Key Takeaways

- Production outperformance and cost efficiencies at Langer Heinrich position Paladin for stronger-than-expected revenue growth and margin expansion due to improved grades and operational execution.

- Strong uranium market dynamics and ESG leadership enhance Paladin's long-term earnings visibility, market valuation, and access to sustainability-focused investors.

- Heavy dependence on a single asset, uncertain uranium demand, rising costs, and competitive pressures could undermine profitability and require potentially dilutive funding options.

Catalysts

About Paladin Energy- Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

- Analyst consensus expects the Langer Heinrich Mine ramp-up to reach full operations and improve revenue, but this view may understate Paladin's true potential; the mine has already exceeded historical throughput records with only half the mining fleet mobilized, pointing toward the real prospect of significantly outsized production and revenue growth as full mining capacity is reached ahead of schedule in FY27, with better-than-expected grades and recoveries boosting net margins.

- While analysts broadly note operational cost efficiencies from optimized ore blending, the repeat upside surprises in recovered grade from stockpiled ore and consistently rising throughput indicate Paladin could meaningfully outpace its cost reduction targets, expanding EBITDA margins beyond current forecasts as its blend and process strategies unlock higher-margin output than previously expected.

- The accelerating global pursuit of energy security and clean baseload power, combined with increasing nuclear reactor adoption in both developed and emerging markets, directly enhances Paladin's multi-year revenue visibility and pricing power as its production comes online amid a structural uranium supply deficit, positioning the company to realize contract premiums and steady earnings growth.

- Paladin's advancement of both the Langer Heinrich Mine and its Patterson Lake South project, coupled with a world-class safety and ESG record, will attract long-term sustainability-focused capital pools, potentially lowering its cost of capital and supporting higher future valuation multiples on cash flows and reserves.

- Management's unprecedented operational transparency, commitment to rigorous bottom-up guidance, and ability to hit or beat targets quarter after quarter sets a new benchmark within the uranium sector, establishing market confidence likely to support sustained share price rerating as Paladin's predictable growth story receives broader institutional recognition, translating into enhanced market capitalization and premium valuation.

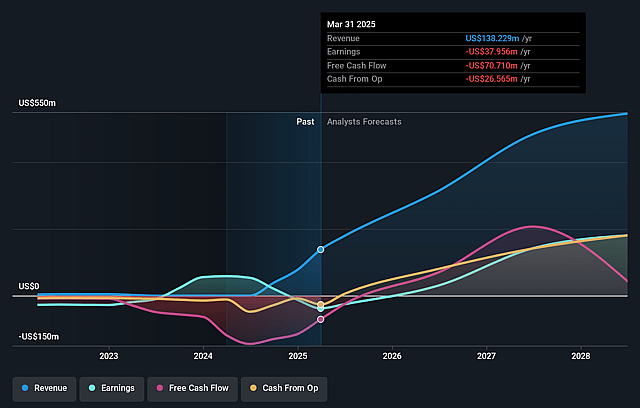

Paladin Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Paladin Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Paladin Energy's revenue will grow by 76.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -27.5% today to 34.7% in 3 years time.

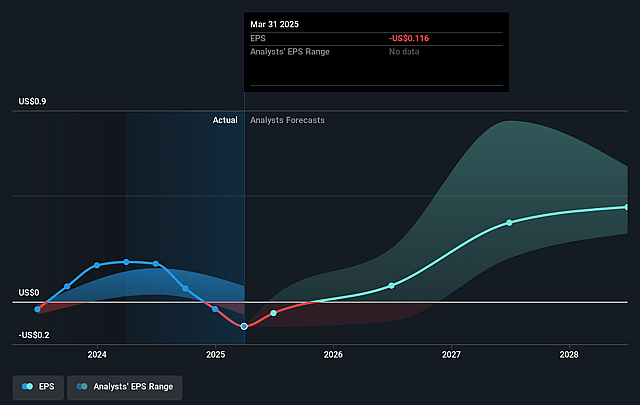

- The bullish analysts expect earnings to reach $265.0 million (and earnings per share of $0.66) by about August 2028, up from $-38.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from -42.9x today. This future PE is greater than the current PE for the AU Oil and Gas industry at 13.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Paladin Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Paladin relies heavily on the Langer Heinrich Mine for its production, and any operational or geopolitical disruption at this site could cause significant revenue and earnings volatility due to its lack of asset diversification.

- The company is exposed to uranium price fluctuations, and the increasing adoption of renewables, ongoing anti-nuclear sentiment and tightening regulatory scrutiny in key markets could cap future uranium demand, suppress spot and contract prices and reduce Paladin's long-term revenue growth.

- Paladin's production cost guidance is rising due to ramp-up expenses and potential cost inflation; if it fails to keep costs under control while uranium prices weaken or plateau, net margins and future earnings could be negatively impacted.

- Market competition from state-backed and lower-cost uranium producers, as well as the risk posed by persistent above-ground uranium inventories, could prevent Paladin from achieving sustained pricing power and pressure both topline revenues and profitability.

- Paladin's development pipeline and capital requirements may necessitate further equity issuance if internal cash flows are insufficient, leading to potential shareholder dilution and a negative impact on earnings per share over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Paladin Energy is A$12.06, which represents two standard deviations above the consensus price target of A$8.53. This valuation is based on what can be assumed as the expectations of Paladin Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$12.63, and the most bearish reporting a price target of just A$5.21.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $763.6 million, earnings will come to $265.0 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$6.35, the bullish analyst price target of A$12.06 is 47.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.