Last Update 18 Nov 25

Fair value Decreased 29%ARVN: Core Oncology And Neuroscience Focus Will Drive Share Recovery Ahead

Arvinas' analyst price target has been revised downward from approximately $17.44 to $12.31 per share. Analysts cite increased competitive risks for vepdegestrant along with heightened uncertainty surrounding the company's future commercial prospects.

Analyst Commentary

Recent research updates on Arvinas highlight diverging views within the analyst community, reflecting both confidence in the company's pipeline and growing concerns regarding its execution and market positioning.

Bullish Takeaways- Bullish analysts note that Arvinas maintains an attractive valuation relative to its substantial cash balance. Shares are seen as undervalued after setbacks in its breast cancer portfolio.

- Recent data on ARV-102, an oral LRRK2 degrader for Parkinson's Disease and Progressive Supranuclear Palsy, show promising biomarker-driven efficacy and support advancement to further clinical development.

- Operational realignment, including reallocating resources and reducing workforce, is viewed as an opportunity to support core oncology and neuroscience assets. This could provide a potential catalyst for future upside.

- There is confidence that the company's multiple clinical programs in early-stage oncology and neurology represent several potential drivers for renewed growth, supporting the share price.

- Bearish analysts highlight "rapidly evolving" competition in the metastatic breast cancer landscape, raising the risk of vepdegestrant's commercial obsolescence and pressuring future revenue prospects.

- Recent announcements to out-license vepdegestrant have introduced significant uncertainty around both the timing and probability of successful commercialization. This could weigh on valuation in the near term.

- Reductions to sales forecasts and price targets reflect a more cautious view on execution, especially as competitors progress and licensing deals become more challenging to secure.

- Shifts in investor focus toward cash burn rates indicate heightened scrutiny on the company's ability to efficiently manage its remaining capital, given delays and setbacks in its lead asset.

What's in the News

- Goldman Sachs downgraded Arvinas to Sell from Neutral and lowered its price target to $6 due to intensifying competition for vepdegestrant in metastatic breast cancer. The firm expects Arvinas shares to be influenced by cash burn considerations. (Goldman Sachs research note)

- Piper Sandler raised Arvinas' price target to $16 based on promising ARV-102 data for Parkinson's Disease, citing strong LRRK2 degradation and plans for a Phase Ib study in Progressive Supranuclear Palsy in 2026. Arvinas and Pfizer have also agreed to jointly out-license vepdegestrant, with a PDUFA date set for June 2026. (Piper Sandler update)

- Arvinas announced new patient-reported outcomes from the VERITAC-2 trial, indicating vepdegestrant provided a significant delay in quality of life deterioration compared to fulvestrant in advanced breast cancer patients. The drug's New Drug Application has been accepted by the FDA and received Fast Track designation. (Company announcement)

- The company presented preclinical data for ARV-806, a KRAS G12D degrader, which demonstrated strong anti-tumor activity and high KRAS degradation in models of pancreatic, colorectal, and lung cancer. ARV-806 is now being evaluated in a Phase 1 trial. (Company announcement)

- Arvinas and Pfizer are seeking a commercialization partner for vepdegestrant and have announced a workforce reduction of about 15%, mainly in roles related to vepdegestrant. The company expects this change will extend its cash runway into the second half of 2028. (Company announcement)

Valuation Changes

- Consensus Analyst Price Target: Dropped significantly from $17.44 to $12.31 per share. This reflects a more cautious outlook on the company's valuation.

- Discount Rate: Increased slightly from 6.78% to 6.96%, which indicates heightened perceived risk in projecting future cash flows.

- Revenue Growth: The projected decline is now less severe, improving from -25.19% to -20.13%.

- Net Profit Margin: Narrowed from 23.34% to 20.88%, suggesting greater cost pressures or reduced profitability expectations.

- Future P/E: Reduced sharply from 51.87x to 23.58x. This signals lower anticipated earnings multiples and valuation compression.

Key Takeaways

- Advancements in targeted therapies and partnerships position Arvinas to capitalize on precision medicine trends and diversify future revenue streams.

- Streamlined operations and supportive industry momentum enhance prospects for improved margins and faster approval timelines.

- Cost-cutting measures, strategic pipeline shifts, and external commercialization uncertainties heighten risks to innovation, growth, and long-term profitability amid rising competition and industry headwinds.

Catalysts

About Arvinas- A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

- Arvinas is positioned to benefit from a growing addressable market due to the rapid aging of the global population and the increasing prevalence of diseases like cancer and neurodegeneration, directly driving long-term potential for revenue growth as more patients seek innovative therapies.

- The company's continued advancements in targeted and personalized therapies, specifically through its differentiated PROTAC platform and new clinical-stage assets such as ARV-102 (for Parkinson's/PSP), ARV-393 (BCL6 degrader), and ARV-806 (KRAS degrader), align with healthcare's shift toward precision medicine and expand opportunities for future high-margin product launches.

- Solid progress and early validation in partnerships and licensing, as seen with Novartis and ongoing collaboration (or renegotiation) with Pfizer, offer the potential for substantial milestone payments and tiered royalties, thus strengthening future earnings and diversifying revenue streams.

- Operational efficiencies executed via company-wide restructuring, strategic pipeline prioritization, and workforce reduction have significantly extended Arvinas' cash runway to 2028, improving the sustainability of R&D and positioning net margins for improvement even ahead of potential major product approvals.

- Industry-wide momentum, including increased M&A and biopharma investment in targeted protein degradation and more supportive regulatory frameworks for breakthrough therapies, are expected to accelerate Arvinas' approval timelines, pipeline value realization, and drive overall earnings uplift as the sector re-rates innovators.

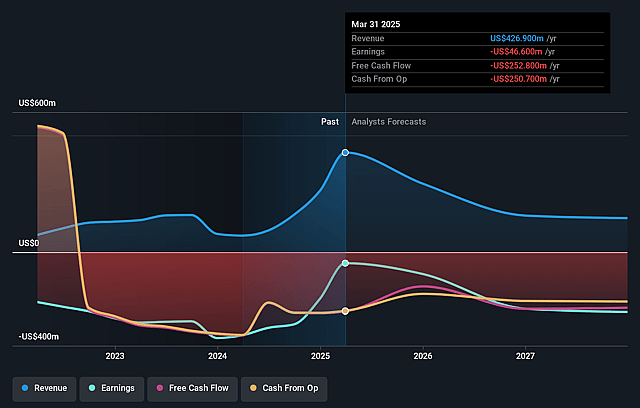

Arvinas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arvinas's revenue will decrease by 22.2% annually over the next 3 years.

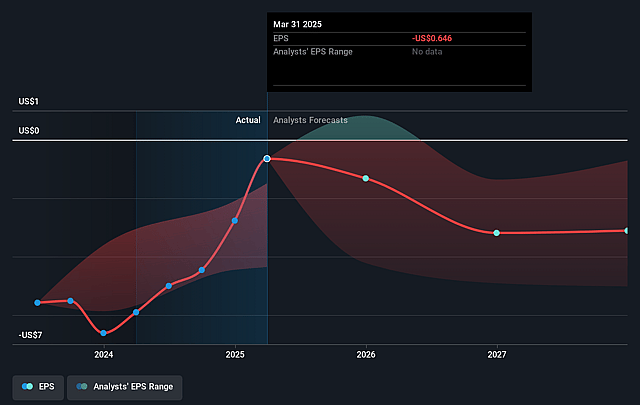

- Analysts are not forecasting that Arvinas will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arvinas's profit margin will increase from -19.5% to the average US Pharmaceuticals industry of 23.2% in 3 years.

- If Arvinas's profit margin were to converge on the industry average, you could expect earnings to reach $40.7 million (and earnings per share of $0.46) by about September 2028, up from $-72.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.1x on those 2028 earnings, up from -8.0x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 6.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arvinas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent restructuring resulted in cutting one-third of Arvinas' workforce, reprioritizing the pipeline, and reducing R&D expenses, reflecting a need to conserve cash that may constrain innovation and slow future program growth, potentially limiting long-term revenue and earnings expansion.

- Uncertainty around vepdeg's commercialization path, including ongoing negotiations with Pfizer over development rights and no near-term plan for internal commercial infrastructure, raises the risk of delays or gaps in market launch, which could suppress anticipated revenue streams and earnings from their lead asset.

- Heavy reliance on the unproven PROTAC platform and early-stage pipeline exposes Arvinas to significant R&D and regulatory risks; if pivotal clinical trials disappoint or timelines slip, this could result in prolonged negative net margins and increased cash burn.

- Increasing competition in the targeted protein degradation and oncology space-including large pharma and other biotechs with advanced programs-may erode potential market share, threaten pricing power, and compress long-term revenue and profitability prospects.

- Broader industry and policy trends such as global drug price regulation, rising cost of capital, and potential supply chain disruptions could heighten margin pressure and operational expenses, impacting long-term earnings and Arvinas' ability to sustain profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.444 for Arvinas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $175.3 million, earnings will come to $40.7 million, and it would be trading on a PE ratio of 49.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $7.9, the analyst price target of $18.44 is 57.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.