Despite the downward trend in earnings at Naspers (JSE:NPN) the stock rallies 5.5%, bringing three-year gains to 61%

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, the Naspers Limited (JSE:NPN) share price is up 59% in the last three years, clearly besting the market return of around 2.1% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 23% in the last year, including dividends.

The past week has proven to be lucrative for Naspers investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Naspers

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

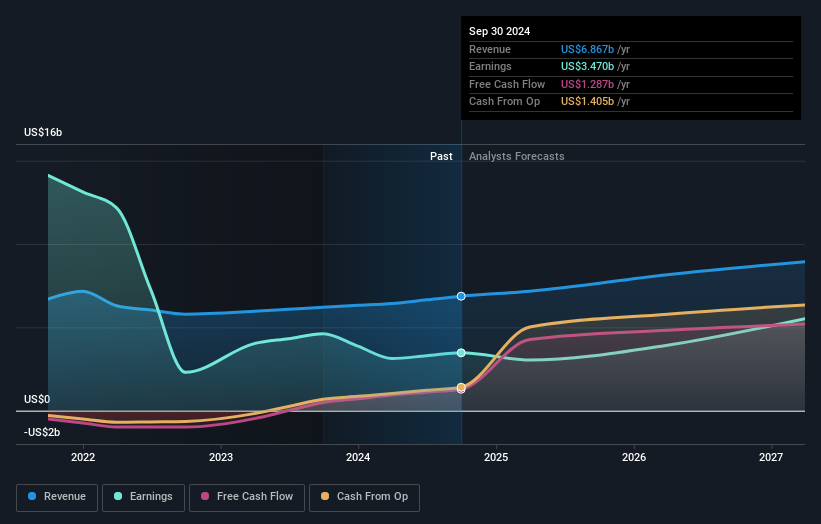

During the three years of share price growth, Naspers actually saw its earnings per share (EPS) drop 16% per year.

So we doubt that the market is looking to EPS for its main judge of the company's value. Therefore, we think it's worth considering other metrics as well.

Languishing at just 0.3%, we doubt the dividend is doing much to prop up the share price. We severely doubt anyone is particularly impressed with the modest 0.1% three-year revenue growth rate. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Naspers has rewarded shareholders with a total shareholder return of 23% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Naspers .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Naspers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:NPN

Naspers

Operates in the consumer internet industry in Africa, Asia, Europe, Latin America, North America, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives