3 Asian Stocks Estimated To Be Trading Below Intrinsic Value By Up To 27.8%

Reviewed by Simply Wall St

Amidst the complex interplay of trade policies and economic strategies, Asian markets have experienced varied performances, with some regions showing resilience while others face challenges. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies. Understanding what makes a stock potentially undervalued involves assessing its financial health, growth prospects, and market position relative to current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.04 | CN¥76.73 | 49.1% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.88 | HK$1.75 | 49.7% |

| Livero (TSE:9245) | ¥1701.00 | ¥3361.77 | 49.4% |

| Kanto Denka Kogyo (TSE:4047) | ¥843.00 | ¥1677.35 | 49.7% |

| J&T Global Express (SEHK:1519) | HK$6.77 | HK$13.35 | 49.3% |

| Good Will Instrument (TWSE:2423) | NT$43.80 | NT$87.36 | 49.9% |

| GEM (SZSE:002340) | CN¥6.11 | CN¥12.00 | 49.1% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.63 | CN¥52.45 | 49.2% |

| cottaLTD (TSE:3359) | ¥430.00 | ¥858.34 | 49.9% |

| BalnibarbiLtd (TSE:3418) | ¥1165.00 | ¥2295.31 | 49.2% |

Here's a peek at a few of the choices from the screener.

MicroPort NeuroScientific (SEHK:2172)

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally, with a market cap of HK$7.06 billion.

Operations: The company generates revenue of CN¥761.76 million from its Surgical & Medical Equipment segment.

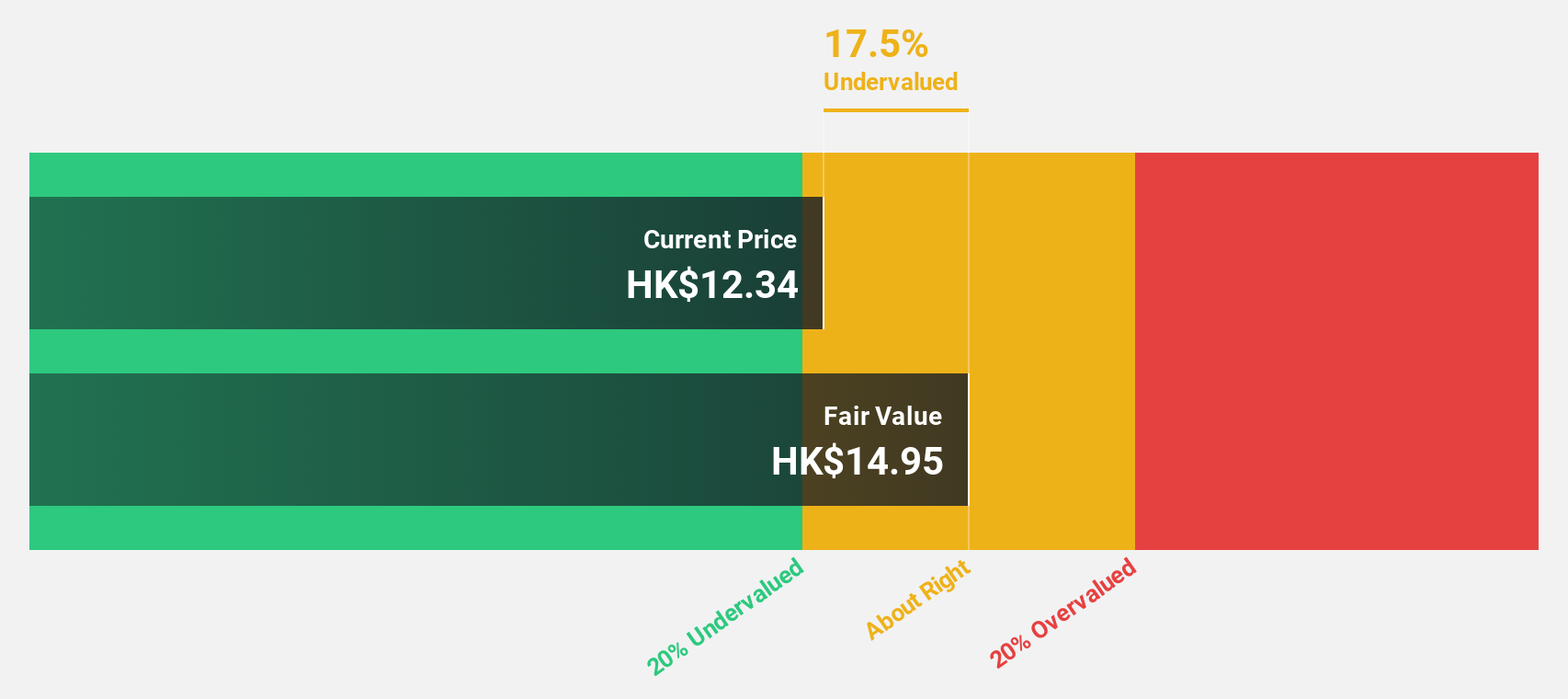

Estimated Discount To Fair Value: 18.1%

MicroPort NeuroScientific appears undervalued based on cash flows, trading at HK$12.26 below its fair value estimate of HK$14.97. Its earnings grew by 74.6% last year, with future earnings expected to grow significantly at 21.5% annually, surpassing the Hong Kong market's growth rate of 10.4%. Recent financials show net income increased to CNY 254.17 million from CNY 145.55 million, reflecting robust profitability despite a forecasted low return on equity of 17.3%.

- Our comprehensive growth report raises the possibility that MicroPort NeuroScientific is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of MicroPort NeuroScientific.

Auras Technology (TPEX:3324)

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across various international markets, with a market cap of NT$54.89 billion.

Operations: The company generates revenue of NT$17.04 billion from its Electronic Components & Parts segment.

Estimated Discount To Fair Value: 27.8%

Auras Technology is trading at TWD 608, significantly below its estimated fair value of TWD 841.98, highlighting its undervaluation based on cash flows. The company reported strong earnings growth of 48.7% last year and forecasts suggest continued robust profit growth at 25.5% annually, outpacing the Taiwan market's average. Despite recent share price volatility, Auras maintains a high return on equity forecast of 30.4%, with revenue expected to grow by 21.8% annually over the next three years.

- Our earnings growth report unveils the potential for significant increases in Auras Technology's future results.

- Unlock comprehensive insights into our analysis of Auras Technology stock in this financial health report.

Rakus (TSE:3923)

Overview: Rakus Co., Ltd., along with its subsidiaries, offers cloud services in Japan and has a market cap of ¥411.24 billion.

Operations: The company's revenue segments include the Cloud Business, generating ¥41.86 billion, and the IT Outsourcing Business, contributing ¥7.06 billion.

Estimated Discount To Fair Value: 22.4%

Rakus is trading at ¥2,281, which is 22.4% below its estimated fair value of ¥2,940.11, underscoring its undervaluation based on cash flows. The company has demonstrated strong earnings growth of 91.2% over the past year and forecasts suggest continued robust profit growth at 23.6% annually, surpassing the JP market's average. Recent share buybacks totaling ¥1,999.85 million aim to enhance capital efficiency and return profits to shareholders.

- In light of our recent growth report, it seems possible that Rakus' financial performance will exceed current levels.

- Dive into the specifics of Rakus here with our thorough financial health report.

Key Takeaways

- Delve into our full catalog of 302 Undervalued Asian Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3923

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives