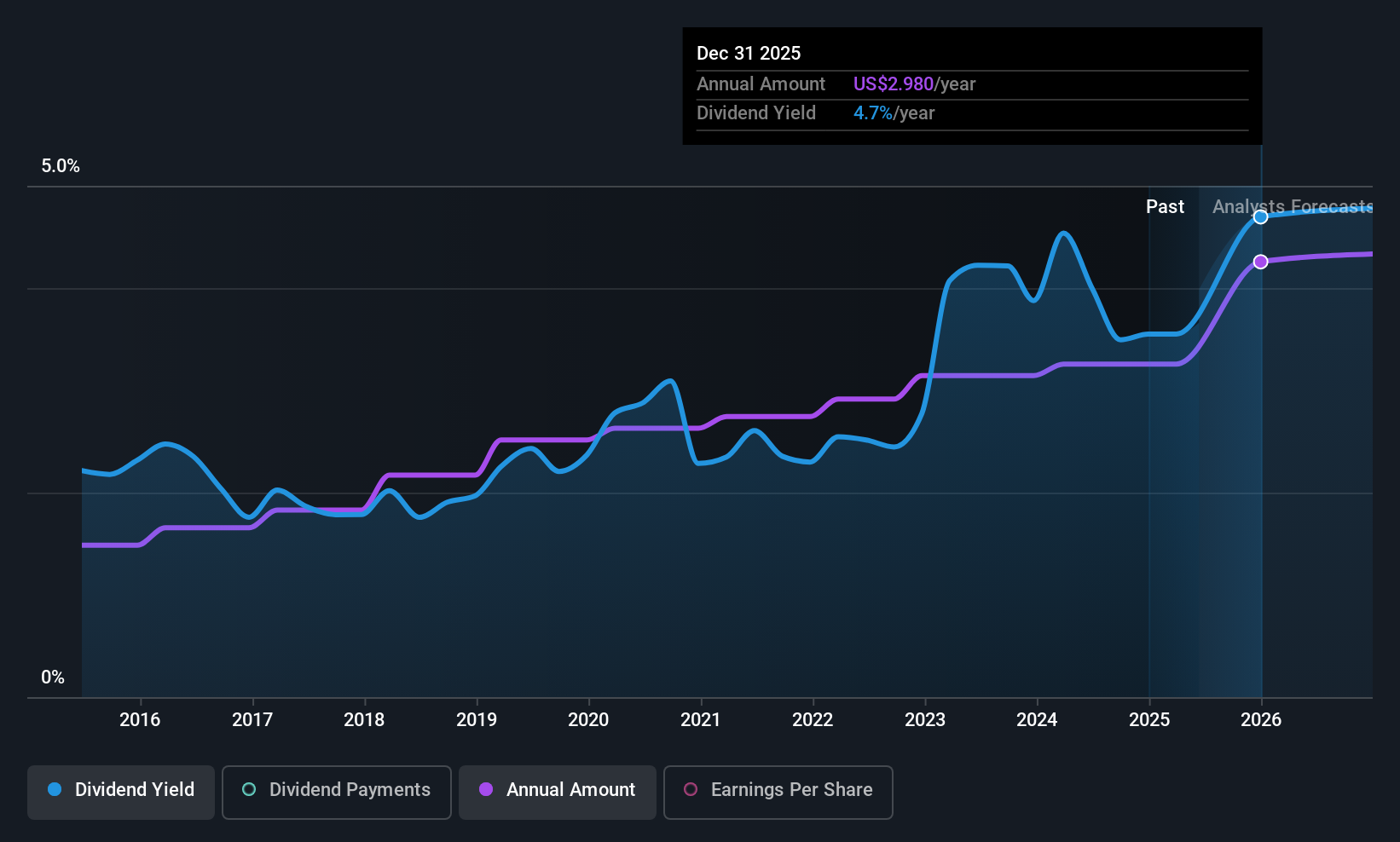

Regions Financial (RF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Regions Financial Corporation is a financial holding company that offers a range of banking and related products and services to individual and corporate customers, with a market cap of approximately $19.82 billion.

Operations: Regions Financial Corporation's revenue is primarily derived from its Consumer Bank segment at $3.62 billion, Corporate Bank segment at $2.35 billion, and Wealth Management segment at $672 million.

Dividend Yield: 4.5%

Regions Financial offers a stable and growing dividend, currently yielding 4.54%, though it trails behind the top 25% of US dividend payers. The company's dividends have been consistent over the past decade, supported by a low payout ratio of 47.6%. Recent earnings showed net income growth to US$490 million, underscoring strong financial health. Strategic leadership changes and share buybacks further bolster its position for sustained dividend reliability.

- Get an in-depth perspective on Regions Financial's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Regions Financial is trading behind its estimated value.

Where To Now?

- Navigate through the entire inventory of 144 Top US Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives