Key Takeaways

- Heavy dependence on a single mine and external market risks could disrupt production and revenue predictability.

- Structural market and technological trends threaten long-term uranium pricing and limit Paladin's ability to capitalize on potential upside.

- Successful ramp-up, operational improvements, and strong uranium market demand position Paladin for improved earnings, cost efficiencies, and long-term growth while mitigating downside risks.

Catalysts

About Paladin Energy- Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

- The rapid acceleration in renewable energy deployment and the declining costs of solar, wind, and battery storage technologies could erode demand for nuclear power over coming decades, creating long-term headwinds for uranium pricing and causing Paladin's revenues to fall short of expectations in the years after ramp-up.

- The company's heavy reliance on a single asset, Langer Heinrich, heightens the risk that any operational, regulatory, or geopolitical disruption-such as water supply interruptions, Namibian policy shifts, or necessary plant maintenance-could sharply impact production volumes and revenue stability, amplifying downside risk to projected earnings.

- Long-term anti-nuclear sentiment and the possibility of new nuclear incidents could result in governments scaling back reactor construction or prematurely closing existing plants, shrinking Paladin's addressable market and putting sustained pressure on sales, contract renewals, and margin stability.

- The trend toward utilities locking in lower, long-duration uranium contracts could compress average realized prices for Paladin just as its production peaks, limiting the company's ability to capture upside from uranium spot price rallies and causing EBITDA and net margins to disappoint versus bullish projections.

- Entry of well-funded state-backed uranium suppliers, expansion of secondary uranium sources, and advances in alternative reactor fuels such as thorium could combine to create an oversupplied market, depressing uranium prices and resulting in significantly lower future free cash flow and depressed returns on capital for Paladin.

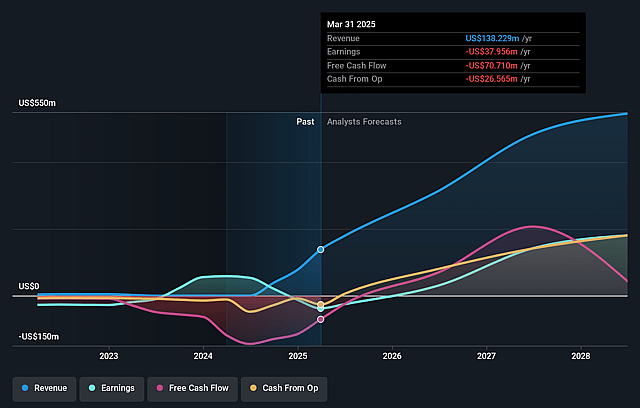

Paladin Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Paladin Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Paladin Energy's revenue will grow by 47.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -27.5% today to 32.2% in 3 years time.

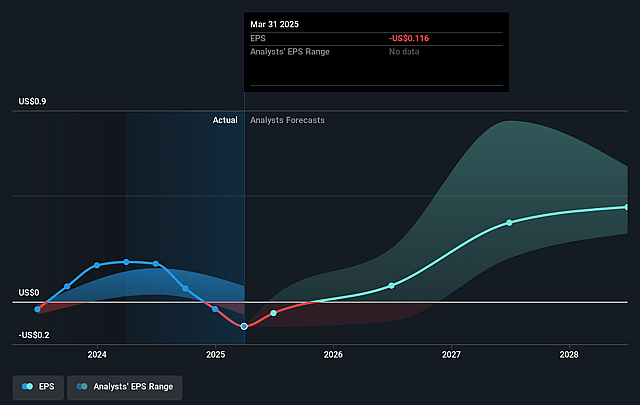

- The bearish analysts expect earnings to reach $143.7 million (and earnings per share of $0.34) by about August 2028, up from $-38.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from -44.6x today. This future PE is lower than the current PE for the AU Oil and Gas industry at 13.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Paladin Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The successful ramp-up at Langer Heinrich Mine, record throughput, and a 33% quarter-on-quarter production increase indicate Paladin is on track to achieve substantially higher revenue and EBITDA as it heads into full operations, which may support share price appreciation.

- Progress at the Patterson Lake South project in Canada, including acceptance of the final environmental impact statement and positive drilling results, enhances Paladin's long-term resource pipeline, potentially supporting future revenue growth and strategic value.

- The company is implementing operational improvements, including water supply upgrades and optimization of mining and processing strategies, which are likely to reduce unit production costs and improve net margins as volumes increase.

- Paladin's diversified contract book with a balanced mix of fixed and market-related pricing provides downside protection and upside exposure as uranium prices rise, which could result in higher realized prices and more stable earnings if the uranium market strengthens.

- Strength in broader uranium sector demand, driven by structural trends in global decarbonization, electrification, and increasing nuclear investment, may provide sustained pricing support and cash flow stability for Paladin over the long term, improving earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Paladin Energy is A$5.24, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Paladin Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$12.69, and the most bearish reporting a price target of just A$5.24.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $446.7 million, earnings will come to $143.7 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$6.61, the bearish analyst price target of A$5.24 is 26.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.