Key Takeaways

- Growth from digital channels and youth demographics is challenged by evolving health trends and rising regulatory risks, potentially limiting revenue and increasing operating costs.

- Currency instability and fierce competition threaten earnings predictability, while sustainability investments may constrain near-term cash flow and earnings growth.

- Currency instability, rising input costs, shifting consumer habits, health trends, and regulatory pressures threaten profit margins and revenue growth for Arcos Dorados in key Latin American markets.

Catalysts

About Arcos Dorados Holdings- Operates as a franchisee of McDonald’s restaurants.

- While digitalization and the success of mobile ordering and loyalty programs are driving higher sales frequency and revenue per customer, Arcos Dorados remains exposed to rising health and wellness trends which may cause declining demand for traditional QSR offerings in the medium term, potentially limiting future top-line growth.

- Although urbanization and the increasing youth demographic in key Latin American markets should benefit store openings and long-term same-store sales, the long-term impact of regulatory risks such as new taxes on packaging, plastics, or carbon emissions could put persistent upward pressure on operating costs and compress net margins over time.

- While investments in operational efficiency and supply chain optimization are supporting margin improvement and stabilized EBITDA in several regions, currency volatility and macroeconomic instability-particularly in Brazil and Argentina-continue to threaten earnings predictability, given the company's extensive local currency exposure.

- Despite ongoing restaurant rollouts and solid growth in digital and delivery channels that are expected to enhance future revenues, intensifying competition from both local players and health-focused fast-casual concepts may force Arcos Dorados into price promotions or menu discounts, exerting negative pressure on profitability and same-store sales growth.

- Even as the company's focus on sustainability initiatives and renewable energy adoption could drive lower utility costs in the long run, the required upfront capital expenditures-paired with potential increases in labor costs across Latin America-could reduce free cash flow and place limits on overall earnings expansion.

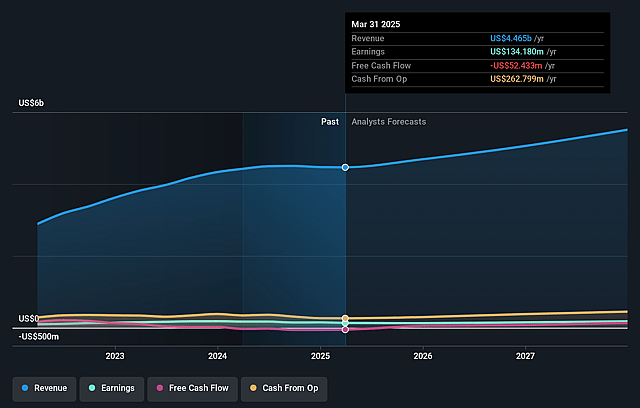

Arcos Dorados Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Arcos Dorados Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Arcos Dorados Holdings's revenue will grow by 6.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.9% today to 3.0% in 3 years time.

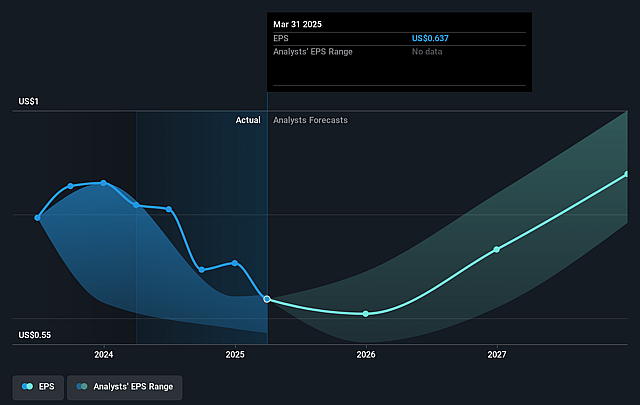

- The bearish analysts expect earnings to reach $165.5 million (and earnings per share of $0.82) by about September 2028, up from $130.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, up from 11.3x today. This future PE is lower than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.12%, as per the Simply Wall St company report.

Arcos Dorados Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing macroeconomic volatility and currency instability in core Latin American markets-especially Brazil and Argentina-could result in unpredictable revenue streams and reduce earnings power due to significant local currency exposure.

- Intensified competition within the quick-service restaurant and dessert sectors, particularly in Brazil, may force Arcos Dorados to maintain aggressive promotional pricing that erodes profit margins and limits the ability to grow net income.

- Consumer traffic in the company's largest market, Brazil, remains subdued and is being offset by higher average check rather than actual visit growth, which could be unsustainable if purchasing power weakens further, leading to potential stagnation or decline in revenues.

- Elevated food and commodity costs, most notably a 30% rise in beef prices in Brazil over the last year, along with a higher normalized royalty rate, are placing ongoing pressure on restaurant-level margins and may continue to weigh on EBITDA and net profits if cost increases persist.

- The global secular trend toward health and wellness, alongside increased regulatory scrutiny on nutrition, labeling, and environmental practices, risks depressing long-term demand for traditional fast food and raising compliance costs, which could negatively impact both top-line revenues and bottom-line profitability for Arcos Dorados.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Arcos Dorados Holdings is $8.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arcos Dorados Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.5 billion, earnings will come to $165.5 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 16.1%.

- Given the current share price of $7.0, the bearish analyst price target of $8.5 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Arcos Dorados Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.