- Australia

- /

- Specialty Stores

- /

- ASX:SUL

3 ASX Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

The Australian market has been experiencing a mix of modest gains and losses, with the ASX 200 (XJO) closing slightly in the green recently, driven by strong performances in materials while financials lagged. In such a fluctuating environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking to navigate current market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 5.81% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.93% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.86% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.22% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.42% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.80% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.03% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.75% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.05% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.95% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

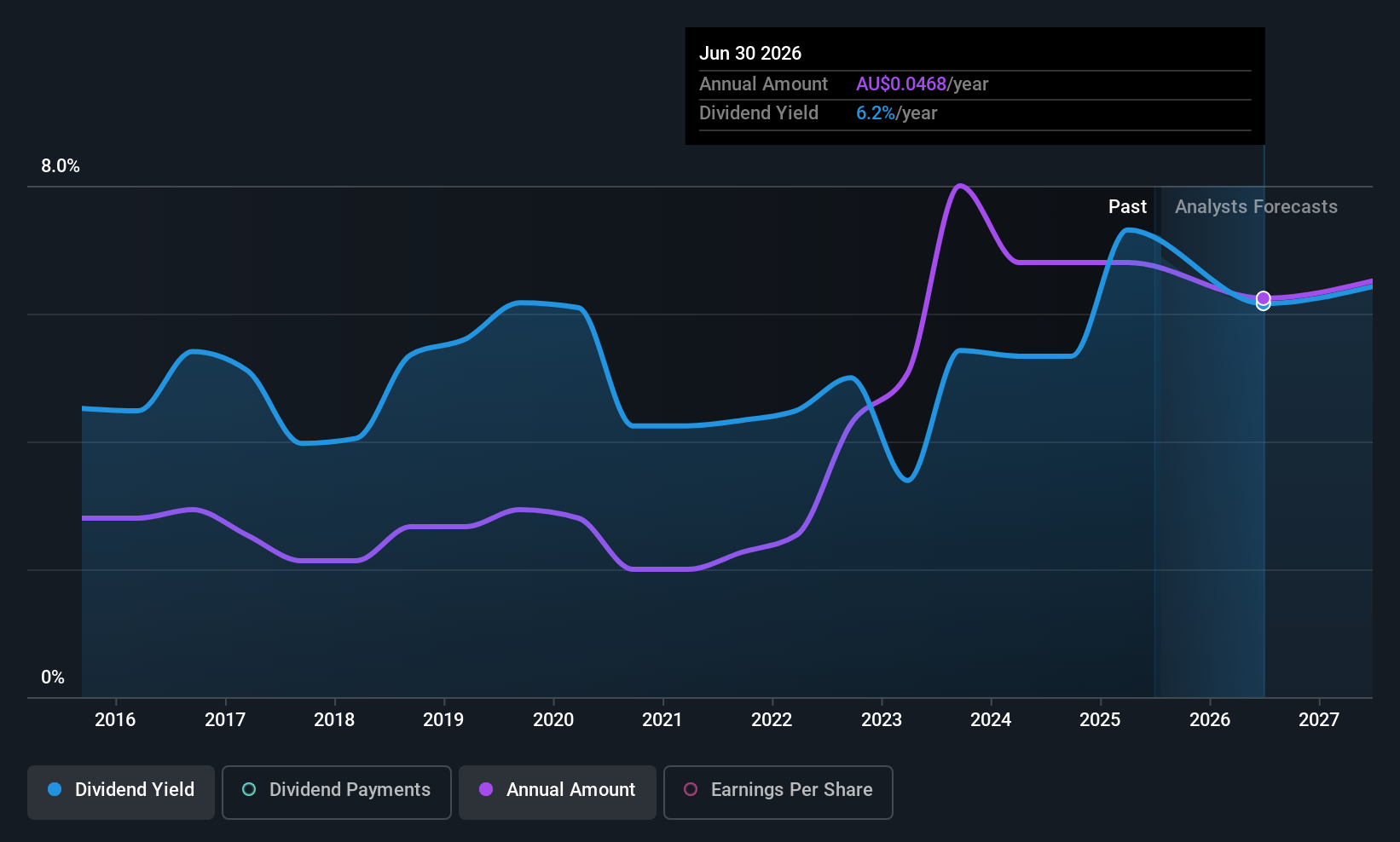

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited operates in the transport, logistics, and rural supply sectors serving food processing, food services, fresh produce, and horticulture industries in Australia with a market cap of A$229.19 million.

Operations: Lindsay Australia Limited generates revenue through its key segments: Transport (A$586.41 million), Rural (A$168.12 million), and Hunters (A$110.37 million).

Dividend Yield: 6%

Lindsay Australia's dividend payments, while offering a yield in the top 25% of the Australian market at 6.03%, have been historically volatile and recently decreased to A$0.015 per share. Despite this, dividends are well-covered by both earnings and cash flows with payout ratios of 68.8% and 25.9%, respectively, suggesting sustainability from a financial standpoint. However, shareholders experienced dilution over the past year, impacting overall returns despite trading below fair value estimates by nearly half.

- Take a closer look at Lindsay Australia's potential here in our dividend report.

- Our expertly prepared valuation report Lindsay Australia implies its share price may be lower than expected.

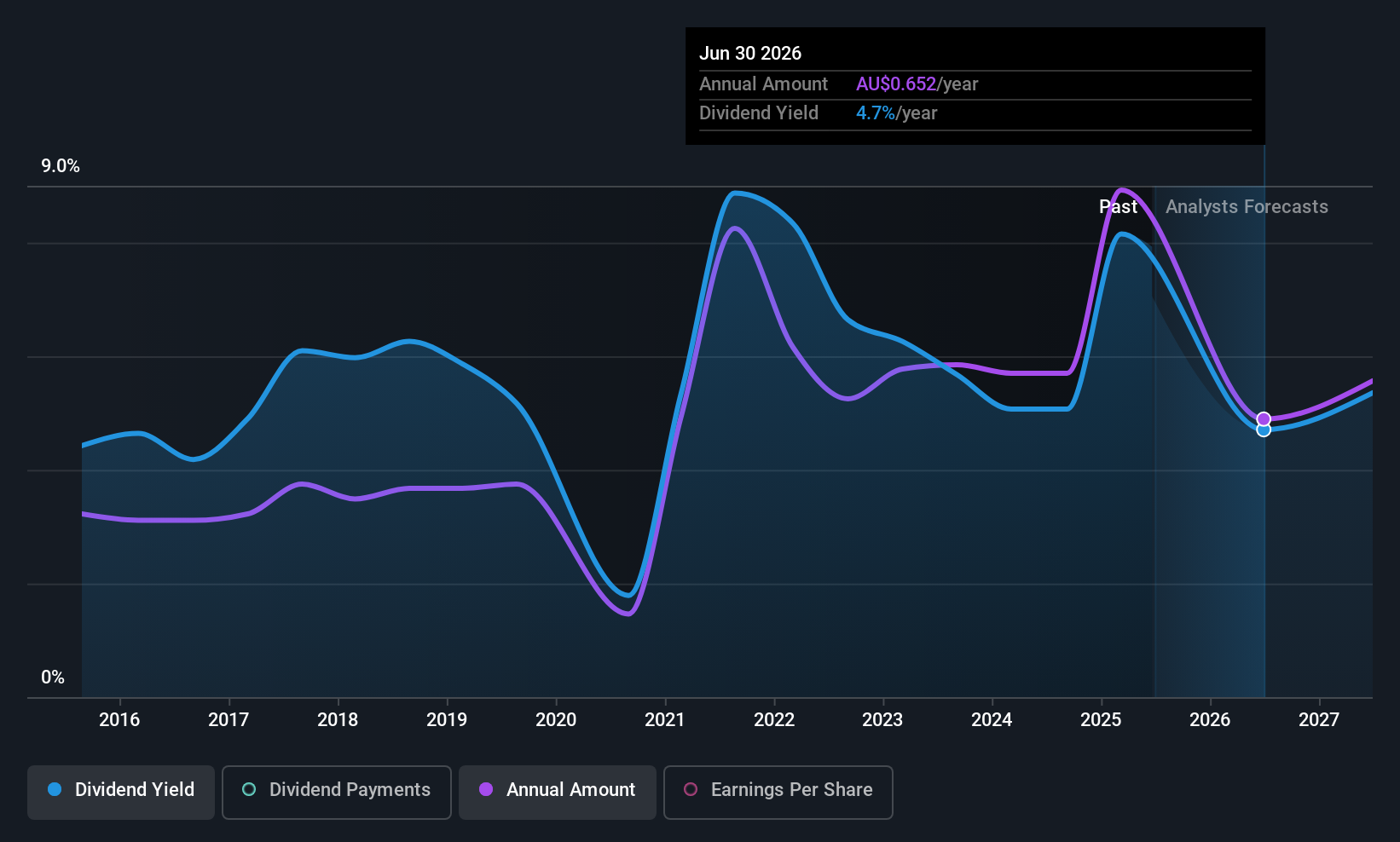

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand, with a market cap of A$3.66 billion.

Operations: Super Retail Group Limited's revenue segments include Rebel at A$1.36 billion, Macpac at A$231.40 million, Super Cheap Auto (SCA) at A$1.53 billion, and Boating, Camping and Fishing (BCF) at A$950.70 million in Australia and New Zealand.

Dividend Yield: 5.9%

Super Retail Group's dividend yield of 5.93% ranks it in the top 25% of Australian dividend payers, although its historical volatility raises concerns about reliability. Recently, the company announced a special dividend of A$0.30 per share alongside a regular one at A$0.34 per share, both well-covered by earnings and cash flows with payout ratios of 67.2% and 52.7%, respectively. However, recent executive changes may introduce uncertainty for investors focused on stability.

- Click to explore a detailed breakdown of our findings in Super Retail Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Super Retail Group shares in the market.

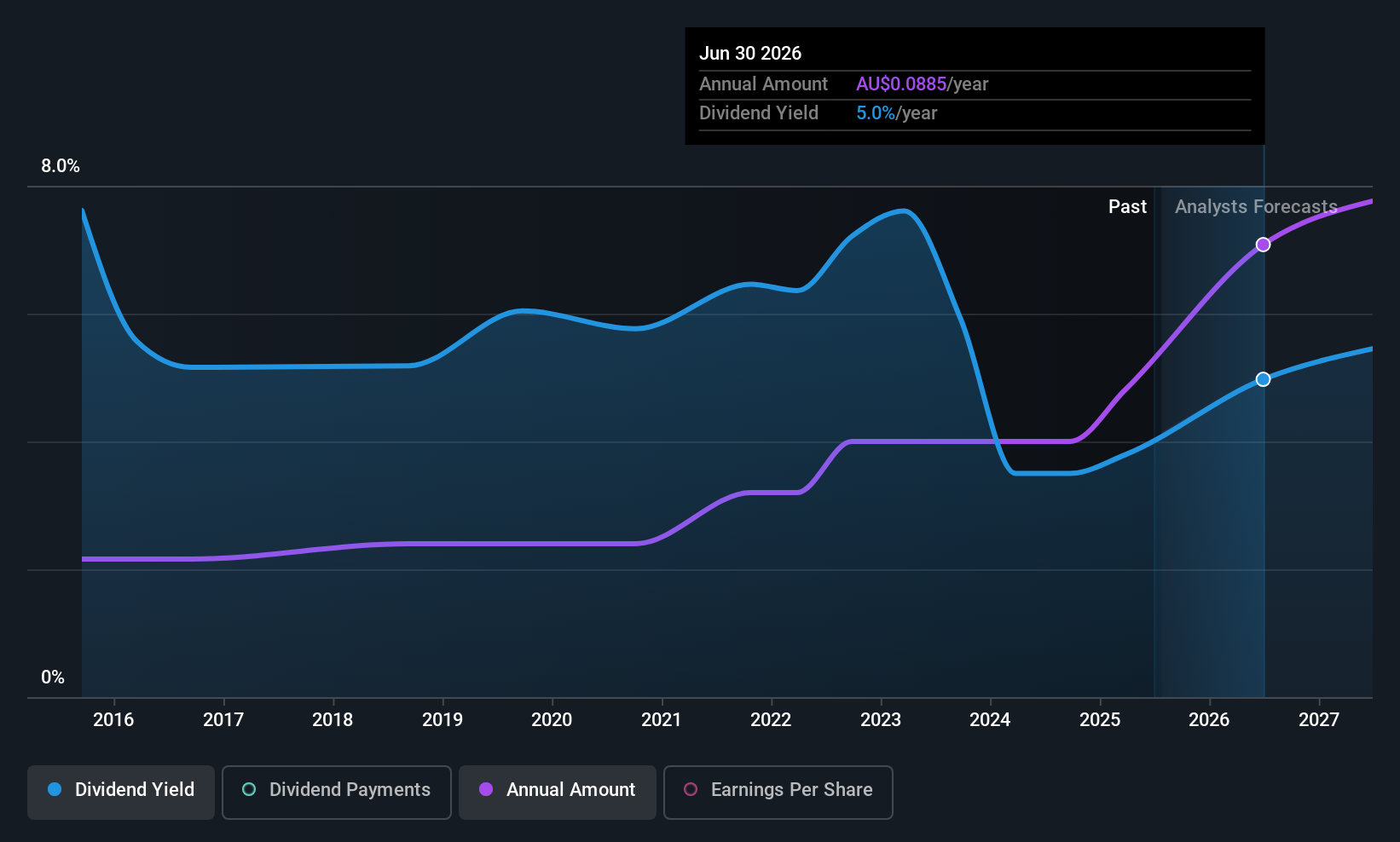

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, with a market cap of A$584.34 million, offers electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Operations: Southern Cross Electrical Engineering Limited generates revenue primarily from the provision of electrical services, amounting to A$801.45 million.

Dividend Yield: 3.4%

Southern Cross Electrical Engineering's dividend yield of 3.41% is lower than the top Australian dividend payers, and its historical volatility suggests unreliability. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 62.5% and 33.3%, respectively. Recent earnings growth of A$801.45 million in sales and A$31.67 million in net income indicates financial health, while ongoing acquisition strategies may enhance future capabilities and diversification for investors seeking long-term value growth.

- Get an in-depth perspective on Southern Cross Electrical Engineering's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Southern Cross Electrical Engineering's share price might be too pessimistic.

Taking Advantage

- Take a closer look at our Top ASX Dividend Stocks list of 30 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUL

Super Retail Group

Engages in the retail of auto, sports, and outdoor leisure products in Australia and New Zealand.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)