TL;DR

For me, Adobe is the quintessential falling knife. I’ll buy if it drops further — not because I believe in a renaissance, but because fortress-like margins and sticky workflows can keep this wounded giant on its feet. One-night vibe-coded apps won't easily replace the Adobes, Salesforce, Atlassian, and Hubspot out there.

Adobe feels like an aging heavyweight — still powerful, but fighting a new kind of match where the rules are being rewritten. The real question is whether it can pull a Microsoft-style reinvention, or drift into IBM territory, slow and dignified but irrelevant.

Long term, I wouldn’t sleep easy: defending premium pricing against fast-iterating players in a world where generative AI is commoditising creativity will be a tough battle. Canva isn’t just “competition”; it’s teaching a whole generation that design isn’t a profession locked inside Photoshop. That’s the kind of disruption even fortress margins can’t wall off forever.

The good

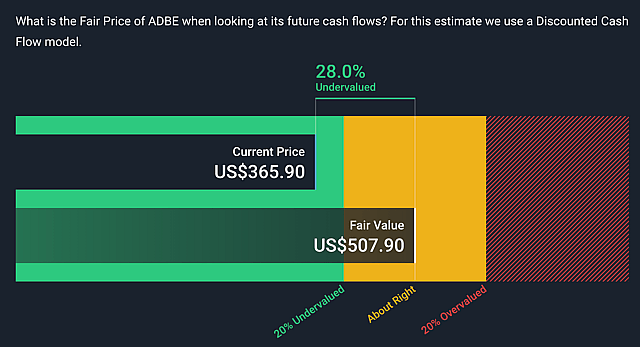

- Discounted cash flow analysis gives a price of $510, 28% above the current stock price.

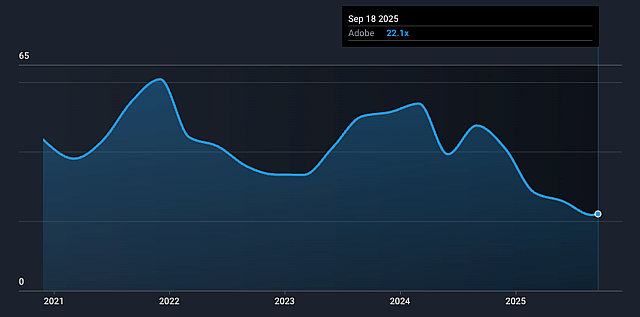

- P/E is 22.4x, way below other SaaS peers like Salesforce (34.9x) or Intuit (48.6x). Also, below the software industry in the US that has an average P/E of 34.9x

- 2025 Q3 EPS and Revenue exceed estimates - just slightly

- Analyst Price Target average is ~ $456, also showing uplift potential. Although analysts are not within a statistically confident range of agreement.

- Adobe is already working on a suite of AI-native products with a clear monetisation framework. The company's AI-influenced ARR has surged past $5 billion, a significant increase from over $3.5 billion at the end of fiscal 2024. Critically, the ARR from new, AI-first products (such as standalone Firefly and Acrobat AI Assistant) surpassed its full-year target of $250 million a quarter ahead of schedule, demonstrating robust demand for these new offerings.

- The AI Product Suite: The company's AI offerings are anchored by three core pillars. Adobe Firefly is a family of creative generative AI models for generating images, video, audio, and vector graphics

- Acrobat AI Assistant transforms static documents into interactive knowledge hubs, allowing users to query and summarise information within PDFs. For enterprise customers

- GenStudio for Performance Marketing provides an AI-powered application for marketing teams to generate on-brand ads and emails at scale.

- Features like Generative Fill in Photoshop and Text to Vector Graphic in Illustrator are embedded directly within the applications that professionals have used for decades. This creates an unparalleled workflow efficiency and a sticky ecosystem that standalone AI image generators cannot easily replicate

The bad

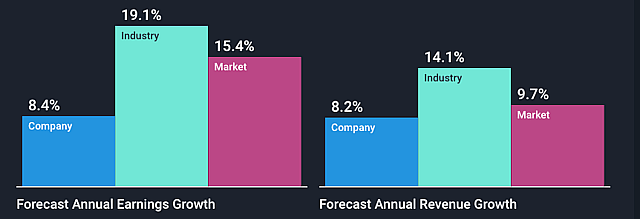

- Growth has been slowing down, and it's below the industry and market average

- Already has high margins (gross ~88%, operating ~36%, FCF ~40%), with little room for further expansion. So EPS upside depends on revenue expansion.

- Growth rates declined over the past years: 17.3% for 2021, 13.4% for 2022, 12.7% for 2023, and 10.9% for 2024 (Adobe’s investor reports)

- The largest risk is rapid commoditization from generative AI, with tools from OpenAI, Google, X, and others threatening Adobe’s high pricing power and lock-in. If these alternatives take share, Adobe’s moat and margins may erode sharply.

- Low-end (SMB) disruption (Canva, Figma) is already trimming new user growth at the entry tier, impairing expansion into new markets.

- The last short-term risk is the FTC Lawsuit filed by the U.S. Federal Trade Commission against Adobe. The suit alleges that the company's primary "Annual, Paid Monthly" subscription plan involves deceptive practices, specifically by obscuring the substantial early termination fee and creating a burdensome cancellation process. The complaint, which cites internal communications referring to the termination fee as "a bit like heroin for Adobe," carries significant reputational and financial risk, leading to higher churn and reduced revenue predictability.

Conclusion

The current market valuation appears to underappreciate the durability of Adobe's competitive moat and the long-term monetisation potential of AI deeply integrated within mission-critical professional workflows. Growth is still there, and Adobe sits on a monopoly that’s not easy to overtake.

Adobe must rapidly innovate, double down on deep Creative Cloud integration, and focus on its professional user base’s nuanced needs to preserve its lead. It remains a high-quality, very efficient business, but its historically premium multiple is only justified if it can prove AI is an opportunity, not a threat, in the next few years

With Adobe’s FV estimated at 20–22x Future PE, Profit Margins stable at 30%, and Revenue growth at 9%, the price target is approximately $430. The market has already discounted the risk of slower growth and disruption, but if Adobe executes on AI monetisation and sustains 8–10% growth, modest upside remains; if growth drops below 7%, then this narrative thesis won't hold.

Sources:

- https://simplywall.st/stocks/us/software/nasdaq-adbe/adobe

- https://www.adobe.com/cc-shared/assets/investor-relations/pdfs/11905202/cu564stre3e.pdf

- https://x.com/zephyr_z9/status/1967341335649644905?s=46&t=GE4041CXag1eZS5UZPvBCA

- https://www.nasdaq.com/articles/adobe-reports-record-q3-revenue

- https://www.ftc.gov/news-events/news/press-releases/2024/06/ftc-takes-action-against-adobe-executives-hiding-fees-preventing-consumers-easily-cancelling

- https://www.webull.com/news/13499540499944448

Have other thoughts on Adobe?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

TechStonks is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. TechStonks holds no position in NasdaqGS:ADBE. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.