- United States

- /

- Banks

- /

- NasdaqCM:CZFS

3 Reliable Dividend Stocks To Consider With Up To 5.2% Yield

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but over the past 12 months, it has risen by 10%, with earnings expected to grow by 15% per annum in the coming years. In this context of steady growth and potential future earnings increases, reliable dividend stocks can offer a combination of income and stability for investors seeking to benefit from both current yields and long-term prospects.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 5.13% | ★★★★★☆ |

| Universal (UVV) | 5.56% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.13% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.63% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.94% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.17% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 6.52% | ★★★★★★ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.46% | ★★★★★★ |

Click here to see the full list of 152 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Citizens Financial Services (CZFS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Citizens Financial Services, Inc. is a bank holding company offering a range of banking products and services to individual, business, governmental, and institutional customers with a market cap of $274.88 million.

Operations: Citizens Financial Services, Inc.'s revenue is primarily derived from its Community Banking segment, which generated $99.93 million.

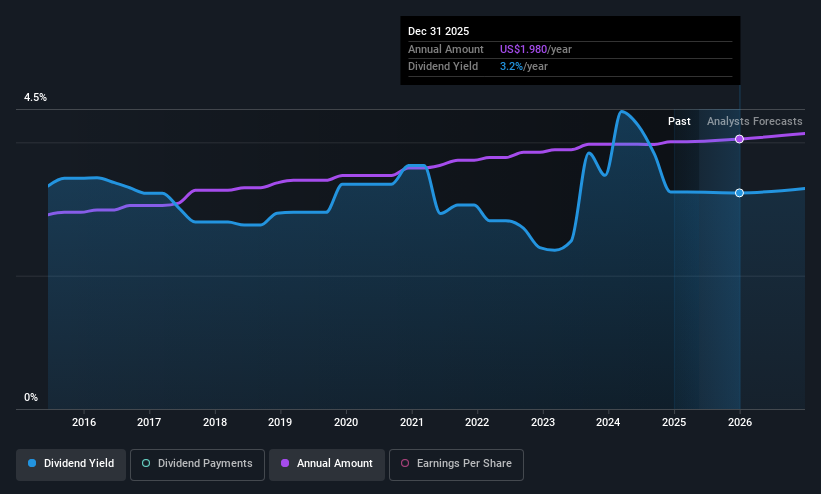

Dividend Yield: 3.4%

Citizens Financial Services offers a stable dividend yield of 3.43%, which, although below the top tier in the US market, has shown consistent growth over the past decade. With a low payout ratio of 32.8%, dividends are well covered by earnings, though future coverage remains uncertain due to insufficient data. Recent announcements affirm a quarterly dividend of US$0.495 per share and highlight steady financial performance with increased earnings and net interest income for Q1 2025.

- Take a closer look at Citizens Financial Services' potential here in our dividend report.

- Our expertly prepared valuation report Citizens Financial Services implies its share price may be lower than expected.

American Eagle Outfitters (AEO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: American Eagle Outfitters, Inc. is a multi-brand specialty retailer operating in the United States and internationally, with a market cap of approximately $1.66 billion.

Operations: American Eagle Outfitters, Inc. generates revenue primarily from its American Eagle segment, which accounts for $3.35 billion, and the Aerie segment, contributing $1.73 billion.

Dividend Yield: 5.2%

American Eagle Outfitters maintains a competitive dividend yield of 5.22%, supported by a payout ratio of 48% and cash payout ratio of 40.8%, ensuring dividends are covered by earnings and cash flows. However, the company's dividend history is volatile, with no growth over the past decade. Recent financial results showed a net loss of US$64.9 million for Q1 2025, leading to withdrawn fiscal guidance due to macroeconomic uncertainties.

- Unlock comprehensive insights into our analysis of American Eagle Outfitters stock in this dividend report.

- Our valuation report here indicates American Eagle Outfitters may be undervalued.

CompX International (CIX)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CompX International Inc. manufactures and sells security products and recreational marine components primarily in North America, with a market cap of $293.43 million.

Operations: CompX International Inc.'s revenue is derived from two main segments: Security Products, contributing $115.59 million, and Marine Components, contributing $32.66 million.

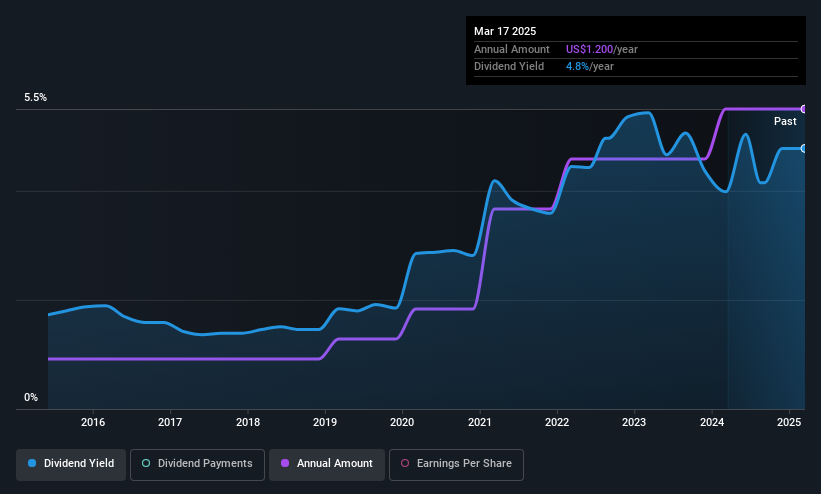

Dividend Yield: 5%

CompX International offers a stable dividend yield of 5.04%, with its dividends reliably covered by earnings and cash flows, evidenced by an 82.3% payout ratio and a 77.1% cash payout ratio. Recent financials show growth, with Q1 net income rising to US$5.13 million from US$3.75 million year-over-year, supporting its dividend stability over the past decade despite no share buybacks in the recent tranche update.

- Navigate through the intricacies of CompX International with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that CompX International is priced lower than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 152 companies within our Top US Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZFS

Citizens Financial Services

A bank holding company, provides various banking products and services for individual, business, governmental, and institutional customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion