Key Takeaways

- Heavy reliance on a limited pipeline and milestone-driven partnerships exposes Arvinas to significant operational and revenue risks amid competitive and reimbursement pressures.

- Rising industry interest and regulatory tailwinds benefit Arvinas, but increased competition and pricing constraints threaten market share and long-term earnings growth.

- Resource cutbacks, limited pipeline diversity, and partnership dependence expose Arvinas to high clinical, financial, and competitive risks, threatening sustainable growth and long-term profitability.

Catalysts

About Arvinas- A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

- Although the rising global prevalence of cancer and neurodegenerative diseases is expanding the long-term addressable market for innovative therapies like those in Arvinas' pipeline, the company's current focus remains on a few late-stage programs with limited diversification. This constrained pipeline heightens the risk that any clinical setbacks or delays could sharply impact their future revenue growth.

- While ongoing advances in genomics and increased regulatory momentum for targeted protein degradation platforms are expected to underpin demand and regulatory acceptance for Arvinas' technology, government and payer efforts to contain healthcare costs could put pressure on pricing and reimbursement for new therapies, creating headwinds for long-term net margin expansion.

- Despite achieving an extended cash runway through substantial cost reductions and portfolio reprioritization, Arvinas remains heavily dependent on milestone payments and potential partnerships for revenue, as reflected in the year-over-year decline in recognized revenue. Should key collaborations face disruption or upcoming milestones slip, this would negatively impact both near-term earnings and long-term financial stability.

- Although a potential first-ever approval of a PROTAC therapy could serve as a significant validation catalyst, the ongoing renegotiation with Pfizer and possible transition of vepdeg to another commercial partner exposes Arvinas to operational uncertainty and delays in product launch, which threatens anticipated future revenue inflection and delays value creation.

- While growing big pharma interest in next-generation platforms supports the long-term strategic value of Arvinas' technology, increasing competition in the targeted protein degradation space from larger, well-capitalized peers may erode Arvinas' market share and limit the company's ability to drive premium pricing or future licensing income, thus constraining long-term earnings growth.

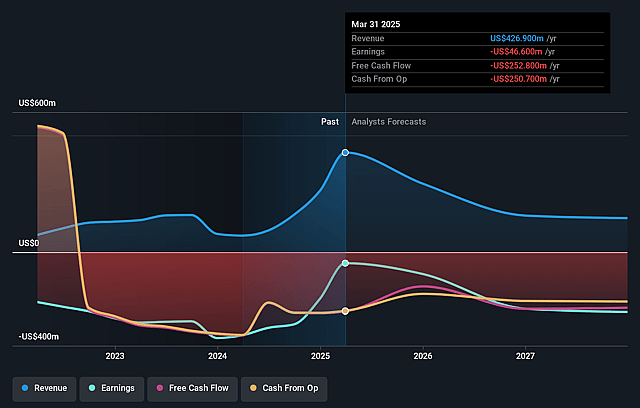

Arvinas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Arvinas compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Arvinas's revenue will decrease by 49.7% annually over the next 3 years.

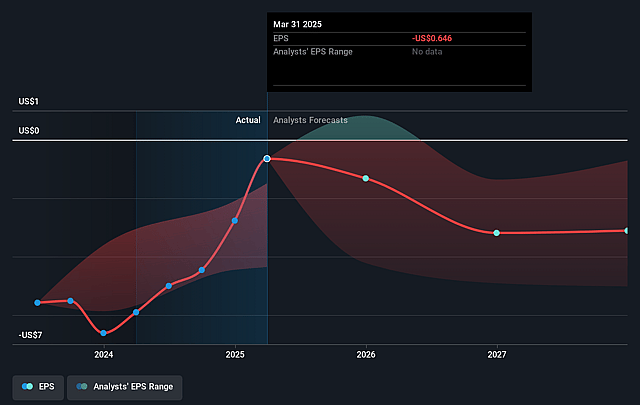

- The bearish analysts are not forecasting that Arvinas will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arvinas's profit margin will increase from -19.5% to the average US Pharmaceuticals industry of 20.9% in 3 years.

- If Arvinas's profit margin were to converge on the industry average, you could expect earnings to reach $9.9 million (and earnings per share of $0.11) by about August 2028, up from $-72.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 76.3x on those 2028 earnings, up from -6.4x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 18.4x.

- Analysts expect the number of shares outstanding to grow by 6.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arvinas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arvinas' decision to cut a number of research programs and reduce its workforce by one third signals limited pipeline diversity and resource constraints, which heightens the risk of clinical setbacks or slowed innovation and may negatively impact future revenue streams and the company's ability to improve net margins over time.

- The removal of major pivotal trials and the downsizing of the commercialization focus for vepdeg-its most advanced clinical asset-significantly reduces the size of its initial addressable market, and ongoing uncertainty with the Pfizer collaboration exposes Arvinas' near-term revenues and long-term earnings to partnership dependence and volatility.

- Current financials reflect a sharp drop in revenue, from $76.5 million to $22.4 million year-over-year for the comparable quarters, due primarily to the winding down of large upfront and milestone payments from Novartis and Pfizer, suggesting that the company remains vulnerable to revenue lulls until meaningful product sales or new partnerships begin.

- Arvinas' asset portfolio is dominated by early-stage clinical programs, which creates substantial risk of clinical failure, potential delays, or regulatory hurdles, threatening the timeline for future product launches and the realization of anticipated revenue inflections or improvements in net earnings.

- Intensifying competition in the targeted protein degradation field from better-resourced pharmaceutical companies, as well as potential future shifts towards healthcare cost containment, could lead to lower pricing power and shrinking net margins for Arvinas' therapies, affecting long-term profitability and share price appreciation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Arvinas is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arvinas's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $47.5 million, earnings will come to $9.9 million, and it would be trading on a PE ratio of 76.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $6.29, the bearish analyst price target of $7.0 is 10.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.