Key Takeaways

- Regaining global rights and leveraging AI-driven PROTAC design could unlock significant revenue, pipeline productivity, and long-term earnings power through licensing or strategic transactions.

- Pipeline breakthroughs and industry shifts toward targeted protein degradation position Arvinas for rapid market expansion, revenue diversification, and enhanced valuation.

- Overdependence on a narrow pipeline, partner reliance, and rising competitive and regulatory threats undermine Arvinas' growth, margin stability, and long-term financial viability.

Catalysts

About Arvinas- A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

- Analysts broadly agree Arvinas's PROTAC vepdeg could be a best-in-class therapy, but the market may underestimate the value-creation event if Arvinas regains global rights from Pfizer; this could unlock global out-licensing or M&A scenarios on extremely favorable terms, driving step-change revenue and milestone flows as well as higher net margins from a leaner commercial approach.

- Analyst consensus highlights upcoming clinical readouts, but underappreciates the rapid ramp potential of ARV-102 in Parkinson's and PSP due to a first-in-class, brain-penetrant mechanism; a breakthrough here could dramatically accelerate revenue diversification and market penetration in high-growth neurodegenerative segments.

- The platform's foundational use of AI and deep learning in PROTAC design and target identification is compressing R&D timelines and boosting clinical success probability, which can enhance pipeline productivity, reduce cost of goods sold, and raise long-term earnings power.

- Arvinas's large cash buffer through 2028 and aggressive cost restructuring position the company uniquely to opportunistically acquire distressed assets or innovative early-stage pipeline candidates from other biotechs, potentially compounding future top-line growth and internal rate of return well beyond current expectations.

- The accelerating shift by the healthcare industry and regulators toward targeted protein degradation and precision medicine dramatically expands the addressable market and pricing power for Arvinas's current and future assets, with sustained demand driven by global demographic aging bolstering revenue growth and improving long-term company valuation.

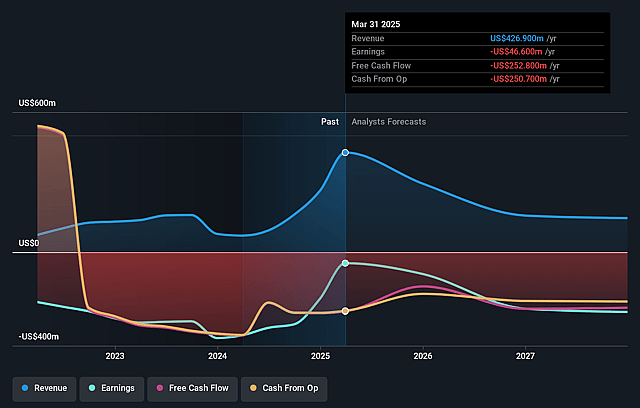

Arvinas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Arvinas compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Arvinas's revenue will decrease by 13.6% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Arvinas will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arvinas's profit margin will increase from -19.5% to the average US Pharmaceuticals industry of 23.2% in 3 years.

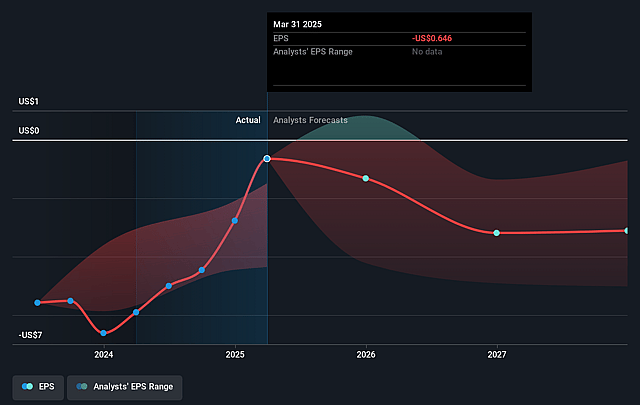

- If Arvinas's profit margin were to converge on the industry average, you could expect earnings to reach $55.9 million (and earnings per share of $0.63) by about September 2028, up from $-72.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 123.0x on those 2028 earnings, up from -8.1x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 6.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arvinas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arvinas is heavily reliant on a small number of clinical-stage assets and programs, such as vepdeg and ARV-102, making the company particularly vulnerable to clinical failures or regulatory setbacks, which could significantly disrupt future revenue growth and cause sharp fluctuations in earnings.

- The company's recent restructuring-marked by a significant reduction of workforce and the paring back of its research pipeline-highlights high R&D expenditures relative to revenues and the challenge of sustaining a broad pipeline, which could lead to prolonged periods of negative net margins and strain its ability to capitalize future operations or reach profitability.

- Arvinas' dependence on critical partnerships and licensing agreements (notably with Pfizer for vepdeg and Novartis for luxdegalutamide) introduces risk that partners may opt out, deprioritize assets, or return rights, potentially resulting in a loss of milestone payments, reduced collaboration revenues, and diminished long-term earnings power, especially if the company is unable to secure alternative partners quickly.

- Mounting regulatory scrutiny and increasing global drug pricing pressures, combined with greater payer reluctance and rising activism around drug access, could compress margins for Arvinas' novel protein degrading therapies, slowing topline revenue growth and threatening the company's ability to expand in key markets.

- Intensifying competition from large pharmaceutical companies advancing internal targeted protein degradation platforms, along with potential shifts in treatment paradigms toward cellular or gene therapies, may erode market share, limit pricing power, and put Arvinas' core PROTAC technology at risk of obsolescence, negatively impacting future revenue and earnings trajectories.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Arvinas is $63.5, which represents two standard deviations above the consensus price target of $18.44. This valuation is based on what can be assumed as the expectations of Arvinas's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $240.8 million, earnings will come to $55.9 million, and it would be trading on a PE ratio of 123.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $8.0, the bullish analyst price target of $63.5 is 87.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.