Last Update 02 Dec 25

Fair value Decreased 0.12%ARCO: Future Upside Will Depend On Momentum Recovery In Brazil

Analysts have slightly lowered their price target for Arcos Dorados Holdings by $0.10, citing ongoing momentum concerns, particularly in Brazil.

Analyst Commentary

Recent analyst commentary on Arcos Dorados Holdings reflects a balanced view of the company's valuation and operational trends, with particular focus on its performance in the Brazilian market.

Bullish Takeaways- Bullish analysts maintain that Arcos Dorados remains well-positioned as a leading quick-service restaurant operator in Latin America. This supports long-term growth potential for the company.

- Steady revenue generation and resilience in the face of regional challenges continue to be seen as strengths for the company.

- Despite current headwinds, the company's diversified presence across multiple countries is viewed as a buffer against localized slowdowns.

- Bearish analysts note persistent momentum concerns in Brazil, which is weighing on near-term growth expectations for the company.

- Recent downgrades and reduced price targets reflect uncertainty about the pace of operational recovery, especially where consumer demand remains soft.

- Execution risks, particularly in key markets, are prompting a more cautious outlook on both valuation and future performance.

- Neutral ratings suggest limited upside potential in the current environment without clear catalysts for renewed acceleration in growth.

Valuation Changes

- Fair Value Estimate has edged down slightly, from $9.51 to $9.50. This reflects minor adjustments to projected cash flows.

- Discount Rate has decreased modestly, moving from 15.17% to 14.99%. This implies a slightly less risky outlook for the company.

- Revenue Growth Forecast has declined marginally, from 7.29% to 7.23%. This indicates a slightly more conservative growth expectation.

- Net Profit Margin estimate has dipped a little, from 3.29% to 3.28%. This points to minor revisions in expected profitability.

- Future P/E Ratio projection has fallen slightly, from 16.49x to 16.46x. This reflects tempered expectations for valuation multiples.

Key Takeaways

- Digital initiatives, operational upgrades, and menu innovation are strengthening customer engagement, brand preference, and margins, supporting sustained revenue and profit growth.

- Favorable demographics and prudent pricing strategies are expected to boost demand, stabilize volumes, and position the company for long-term earnings expansion.

- Weak consumer demand, rising costs, and competitive pressures in core markets risk squeezing margins, hindering revenue growth, and threatening earnings stability if unaddressed.

Catalysts

About Arcos Dorados Holdings- Operates as a franchisee of McDonald’s restaurants.

- Continued digital adoption-including loyalty program rollouts, app engagement, and digital ordering-are driving higher visit frequency, stronger customer retention, and higher identified sales, which is likely to support future revenue growth and improve gross margins as digital channels scale.

- Ongoing expansion and modernization of Experience of the Future (EOTF) restaurants, combined with investments in operational efficiency and cost control measures, are expected to drive higher average ticket size, increased throughput, and EBITDA margin expansion over time.

- Young and growing urban populations in Latin America, alongside rising middle-class discretionary spending, are poised to boost out-of-home dining demand, providing sustained top-line growth for Arcos Dorados as the leading QSR operator in the region.

- Menu innovation (localized flavors, health/value offerings, limited-time partnerships like Minecraft and Formula 1) and targeted marketing campaigns are strengthening brand preference and helping to protect or grow market share in competitive environments, positively impacting both revenue and gross margins.

- Prudent pricing strategies-raising prices in line with inflation while prioritizing affordability and value-should support volume stability and future margin recovery, positioning the company for earnings growth as macroeconomic conditions improve.

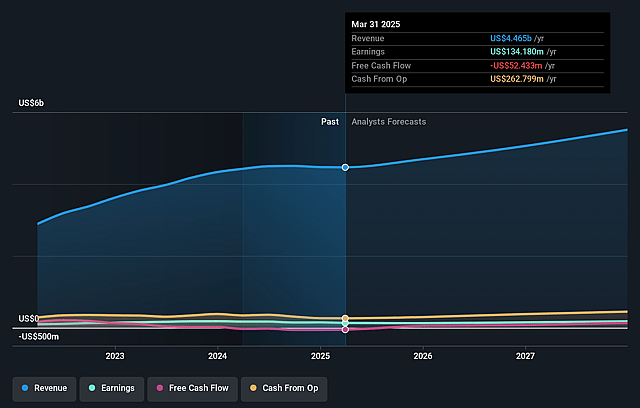

Arcos Dorados Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arcos Dorados Holdings's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 3.2% in 3 years time.

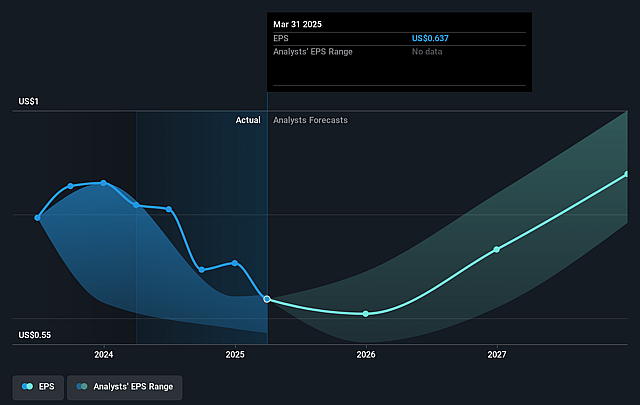

- Analysts expect earnings to reach $184.6 million (and earnings per share of $0.89) by about September 2028, up from $130.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $210.3 million in earnings, and the most bearish expecting $154 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from 11.2x today. This future PE is lower than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.12%, as per the Simply Wall St company report.

Arcos Dorados Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic volatility and weakening consumer confidence in key markets like Brazil are causing subdued sales and reduced guest traffic, leading to a heavier reliance on price increases over volume growth; this dynamic is likely to constrain top-line revenue growth and could pressure same-store sales if consumer conditions remain sluggish or worsen.

- Intensifying competition, particularly within Brazil and in the dessert center segment, is prompting more aggressive pricing and promotional activities across the industry, which may erode market share and compress profit margins if Arcos Dorados is forced to match these strategies over the long term.

- Elevated input costs, especially due to a 30% increase in beef prices in Brazil over the past 12 months and ongoing FX volatility affecting imported goods, have resulted in gross margin pressure; if these cost headwinds persist or intensify, net margins and EBITDA could deteriorate further.

- Growing dependence on digital channels and loyalty programs is a double-edged sword-while driving identified sales growth, failure to continuously innovate and modernize digital platforms could result in lower customer engagement, falling behind competitors and negatively impacting revenue and same-store sales momentum.

- Vulnerability to adverse currency movements (e.g., Brazilian real and Mexican peso) and exposure to regulatory risks (such as potential new fast-food regulations or taxes in Latin America) could reduce reported earnings in USD, increase compliance costs, and squeeze free cash flow, undermining long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.4 for Arcos Dorados Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.7 billion, earnings will come to $184.6 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 16.1%.

- Given the current share price of $6.9, the analyst price target of $10.4 is 33.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Arcos Dorados Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.