Key Takeaways

- Adopting new technology like AI, AR/VR and browser-first cloud software will keep Adobe on top of the creative industry.

- AI Integration will empower commercial users and help onboard new users by making workflows simpler.

- The Experience Cloud will experience a positive feedback loop, the value it creates for customers will drive ARPU.

- I believe that the pending Figma acquisition will be closed successfully.

Catalysts

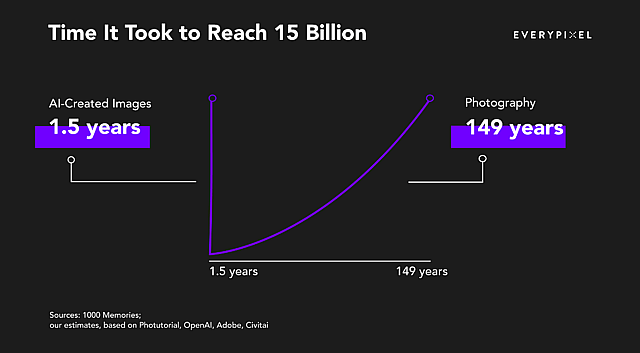

AI integration will increase the addressable market and therefore future revenues

Currently, one of the biggest restrictions on Adobe’s growth is it’s relatively shallow Total Addressable Market (TAM). As it stands, Adobe’s products tend to favor the power-user or professional. Adobe Photoshop, Illustrator, Premier Pro etc. all cater to users that have a profound knowledge of the tools they’re using because they tend to be more complex. It’s not worth the time for an individual or beginner to purchase an Adobe license because the products are ‘overkill’ and too complex for many individual user’s use cases which can be met by more user-friendly applications like Canva.

This is where AI steps in. For years, Adobe have already been implementing various AI features in its products through Adobe Sensei such as Neural Filters in Photoshop, Liquid Mode in Acrobat and automatic filter adjustment in Adobe Lightroom. As a personal anecdote, I am an avid user (and subscriber) of Adobe Lightroom CC, have already found these AI tools to be infinitely helpful in cutting down the time I need to spend editing photo. I have also felt like it’s also provided a unique learning opportunity, where I’ve observed the adjustments the AI has made and applied these same principles in manual editing.

The next big step for Adobe came with the introduction of Firefly, its first foray into Generative AI. Adobe Firefly works as a co-pilot to help navigate and achieve some incredibly complex tasks at the push of a button, bringing productivity gains to users at the individual and enterprise level. Since its launch in March, Firefly has already delivered over half a billion generations and it’s showing no signs of stopping, with the technology being rolled out to applications like Adobe Illustrator and is now available for prompting in over 100 languages.

AI allows Adobe to expand upon its current TAM which currently sits at $30 Billion for its Creative Cloud. Tools like AI reduce the barriers to entry for less skilled people and allows for the commencement of design projects that would have otherwise been overlooked. With the implementation of AI, Adobe has been able to broaden its target demographics from professionals and power-users to a more general audience.

EveryPixel: AI Has Helped Reignite Interest In Digital Creative Work

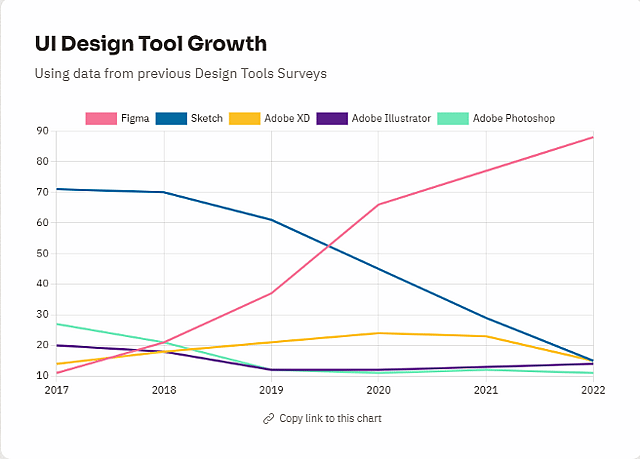

Figma’s acquisition (if approved by regulators) will add synergies, and help Adobe maintain market share and pricing power

Back in September of 2022, Adobe announced plans for a $20 Billion buyout of Figma, the main competitor to Adobe’s XD, Adobe’s vector-based experience design platform. Although the acquisition is far from a forgone conclusion, being blocked by the The Competition and Markets Authority (CMA) pending investigation, it seems to be unfolding in a very similar vein to the Microsoft acquisition of Activision-Blizzard - which the CMA also tried to block. That deal was finally approved in July of 2023, so let’s operate off the assumption that the Figma deal is approved too.

The largest contribution from the acquisition of Figma will be allowing customers to have an in-browser design experience which significantly reduces collaboration friction and allows a broader team to be involved in the process. Any device with a browser becomes one that can be used for collaboration, rather than a device that needs the appropriate program installed - a huge positive for hybrid workers that may spend time in the office and at home. Other than that, the acquisition is a justified defensive play, meant to sustain Adobe’s dominant market share and pricing power. Part of what makes Adobe so successful is their relative lack of competition amongst their Creative Cloud offerings. In many cases, their software is industry standard and their pricing reflects that, being able to boost margins while retaining customers due to their relative stickiness, which results in EBITDA margins of 40%. In the future, Figma will likely be an integrated part of Adobe’s offering with the company possibly opting to shift some of its existing software as an in-browser cloud solution.

Flying Donkey: UI Design Tool Growth - Why Acquisition Is Important For Adobe

The Experience Cloud will grow as its utility empowers its customers to grow

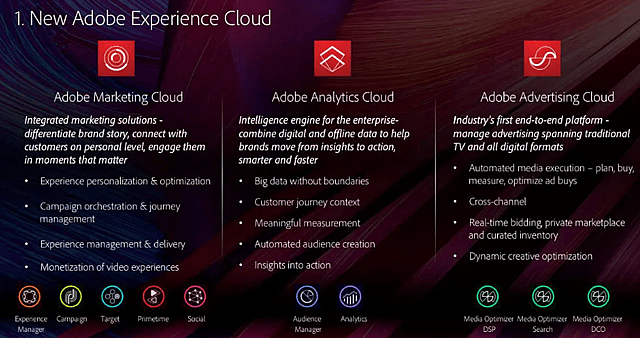

For most people, Adobe is synonymous with two things. Creativity and PDFs. Two very different ends of the spectrum, but two important segments where Adobe has carved out a groove of market share dominance in its software offerings. One lesser known side of Adobe’s business is its Experience Cloud, which is a set of software tools designed to help empower businesses, both small and large, to improve content delivery, marketing and data analytics. In a age of growing digitization and behavior tracking (for better or for worse), businesses now have the opportunity to know much more about their customer. This is beneficial in a number of ways. Firstly, a business is now able to personalize marketing campaigns to the individual, creating a greater chance of sales conversion. Secondly, a business has a greater understanding of each customers behavior and are able to target them with products that suit their needs. The problem lies in the fact that much of this data is inaccessible to smaller businesses and a costly endeavor for larger businesses to source it, which is where the value proposition for Adobe’s Experience Cloud is.

This platform is not just a tool; it's a strategic investment in digital transformation. It includes a range of solutions all designed to provide infinitely detailed insights into customer behavior and preferences. This analytical approach ensures that businesses can engage customers at a significantly personal level, increasing sales conversions and customer satisfaction.

ZDNet: Adobe Experience Cloud and What It Does

The crux of this catalyst is simple. If Adobe’s Experience Cloud is able to drive sales and customer acquisition amongst its own enterprise customers, then a snowball effect is created. The size of, and capital available to Adobe’s customers begins to grow and allows Adobe to up-sell these customers, driving up average revenue per user. As these businesses grow, the need for more sophisticated tools and services from Adobe's suite will naturally follow, creating a cyclical growth opportunity for Adobe.

The alignment of Adobe's Experience Cloud with emerging marketing trends showcases a future-ready approach, ensuring that Adobe is well-positioned to capture increasing market share in the burgeoning field of customer experience management.

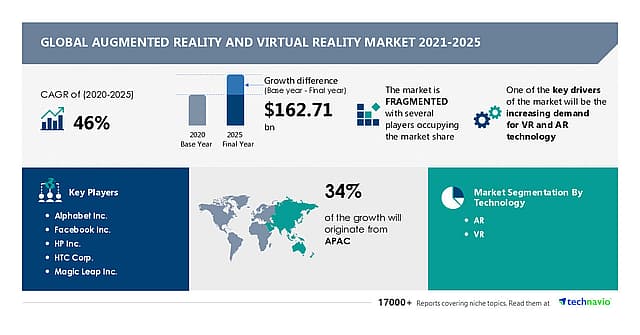

Breakthroughs in VR could open new growth avenues for Adobe

In the realm of Augmented Reality (AR), there are still a lot of untapped potential for growth. Mixed reality (both augmented reality and virtual reality) seems to have taken a back seat while AI has taken the spotlight for the focus of companies' future-proofing strategy, but we can’t ignore the potential it has to spur on incredible growth, when you consider the $13.7 Billion Meta Platforms invested in the space last year. Adobe Aero is Adobe’s way of bringing the design tools people are familiar with in to the world of Mixed Reality. Aero is a tool that’s integrated with other Creative Cloud apps that allow designers and developers to import their assets to create immersive AR experiences. Aero's potential goes beyond mere creative visuals; it is a bridge to a new frontier in content interaction.

Adobe's foray into the AR market with Aero is rather strategic. The application facilitates the creation of AR content without the need for coding knowledge, making it accessible to a broader audience. This democratization of AR content creation opens doors for professionals and amateurs alike, expanding Adobe's total addressable market - keeping with Adobe’s theme of lowering barriers to entry to ensure continual subscription growth.

From a business perspective, the integration of AR into various industries is no longer a futuristic concept but almost a growing necessity. Whether it's enhancing retail experiences or providing interactive educational content, Adobe Aero stands poised to drive significant revenue growth. Recent studies have shown that customer engagement and activation levels are up to 20% greater when the customer is exposed to an AR experience, proving the efficacy of where Adobe is placing their focus with Adobe Aero. And it’s likely that this will continue to be true as businesses increasingly recognize the value of AR in enhancing customer engagement. If Aero is able to help Adobe become a leader in designing mixed reality experiences, a competitive moat will begin to form in a potentially hugely valuable revenue stream.

PR Newswire: VR Market Presents A Risky But Lucrative Opportunity

Assumptions

Firefly will take Adobe Creative Cloud to the next Level

One of the key assumptions of my narrative is that Adobe Firefly will enhance Adobe’s creative suite to the point where a new phase of growth occurs. The business case for implementing AI into Adobe’s products lies in the opportunity to growth its TAM. In theory, tools like AI reduce the barriers to entry for less skilled people and will also help design projects that would have otherwise been overlooked or underfunded get off the ground. Think about it this way, if AI design flows can help output the same amount with a smaller headcount, or help a business achieve more with the same headcount, then funding concerns are eased for small businesses aiming to be the next unicorn.

For this narrative, I estimate that Adobe’s Sensei and Firefly AI models will help boost the total addressable market of the Creative Cloud by 35%, putting the new TAM at $40.5B. I also estimate that Adobe will remain a dominant player in this field, and retain a market share of 70%, resulting in about $28.35 Billion in revenue in 2028 which excludes the impacts of Adobe Aero.

Experience Cloud grows as a percentage of ARR

Given the importance of enterprise customers to Adobe and the fact that the Experience Cloud suite of tools is a relatively unfulfilled vertical, I assume there’s still capacity for the company to grow this segment of the business as a revenue stream. A core premise of my belief here is that I think that many businesses still under-utilize data analytics and content delivery systems. In 2017, Econsultancy estimated that 62% of businesses had no data analytics strategy and although I believe this number is smaller today in 2023, I think there is still a massive opportunity for Adobe here to revolutionize how these remaining businesses operate.

The segment is a growth avenue that sees some strong synergies with the core design services, especially designs related to advertising. This is an important direction for Adobe, as the company has already captured upwards of 70% of the professional design market in developed countries, and needs to branch out to related fields such as a seamless transition of design assets to advertising campaigns. Estimates for this segment pin the TAM at $110 Billion for 2024 with expectations of 15%+ growth over the coming years. Even if we take a more conservative 10% per annum growth for the Document Cloud’s total addressable market, we reach a figure of $161 Billion in TAM for this segment. Unlike the Creative Cloud segment, there are more competitors here to Adobe like Canva or Salesforce and so I’m assuming that it can capture only abut 10% of the market share. I assume that the Experience Cloud makes $16.1 Billion in 2028.

Adobe Aero spearheads the company’s entrance into AR/VR

Although the peak hype around metaverse has subsided, there are still plenty of companies (namely, Meta Platforms, but also Apple with the Vision Pro) that are investing billions in building out the AR/VR technological infrastructure. Adobe Aero is tailored for AR/VR design, allowing the company to offer these services should demand pick up. Just one aspect where AR/VR design could be relevant is in-game advertising for AR/VR entertainment. In-game advertising is estimated to reach $46B in 2027, and my estimate is that 4% of that can be captured by Adobe’s solutions - about $1.8B. And Gaming is not the only branch for AR/VR, with educational content being a huge proportion of where AR/VR experiences are most valuable. All in all, I think Aero on it’s own can capture a total market of $4.5 Billion in 2028.

Document Cloud will continue to be the backbone of the office

Whether you’re aware of it or not. It’s likely you’ve interacted with a piece of Adobe Document Cloud’s suite. According to 6Sense’s market share data for PDF readers, Adobe holds a scarcely believable 96% market share in the PDF reader space across its Adobe Acrobat DC and Acrobat Pro products. A leadership position which I assume to be insurmountable. With over 50 million searches for PDF-related actions per month, according to Adobe’s previous 10k report, there are still plenty of opportunities to capture more users with a product-led strategy that aims to create the best PDF experience on the market. Thankfully, the relative simplicity of the document experience means that there’s not a lot of wiggle room for new competition to pop up and capture market share with a disruptive feature/technology. I assume continued growth for Adobe’s Document Cloud suite, aided particularly by the current workforce demographics. It’s an interesting time, considering many people who were educated in the years prior to computer and internet technology being commonplace are likely reaching retirement age and so a lot the small businesses being ran by people who weren’t tech-savvy enough to be an Adobe Document Cloud subscriber will likely have their businesses bought our or replaced by someone who does, providing further opportunities to expand their market penetration. According to research, the global market size for PDF related services is expected to reach $3.6 Billion in 2028. If we consider that Adobe is likely to keep their 96% market share, then I’m assuming $3.6 Billion in revenues for Adobe Document Cloud, encompassing both Adobe Acrobat and Adobe eSignatures, by 2028.

Shares outstanding to remain constant

Although Adobe has decreased the current shares outstanding by 2.96% over the last 12 months, I am operating off the assumption that the current shares outstanding remains consistent over the duration of the DCF model. Although the value of share buybacks currently outweighs stock-based compensation, the value of stock-based compensation has risen dramatically to $3.76 Billion in the 12 months to May 2023, up 31% from the prior year. I anticipate the impacts of rising stock-based compensation and performance shares vesting will cancel out the impacts of share buybacks resulting in a net zero change.

Bottom line

Given my expected $52.55 Billion of sales, $21.02 Billion in EBITDA, and a 21% effective tax rate, investors will be left with $16.61 Billion in free cash flows in 2028. Which is representative of a 31.6% Free Cash Flow Margin.

My assumptions for this valuation case are:

- Beyond 2028, revenue growth will contract as market saturation is achieved and growth initiatives begin to reach a long-run steady state following a few years of rapid growth. I anticipate linear growth in Adobe’s revenues until 2028 (indicative of a 23.175% annualized figure), however after 2028, I expect growth to taper off significantly to around 5% in 2033 and beyond. From 2028 to 2033, I anticipate linear growth decline.

- I expect the current EBITDA and effective tax rate assumptions to remain consistent through to 2028. With a 31.6% FCF margin consistent for the first 5 years of the calculation. From 2028 to 2033, I anticipate added competition in from AI start-ups-turned-unicorns that will have risen to the top. This extra competition Adobe will face will erode margins slightly due to competitive pressures having a negative impact on subscription pricing. In this period, I expect EBITDA margins to decline to 35% (with effective tax rate remaining consistent) which results in a long run FCF margin of 27.7%

- Simply Wall St uses an 8.0% discount rate which consists of a risk-free rate of 2.11, an unlevered beta of 0.999 and an equity risk premium of 5.9%. However, due to my assumptions in this narrative relying

Risks

The Figma deal cannot proceed

The Figma acquisition is key for Adobe in two ways. Firstly, it opens the door for Adobe’s rapid entrance into a new target market. Traditionally, Adobe has focused on an enterprise level customer-base. Figma on the other hand has primarily served small to midsize businesses. Part of the synergies of the deal would be the target market acquisition on Adobe’s behalf. Secondly - and perhaps most importantly - the deal removes Adobe’s largest competitor for Adobe XD from the market.

One of the big risks to my narrative is that this doesn’t actually happen. The CMA has already launched an in-depth probe into the deal citing a risk of “substantial lessening of competition” if the deal proceeds. This ‘Phase 2’ investigation already follows an initial ‘Phase 1’ investigation completed by the watchdog which came to the conclusion that more action was needed. And it’s not just the British who are keeping a close eye on the deal, with the acquisition bid being assessed by regulators in the US and the EU as well.

With no way of knowing the likelihood of the deal proceeding, one must understand that the anti-trust watchdogs have been particularly active in the last year with the CMA blocking a record 3 acquisitions from being completed. So there’s definitely a non-zero chance of the deal running into roadblocks and I will monitor this closely with respect to my narrative.

The Generative AI focus comes at a cost

As is the way with many new technologies, people tend to get carried away with how it’s going to disrupt the current landscape and how it’ll bring about a period of exponential growth through its implementation. But people tend to overlook the biggest drawback to these technological breakthroughs. The cost. This is not just a one dimensional factor of cost either. Generative AI is costly to develop, costly to implement and costly to maintain.

As a bit of a case study into the costliness of running AI models, we can turn to the example of Latitude, a small gaming start-up that decided to implement OpenAI’s GPT model to help users create storylines and quests based off of user prompts. This small start-up saw running costs of OpenAI’s GPT reach north of $200,000 per month back in late 2021, owing to the millions of user queries it needed to run each day. Now let’s take this example, scale up the cost as we’ll be needing image rendering capabilities, and now also scale up the several million queries a month to the several hundred million queries that Adobe have already seen for its Firefly product and you begin to see the full picture. This is going to be costing Adobe hundreds of millions, if not billions of dollars to maintain.

There’s also one more problem that Adobe’s current push for generative AI. Yes, Firefly has seen rapidly growing query numbers (which Adobe are celebrating), but you have to ask yourself: how many of these queries are from people hearing about it for the first time and trying it out, with no intention to use it long-term? Adobe have already spoken in their recent earnings call about the growing use of Firefly and how it can broaden the TAM by helping onboard less experienced users. But less experienced users are more likely to churn subscriptions as their use-cases are relatively limited and enterprise customers may be resistant to taking on generative AI when it comes to branding, instead opting for manual creation flows. This would mean that Firefly could be an expensive project to get off the ground, with little in the way of long-term use cases.

With this in mind, I’ll be closely monitoring future integrations of Adobe Firefly to see if its utility expands, as well as the enterprise customers it onboards.

Have other thoughts on Adobe?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Bailey holds no position in NasdaqGS:ADBE. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.